| Google Finance Yahoo Finance CNNMoney Wall Street Journal MarketWatch BBC Business News IB Times GlobeInvestor | |||||||||||||||

|

|||||||||||||||

|

Home CME Group Open Markets Performance Record Free Chat Room Fading Volatility BreakOut Strategy Sitemap |

|||||||||||||||

![]() Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

This webpage is dedicated to common questions sent to TheStrategyLab via email and/or private messages about our trade methodology involving our free resources and fee base resources.

Also, we highly recommend you join our discussion at the free TSL Support Forum to ask questions at the below link if the info at this FAQs webpage doesn't answer your questions.

http://www.thestrategylab.com/tsl/forum/viewforum.php?f=90

With that said, TheStrategyLab is proud of the fact that we've freely helped hundreds of traders via either improving their knowledge about trading and/or improving their profit level without trying to get them to purchase any of our fee-based materials and without mentioning we are traders/vendors. In addition, we've been online since 2002 and most of our clientele are via word of mouth or Google search engine. Further, we do not advertise our services at other online locations nor do we spam other online locations which is another reason why there's very few discussions about TheStrategyLab.com elsewhere online except for mischaracterization posted by trolls.

In fact, a lot of traders are not interested in our free chat room nor interested in our live screen sharing...its a distraction to their trading. Instead, they prefer to talk to us about trader psychology, behavior finance, algorithms in today's markets along with other aspects of trading that they believe is impacting their trade results. I freely discuss these topics at other forums and will tell traders that they can review these topics at other social media sites but do not ask us questions about our education resources at those social media sties for traders like Twitter, Stocktwits, TradingView, other trader forums and other chat rooms. Instead, just copy the link or info and repost it @ TheStrategyLab forum and then ask us questions about that topic.

These types of trader talk will give them a good indication of my professionalism, communication skills, trading tips and ability to understand problems along with providing resolution for many things related to trading without discussing services by TheStrategyLab. In fact, most traders I talk to are not aware that I'm a also a vendor because I don't advertise to them nor do I bait them into asking questions about my services at those other forums.

In fact, the only negative discussions about TheStrategyLab website or about our services have been started by trolls that do not post verification of their own trade performance. Yeah, some trolls are obviously trolling TheStrategyLab after they were banned from our resources while other trolls are angry because I hold them accountable via calling them out about their unprofessional / bad online behavior in their effort to gain attention / importance from anonymous others.

Question:

What exactly is TheStrategyLab website or its purpose ?

Answer:

We are an education website and a research / development website for market analysis and trade strategies. Hence the phrase "Lab" in the name TheStrategyLab. Simply, we educate traders about the price action they're trading involving many different trading instruments.

To be specific, TheStrategyLab helps traders to merge our price action analysis called WRB Analysis with their trade signal strategies. Also, some traders request help from us to help them design their own custom trade signal strategies that uses price action concepts from WRB Analysis.

Simply, WRB Analysis is an analysis...not a trade signal. You can use it with anything that produces WRB intervals, WRB Hidden GAP intervals, contracting volatility intervals, volatility spikes, swing points and strong continuation price actions. Trading in our opinion is part science, part psychology, part art and those using our trade methodology only have access to the part science aspect. To be up front, we do not believe you can be a profitable trader via technical analysis alone and nothing else.

TheStrategyLab are not programmers, not coders and we do not use any automated trading systems nor custom indicators. Yet, many users of WRB Analysis have merged their own trade methods involving indicators, price action patterns and proprietary trading systems with WRB Analysis.

Further, the trader must interact with us and discuss how they trade, they must share with us chart examples of their entries / exits (I don't need to know the details of their trade methods) and share with us screenshots of timestamp trade fills (simulator or real money) in their broker trade execution platform so that we can provide proper support to help them improve the results of their trading. This type of interaction will help them and us to identify problem areas in their trading. Therefore, to use WRB Analysis...you can not just download the information and disappear (not communicate with us) and then expect to be a profitable trader.

Thus, you must communicate with us. In fact, since 2010, you will need to share with us verification of your learning via DOKs involving WRB Analysis and verification of your application of WRB Analysis via screenshots of timestamp trades fills (simulator or real money) in your broker trade execution platform because its the only way for us to determine if you're properly using WRB Analysis with your trade signal strategies or with our trade signal strategies.

You must also share with us your backtest results, statistical analysis or broker statements prior to learning WRB Analysis and after you've learned / applied WRB Analysis. This will allow you to determine the merits of WRB Analysis via comparing your trade results before / after WRB Analysis on your own for your due diligence. In fact, we've setup a private thread section at our forum for you to post this information without others having access to your private information to help reduce trolling of members of TheStrategyLab.

(click on below verification of trade performance screenshots to review large image)

The above different redacted screenshots represent different ways I verify my trade performance just one single trading day from my private trade journal of hundreds of trading days. There are more (different) verification screenshots for the above exact same trading day from my other two monitors, laptop that contains my chart configurations for WRB Zones, correlation analysis and intermarket analysis...annotated with WRB Zones and WRB Analysis Pivot Points.

Also, there are documentations of my interactions with other members of TheStrategyLab that were trading correlated trading instruments or trading the same trading instrument that I traded on that particular trading day...info that will never be shared except for the real-time posted trades in the free chat room. Just as importantly, other users of WRB Analysis are doing the same in their private threads here @ TheStrategyLab.

Further, these interactions (e.g. free chat room, private messages, live screen sharing) are critically important in my daily trading results because often a member will notice a change in supply/demand or change in volatility that I had not notice. All of this info are stored in my private trade journal and not shown for security & privacy reasons except for the screenshots (images) I've redacted / copied / reposted here @ TheStrategyLab.

I mention this because I don't want anyone to assume in error that I'm trading via the above first screenshot image only and nothing else. In fact, many users of WRB Analysis have stated that they do not care about my documentation via screenshots to verify my trade performance because they're more interested in real time price action analysis via WRB Analysis info from myself and other veteran users of WRB Analysis because it reveals to them the importance of documenting their trading. It gives them critical feedback about their trading that they can not get from a single screenshot of a broker statement.

In addition, the documentations must involve chart configurations for the above single trading day as I navigated from trade to trade.

Simply, they know that I use a multiple monitor configuration for my trading information and I make screenshots of this several times per trading day...its directly connected to how I interact with the markets that I'm trading on that specific trading day...info more valuable than a broker PnL statement or broker statement.

(this is not my multiple monitor setup)

Think about this carefully, if someone is trading via a multiple monitor setup and he/she only show a broker statement, broker PnL statement or just one chart on Twitter, Stocktwits, TradingView, forum or chat room...don't be naive and think that's all there is to trading. The same issue exists during live screen sharing or live streaming...viewers can not see the other monitors.

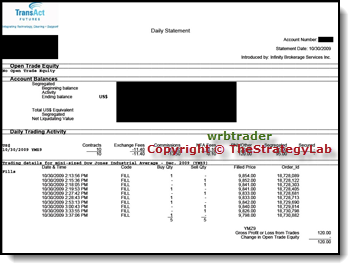

Something else that's very important about verification of trade performance via screenshots...take a closer look at the last screenshot image above...its my actual broker statement. You will notice that my broker is just like many other brokers that send out the statements to their clients late in the evening / at night...they only show trade fills, commission & fees without the timestamp of the trade fills.

This is normal policy with most brokers which is the reason why I put more value on screenshots of the timestamp trade fills in the broker trade execution platform that the trader can take immediately after their trading day has completed as represented by the above first three images for my trade performance on that particular trading day.

The timestamps trade fills in the broker trade execution platform is the only way to determine if someone is following their trading plan and is the only proof a trader needs when debating with their broker about a problematic trade fill.

This is the primary reason why I tell users @ TheStrategyLab to post screenshots of timestamp trade fills (simulator or real money) from their broker trade execution platform if their broker statements do not contain the timestamps. Its the only way for me to determine if they're using WRB Analysis correctly or not in a live trading environment. This is why I'm critical of traders at other forums, chat rooms, Twitter, Stocktwits or TradingView that spell out their trade strategy but then only show broker statements with no timestamps...we do not know if they're really following their trading plan or just gambling.

Now you know why there's a big emphasis on screenshots of timestamp trade fills in our private thread section @ TheStrategyLab.

Private Thread Section @ TheStrategyLab

(click on image to review TheStrategyLab Members Private Threads)

http://www.thestrategylab.com/images/thestrategylab-members-private-threads.png

Many users of WRB Analysis that are registered at our forum...they are posting this information about their trading in their private thread very similar to the verification of trade performance screenshots shown above that we copied from our private thread and then redacted. Yet, although the above verification of trade performance are redacted and other trading days verification are randomly posted in different areas of this website & forum...some verification information will never be shared for security & privacy reasons.

TheStrategyLab has done the posting of real time trades, live screen sharing meetings, screenshots of broker statements, screenshots of broker PnL statements, screenshots of audit trails, CME audited trade competitions, shared backtesting results although we use no automation trading systems nor use any custom indicators...at some point you got to say NO and put the naysayers, haters & trolls on ignore.

Further, we do not share any content from our members private thread due to our own security & privacy policy except for some members that posted public screenshots of their broker statements prior to 2011 when I was still creating the private thread section.

The theme @ TheStrategyLab since 2010 is that traders using our education resources must post verification of their learning / application of WRB Analysis in their private thread. Those that do not are eventually identified and weeded out of TheStrategyLab but they are welcome to return any time they want when they're able to post similar like verification information like the above & below except for those that have been banned for violation of our terms of use policy.

Question:

(click on image to review trader profile at Futures.io)

Futures.io wrbtrader Trader Profile @ http://www.thestrategylab.com/images/futures.io-wrbtrader-profile.png

wrbtrader Message Post History at Futures.io @ https://futures.io/search.php?searchid=10345773

I've been using your forum and website for over 10 years. I've seen you post your trades in real time for many years and I was a member of your live screen sharing that we all had our broker trade execution platform live in front of each other when trades happen live. I've then seen you post the same trades in the chat room while managing the members in the chat room.

Next, I've seen you post redacted screenshots of the trade fills in your broker trade execution platform in your public trade journal, private trade journal. I have seen many members post their trades in real time too and I have read the archive chat logs for the days I was not in the chat room.

I've also seen your redacted statements in your trader profile at other forums like Futures.io, Traderslaboratory.com, ForexFactory.com and in your social media profiles like Twitter, Stocktwits and TradingView for many years.

Why do people say its all faked ?

Answer:

Jealousy and trolling which is why I have a private thread section for members and myself to minimize the trolling. In addition, the jealousy and trolling is usually by those that do not post their own verification of trade performance.

Question:

Is there a way to determine the reliability or usefulness of TheStrategyLab's strategies prior to purchasing the strategies?

Answer:

(click on image to review trades posted in real time by users of WRB Analysis)

http://www.thestrategylab.com/images/thestrategylab-review-wrb-analysis-chat-room-members-020708.png

Archive Chat Log @ http://www.thestrategylab.com/020708FuturesTrades.htm

Yes...we offer free resources for you to review and then apply to determine the usefulness of WRB Analysis @ WRB Analysis free Study Guide (analysis) and Volatility Breakouts @ Fading Volatility Breakouts. The WRB Analysis free study guide is designed to help improve the performance of your own trade strategies and/or improve your understanding of the price action you're trading so that you'll make better trade decisions.

In contrast, if you don't have a trade strategy, you can use our free Fading Volatility Breakouts strategy with the WRB Analysis study guide so that you'll see how we merged a trade signal strategy with WRB Analysis. This is an important step in the free resources so that you can do your own due diligence and learn how to merge your own trade signal strategies with WRB Analysis. In addition, we offer @ free chat room for users of WRB Analysis to post their real time questions, real time trades or real time analysis involving WRB Analysis Free Study Guide or the Fading Volatility Breakout (FVB) trade signal strategy that's embedded with WRB Analysis.

Most users of WRB Analysis have determined that WRB Analysis is useful. They use its price action concepts either in their entry signal, exit signal, trade management (stop loss, trailing stop), profit target, trend analysis, range analysis or volatility analysis. Yet, we have no problems in admitting that some users did not see an improvement in their trading because their trade signal strategy did not work with WRB Analysis.

Therefore, if you're going to use our education content, you'll be required to learn and apply the WRB Analysis free study guide prior to the purchase of any of our fee base education content because WRB Analysis gives that critical "understanding of the price action" that's called market context to help minimize losses and maximize profits along with giving you the due diligence. In addition, you're required to document your learning and application of WRB Analysis as described in the next question.

To prevent any misunderstandings, the free Fading Volatility Breakout (FVB) trade signal strategy is not a trade strategy I use often but some of the price action concepts from the FVB strategy I do use every trading day. The FVB trade signal strategy is for traders to see how I merge WRB Analysis with a trade signal. The FVB strategy then gives the user ideas involving how he/she can merge WRB Analysis with their own trade signal strategies and/or how to design an objective rule-base trade method. In addition, the other purpose of the FVB trade strategy is for traders to see my communication skills and support so that they can determine if interacting with TheStrategyLab (e.g. wrbtrader) is suitable for them.

To prevent any misunderstandings, the free Fading Volatility Breakout (FVB) trade signal strategy is not a trade strategy I use often but some of the price action concepts from the FVB strategy I do use every trading day. The FVB trade signal strategy is for traders to see how I merge WRB Analysis with a trade signal. The FVB strategy then gives the user ideas involving how he/she can merge WRB Analysis with their own trade signal strategies and/or how to design an objective rule-base trade method. In addition, the other purpose of the FVB trade strategy is for traders to see my communication skills and support so that they can determine if interacting with TheStrategyLab (e.g. wrbtrader) is suitable for them.

Question:

You're consistently profitable...why do you not start a hedge fund or trade OPM (Other's People Money) ?

Answer:

I'm well capitalized. Thus, I do not need other peoples money although in theory its less risk when trading other peoples money. Also, I own my own business (inherited a family business when my grandparents died) in France and its already stressful knowing I'm responsible for the financial needs of employees and other family members.

In addition, an OPM or hedge fund falls under a different type of scrutiny that allows others to impact your trade decisions and business decisions. Therefore, you would need to consider the accounting, regulations, backup trader when you're on vacation or ill and many other business aspects.

Last of all, maybe the most important reason, I'm nearing the end (retirement) of my trading career as a trader and I would have health concerns involving the stress that would come with trading OPM or as a hedge fund...a lot more stressful than trading my own account that supports my family. In fact, I've already started limiting my trading via reducing my position size, reducing the number of trades and more days off from trading to spend more family time with my children.

Trading is just too mentally demanding and I've already been doing such for +20 years. Simply, at this phase in my life, a hedge fund or OPM is an unrealistic endeavor. If I can do it all over again, a hedge fund or OPM...I would have done such in the 1990s during the dot com years before the markets came crashing down and before I started a family.

Question:

You require users of WRB Analysis to document / verify their learning via DOKs, document / verify application of WRB Analysis Free Study Guide and other education resources via screenshots of timestamp trade fills (simulator or real money) in broker trade execution platform including revealing position size and chart time frame...why ?

Answer:

Yes...its a requirement since 2014. Actually, any trader that talks about the importance of backtesting, its a trader that's already doing the above type of documentation / verification of their trading. In fact, traders that do not document their trading on a simulator and then do not document their trading via real money trading...they are traders I can not help with their trading and their discussions tend to be more about their "feelings" about the price action instead of discussions with any facts. More importantly, they are traders that can not help themselves. For example, many traders come to me and ask me how can WRB Analysis improve the trade performance of their entry strategy, exit strategy, profit targets, stop/loss protection, trend analysis or range analysis.

I will then ask them to send me any documentations / verification of any recent trade performance that contains timestamp info about the trades or they can send me the info after their next trading day...most traders have excuses about why they're not able to forward that info to me. Without that info, I'm unable to provide them any support nor are they able to help their own trading.

These are the types of traders that I will refuse to help and try very hard not to allow them access to my education resources (free or fee-base) when they continue with that facade of not able to document / verify their trading. Yeah, my policies create anger but you must understand...if they can ask me as a vendor to verify my trade performance...why is it so wrong for me to ask them to do the same when they solicit me for help so that I can determine what's wrong with their trading ?

Also, I do not like sharing my education resources with a trader that's not willing to use a professional trade journal software or not willing to use a spreadsheet to journal their trading (simulator or real money). It was one of the primary reasons why I started the free chat room...its an easy way to show traders that the time they take to document each trade will help their trading in the long run and it prepares them to move into a better documentation via a professional trade journal software for users of WRB Analysis...journaling their trades and thoughts in a timestamp environment so that they can correlate their info with the broker statements they get later at night from the broker.

(click on image to review broker trade execution platform with trading results)

Archive Chat Log @ http://www.thestrategylab.com/ftchat/forum/viewtopic.php?f=186&t=2961

Therefore, if you see someone that say something works or does not work and they're unable to provide you with any type of timestamp documentation as the above for verification...their commentary is just hearsay (rumor or without truth) especially if they're someone that you've already seen them talk about the importance of backtesting or they talk about vendors should show verification of their trading beyond a text message post or small snippet image of a profit / loss column.

Regardless, the requirement for users of WRB Analysis to document their learning and application of WRB Analysis is too allow me to provide proper support and for me to provide custom support that's specific to that trader. I only do this because I've personally visited traders in their homes while they were trading and I immediately notice they were moving from trade to trade without properly documenting their trading.

I would then ask them about trades in the recent past and they were unable to give a reason for any particular trade except show how much profit or loss involving a particular trade or show a broker statement that has only trade fills, order IDs & fees but no timestamp of the trades and no detail reasons for each trade.

I then came to the conclusion that there's too much cliché in the talk about backtesting and traders can not provide any statistical results via their own application nor provide any specific details about entry signal, exit signal, trade management, reasons for the trade or market context of the trading day of the trades. Just the same, there's too much cliché in the talk about the importance of verification of trade performance...most traders do not do it because of laziness. Yet, its not uncommon for these particular traders to be the ones that demand verification or backtesting results from others.

Unfortunately, these are the traders that tend to not know how to adapt their trading when market conditions change and they're traders that are unable to minimize drawdown periods.

Therefore, do not become one of those traders that talks about the importance of having a trading plan and doing backtesting, forward testing or simulator but that has no verification they've actually did such especially if you want to learn WRB Analysis to improve your trading.

Traders that do not maintain backtest results of WRB Analysis or do not maintain statistical analysis of their own trading involving WRB Analysis...their trading will be consistently problematic. For example, if a trader can not tell me the percentage of trades that reached WRB pt1 versus WRB pt2 versus WRB pt3...its a big problem. Another example, if a trader can not tell me the WRB Zone they used for each trade...its a big problem.

Simply, I want to avoid working with traders that do not or refuse to properly document their learning and application of WRB Analysis or any other method including their own custom trading system. Another way to look at it, vendors should scrutinize whom they work with and have something in place to help them determine which trader is willing to do the work to succeed because profitable trading involves much more than following a trade strategy. I go into details about variables that are more important that trade setups in my "daily trading routine" that's posted in my performance record.

Question:

Do you post your full brokerage statements?

Answer:

(click on image to review wrbtrader / M.A. Perry broker statement)

I have posted some redacted full brokerage statements randomly at the website, forum or free chat room whereas most of my full brokerage statements (not redacted) are only posted in my private thread for security reasons and tax reasons because I'm acutely aware online privacy and cyber-security. In addition, I'm a strong believer that redacted screenshots of trade fills in broker trade execution platform provides more verification of trade performance than redacted screenshots of broker statements.

Also, I post all my trades in real-time in a free chat room for every day I do trade that correlate with the info in my redacted screenshots of trade fills in my broker trade execution platform and then store the archive chat logs of these trades and WRB Analysis.

Yet, a few anonymous people have asked for access to my tax statements while not posting any verification of trade performance of their own nor their own tax statements. This is the typical tactic used by trolls. They ask for one type of verification...you show them the proof...they then ask for another type of verification...all while they are not able to post their own verification of trade performance. In fact, I do not believe I've ever been asked to post more verification of trade performance by another trader that also post his / her own verification of trade performance. Thus, its only asked by those that do not post their own verification info.

I tell these particular trolls / disbelievers / haters that I pay taxes in France and Canada (French province) and my trading is not my only business. I'm also the owner of a photography business in Europe. Thus, my trading supports my family and helps my business elsewhere whenever there's financial difficulties in the photography business. Simply, my tax statements are for my eyes only. Therefore, the trolls / disbelievers / haters will never have access to my private financial information beyond what I've already posted here @ TheStrategyLab...info that's a lot more than what the trolls are able to post about their own trading.

Reminder, I'm also posting real-time trades (winners & losers) in our free chat room that correlates to the trades shown in the broker PnL statements that you see on this webpage and any where else at my website. I post real-time trades with other members doing the same too about their trading. In fact, TheStrategyLab is one of the few websites that users of its trade methods post verification of their trading.

In fact, many verification of trade performance by users of WRB Analysis are archived @ https://www.thestrategylab.com/ftchat/forum/

(click on image to review trading results)

Archive Chat Log @ https://www.thestrategylab.com/092706FuturesTrades.htm

This screenshot was taken during live screen share meeting with several users of the free chat room and we posted the above link to the archive chat log for the free chat room used by other users of WRB Analysis just to show that we do in fact verify our trading many different ways for those not allowed access to the live screen share meeting or not allowed access to the free chat room.

Below to the right is a screenshot of a broker statement from our public thread section for users of WRB Analysis to post their broker statements for anyone to review. The image was copied and reposted here for you to review after we had permission of the client. Yet, had the image been originally posted in our private thread section...it would not have been copied and reposted for public review even if it had been redacted.

Real money & simulator trading results by traders using WRB Analysis.

Today, we require all users of our free chat room to post their real-time trades. If they log into the free chat room but for whatever reason decide not to post their real-time trades...they must post their screenshots of timestamp trade fills in their broker trade execution platform or post their broker statements...no exceptions.

(click on image to review WRB Analysis user's real money trading results)

https://www.thestrategylab.com/images/thestrategylab-member-103009-daily-broker-statement.png

Yet, we prefer our users to post screenshots of timestamp trade fills in their broker trade execution platform because it shows us at least one of the screen configuration while they were trading, we can use the timestamp to determine if they're using WRB Analysis correctly, and its less likely to be faked in comparison to broker statements that only show trade fills (without the timestamps) with commissions & fees.

Users that refuse to follow this rule in our terms of use policy...they are not allowed to return to the free chat room and its the real reason behind many trolls attacking TheStrategyLab...they were removed from our free chat room or we banned them for trying to use our free chat room as a signal calling trade alert service.

It's one of the reason why the membership of our free chat room has been declining although other reasons for the decline are due to the rise of Twitter, Stocktwits and TradingView. Simply, we do weed out wannabe traders and trolls that do not post verification of their trade performance while using our education resource. These wannabe traders then prefer to use Twitter, Stocktwits and TradingView.

(click on image to review common broker snippet...verification...informative?)

Sarcasm via a real screenshot of a broker PnL statement / blotter by other traders on social media by a traders that thinks in error that he/she has verify their trading so that someone can help them with problem areas in their trading.

Regardless, its still strange to see so many traders on the internet (social media) like Twitter, Stocktwits, TradingView and other trader discussion forums...spend most of their day writing messages about the markets but can not find time to properly document learning / application of their trade methods because a small snippet / blotter (commonly posted at forums) falls short by a mile for anything.

Question:

Why do you have a Private Trade Journal and Private Thread section of the Forum ?

It's simple. Every public DOK and their charts, public screenshots of redacted images of trade fills in broker trade execution platform and public redacted broker statements that have been posted at TheStrategyLab website or forum...

They have been copied and renamed without our permission...without our knowledge. Next, these individuals then use our verification of trade performance images as their own to help sell scam automated trading systems and scam custom indicators. Thus, members verification of trade performance and my own verification of trade performance here @ TheStrategyLab are currently being used by those with hidden agendas and by those for illegal purposes to sell bullshit trading systems that has nothing to do with TheStrategyLab.

In fact, the host of our website will occasionally notify us of unusual hack attempt activities on our forums private sections since their creation from areas of the dark web known for criminal activities.

Thus, in June of 2011, I created a private section of the forum for members that only have access to their own private thread in which other members in the private section do not have access to another members private thread. Further, in July of 2018, I moved my trade journal from the public threads to the private trade journal section of the forum after the DMCA notified me of unusual number of my trade performance images being found at sites of individuals with fake identities...

I've even had a few of these scam websites or individuals with fake identities specifically contact me just to tell me that my verification of trade performance images can not be copyright protected after they had their website taken down by the DMCA and Google.

As expected, these idiots had contact me via fake IP addresses, rented IP addresses while unwillingly to verify their real name, address location and not able to verify their own trade performance. A few gave me a city and country location that did not correlate with their IP address in their emails.

To prevent scam artists, trolls, frauds, hackers from having access to TheStrategyLab's verification trade performance images considering anyone can download or copy anything that's posted in the public domain...I created a private section of the forum for members only and myself. Seriously, there are just too many scam reseller websites of automated trading systems, custom indicators in the thousands that its impossible to have the DMCA and Google to take down those websites...its like a whack-a-mole game. Sadly, there are a few review websites or review blogs secretly affiliated with these reseller websites.

https://www.dmca.com/

https://support.google.com/legal

The DMCA stands for the Digital Millennium Copyright Act under the U.S. copyright law. It covers the rights and obligations of the beholders of copyrighted materials whose rights have been infringed (usually online). DMCA’s regulations apply also to the rights and obligations of the Internet Service Providers and the servers or networks on which the infringing content was placed.

On October 12, 1998, Congress passed the Digital Millennium Copyright Act (DMCA). The law became effective in October 2000 and it has been incorporated into the Copyright Act (Title 17 of the U. S. Code).

https://en.wikipedia.org/wiki/Digital_Millennium_Copyright_Act

Question:

Do you show your losing trades and losing trading days?

(click on image to review trading results)

Archive Chat Log @ https://www.thestrategylab.com/092906FuturesTrades.htm

Yes. I do show my trade losses in the free chat room, trade losses in trade fill windown/audit trail window, and in my brokerage statements. In addition, I discuss the reasons for those losing trades or losing trading days only in the free chat room but I only discuss the specific details of the trade strategy used in the losing trade via private message with fee-base clients...if a fee-base client ask questions about the losing trade.

Most of the time its just my wrong analysis or poor trade management after trade entry or simple trade errors in opening/closing a trade in the trade execution platform. Thus, we all have bad trading days and I have no problem in discussing my own bad trading day as it occurs in real-time. Yet, I never discuss the reasons for my trades with free users unless it involves only the WRB Analysis Free Study Guide.

Simply, I believe that discussing losing trades are just as educational in discussion profitable trades on any given trading day especially in real-time as it occurs. In fact, I highly encourage other traders to do the same in the chat room or via their private trade journal because it helps to identify the problem so that it can be minimize or prevented in the next trade.

Trade performance screenshots like the above are now only posted in our private trade journal by myself and our members. Its important documentation to help improve trade performance regardless if its done in public / private regardless if you're a scalper, day trading, swing trading, position trading or just learning (simulator trading).

Members Private Trade Journals @ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=349

Members Private Threads @ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=118

Reminder...brokerage statements, real-time trades, live screen share meeting are not verification if WRB Analysis will work or not work for you. Heck, you can be sitting side by side next to me in person and watch me trade with your own two eyes...it will only prove I do trade but it will not give you any indication for your future performance. You can only get that indication from your use of the WRB Analysis free study guide via comparing your trade results before learning WRB Analysis versus your trade results after learning/applying WRB Analysis.

Yet, whatever verification you find...there's still no guarantee it will be your future performance because markets are always changing due to changes such as low volatility to high volatility, high volatility to low volatility, trend to range, range to trend, global economics, geo-political events, changes in exchange rules, changes in technology and changes in your own personal lives that will arguably have the most impact on your trading.

Question:

Do you allow traders to have access to your depth of market (DOM) window via screen sharing in real-time while you're trading or do you have any recorded videos of your depth of market (DOM) while you traded ?

Answer:

First of all, this particular question is usually aimed at someone that has a signal calling trade alerts room service or a mentoring service. I do not offer those types of services and I've never had such services. More importantly, I do not allow someone to mimic (copy) my trades and I've never allowed such. Typically, those that ask for access to my DOM window are attempting to mimic my trades without my permission or attempting to use such as a signal calling service. Just as importantly, I'm not a DOM trader although I've tried it a few times in the past and have even documented (with images) my DOM use many times.

TheStrategyLab first posted broker PnL statement on September 26th 2006 via my Japanese account user name @ http://www.thestrategylab.com/images/092606NihabaAshiPnLBlotterProfit.png (statement pulled from September 2006)

Regardless, even though you can see the DOM in the image at the above link...I don't use bid/ask information, price ladders or market depth when I'm trading to determine my trade decisions. Simply, my trade execution window (order pane) is my primary route to execute my trades because I'm able to minimize my trade errors when I don't watch the DOM. In fact, I now keep my market depth window minimized down in my task bar so that I do not see it.

Today's markets are heavily occupied by algorithms that constantly cancel trade orders. Thus, the info you see in your depth of market (DOM)...50% to 85% (depending on the trading instrument) is a false representation of changes in supply/demand. Therefore, be careful with trade decisions dependent upon information in the DOM.

Secondly, I don't sit at my computer the entire market day and that's another reason why I don't offer a signal calling trading room beyond saying I trade actively on most days the first two hours of the regular trading session.

With that said, I do plan on doing recorded videos of trades with explanations of the trades via the price action concepts from the WRB Analysis free study guide. Yet, these videos will not contain any recordings of my DOM window or market depth window considering I do not use such. In contrast, you will only be able to see the trade order pane screen for my trade executions (entry/exit), a few of my charts and the free chat room window that includes my posting of the confirmed trades in the free chat room. Yet, you will not be able to see all my other screens because I use a multi-monitor setup. These videos will initially only be available to active users of the chat room or active users of the forum. I may even add hindsight audio to the recorded real-time videos to make them more educational about the WRB Analysis free study guide.

Question:

Your website is an education website. Why do you not offer a signal calling trade alert service or a mentoring service ?

Answer:

I am not a fan of signal calling trade alert services. I've learned enough about them that the only way users can profit is if the trades are called far in advance. The typical trader isn't able to profit from such because the price action often changes after the trade was called in advance. In contrast, trades called in real-time (not in advance), I've learned (study) behavior finance and cognitive decision making reactions to know that traders can not react fast enough to get similar like fills when they try to mimic (copy) trades by others. Further, I do not have the time and energy to manage such a service.

Also, although I post my trades in real-time in a free chat room, I do not want other traders trying to mimic my trades because of the above explanation and that's why the free chat room is not setup as a signal calling chat room.

Currently, I do not offer a mentoring service but I often get offers by traders to mentor them. Proper mentoring to ensure success for the student requires a lot of work and requires it to be performed in person at a great expense although I'm aware of some traders out there trying to mentor online only. Yet, one day I may offer a mentoring service and if I do such...I will follow the guidelines I've outline @ http://www.thestrategylab.com/TraderMentor.htm

This is why I require users of WRB Analysis to document (verification) their learning via DOKs and application via Screenshots of timestamp trade fills in broker trade execution platform of WRB Analysis. In fact, if I do mentor, I will not mentor anyone if they can not provide me with any documentation (verification) of their learning / application of WRB Analysis.

Question:

Your website has many positive reviews in different languages and lots of positive testimonials from traders around the world and only one negative review. Can you explain the one negative review and explain why some users didn't find WRB Analysis useful while most users say its useful ?

Answer:

I have a lot of satisfy users of WRB Analysis that have an improvement in their trading and a small percentage of users that did not see an improvement in their trading. Simply, there are traders out there that WRB Analysis can not help. That's normal and there's no such thing as perfection and I make no guarantees. In addition, I do not know how many of the dissatisfied users are incorrectly using WRB Analysis considering they tend to not document their learning and application of WRB Analysis. Further, I do not know how many of the dissatisfied users are missing other key variables that's needed for successful trading such as discipline, stress management, proper margin/leverage use, proper trading instrument, proper trading environment, proper capitalization and many other aspects that's critical for successful trading.

I have heard complaints by a small group of fee base clients that say WRB Analysis is confusing. Unfortunately, most of them did not follow the designated Learning / Application Route of Tutorials and Trade Signals that's posted in their private threads and I saw too many errors by them in their demonstration of knowledge (DOKs).

Also, as noted in an earlier question, all users of WRB Analysis (free users and fee base clients) are required to document their learning and then trading on simulator prior to any real money trading...continuing to verify their learning / application of WRB Analysis with real money trading. That documentation requires them to keep information such as the date of the trades, timestamps of entries/exits, chart time frame, position size management and reasons (WRB Analysis) for the trade. This is the minimum information that anyone doing backtesting would keep. Unfortunately, the requirements are ignored and that makes it impossible for me to help any trader struggling or confused by WRB Analysis.

Also, be very careful about the negative opinions out there because most of the negative opinions you've seen were posted by traders we've already had banned from our website resources because they had either harassed other members, harassed us, impersonating members in an attempt to gain access to services they did not pay for, impersonating other members that had already given us a positive testimonial, hack attempts on trading accounts or they are upset I banned them from the free chat room for their disruptive and trolling behavior in the chat room.

More importantly, the one negative review you saw by a blogger...he did not use WRB Analysis and refused to view my archives of my real-time trades, refused to view archives of real-time WRB Analysis, refuse to view my broker PnL statements and refuse to review clients full brokerage statements. Instead, he wanted access to my trading accounts while not disclosing to me in our conversation that he's a convicted felon that defrauded his victims over 60 million dollars...ruining their financial lives and stealing their hopes & dreams.

Seriously, if you think my denying him access to my trading accounts is unreasonable. You're more than welcome to contact him and share your trading accounts or any other private information with him. Good luck with that considering he's someone that had access to private information about his clients and then decided to defraud them in the tune of +16 million dollars resulting him in being sent to prison.

If you think my real-time trades are fake, my broker PnL statements are fake, clients full brokerage statements are fake, users documented real-time trades are fake, positive testimonials (accolades) are fake, users statistical analysis of my methods are fake, users statistical analysis of their own trade methods merged with WRB Analysis are fake...stop reading this FAQs and go hang out with that convicted felon and ask him to share with you his real-time trades, full brokerage statements and DOM (if he uses it) considering he's a trader and vendor too.

The real issue is this. I do not tolerate individuals being unprofessional, bullying, intimidating, harassing, trolling or engaging in targeting abuse of users of WRB Analysis or to myself especially those that try incite others to do the same. I hold them accountable for such behavior via banning them. Also, I stop sharing any useful trading education content with them. In addition, I maintain a digital documentation of such behavior for future reference. Unfortunately, they choose to retaliate after being banned via going elsewhere to post negative comments under the umbrella of false statements that you've seen about TheStrategyLab. Their only truth is that I refuse to share private information about my trading and myself beyond any information I've already shared. Ironically, some of them did share their brokerage statements and/or positive reviews about WRB Analysis prior to being banned.

Official Rebuttal @ http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=46&t=3167

Question:

What exactly is the demonstration of knowledge (DOKs) and why is it so important ?

Answer:

DOKs requires users of WRB Analysis to learn the education content and then prove they've understood and can identify the price action concepts on hindsight charts...essentially the trader uses the DOK to pretend he/she is teaching the reader about the price action concept. Thus, DOKs allows me to see where the user of WRB Analysis is at in his/her learning/application route so that I can determine if they're correctly following the instructions in the learning/application route. More importantly, DOKs allows me to tell the user of WRB Analysis if they've correctly understood the price action concepts.

Essentially, the DOKs ensures the user of WRB Analysis will receive proper support if/when they become confused about any price action concept. Therefore, the DOKs are critically important in the communication between the user of WRB Analysis with myself and other users that can help.

Simply, a user of WRB Analysis that does not post DOKs or consistently posts incorrect DOKs or skips around in the learning/application route instead of following the designated instructions or begins trading with real money without the required 30 day minimum simulator phase to help them traverse from hindsight chart learning to real-time streaming application...these small group of traders will often be confused, complain the most and argue the most.

You can review examples of simple DOKs @ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=61 (DOKs from fee base clients involving the fee base education content is not shared with none clients).

Question:

You're a member of several popular trading forums. Yet, you do not discuss your trade method at those forums and you do not mention your services. Therefore, why do you use those forums...do you have a hidden agenda ?

Answer:

I have several close personal friends (retail traders, institutional traders and former institutional traders) that are members of those forums that I communicate mainly with in private message. Yet, my public messages at those forums tend to involve trader psychology or debating with traders that are hypocrites in their views about technical analysis when I know for fact they use technical analysis (e.g. they use charts while trading). In addition, I will often talk general market discussions that has nothing to do with my services at TheStrategyLab (e.g. wall street, quantum computing, algorithms, charting software, sports, hobbies and so on).

Unfortunately, there are some idiots out there that views my no discussions about my own trade method at those forums as some kind'uv of a conspiracy or something vendors do...vendors do not post verification of their trading. Others label you as a guru even though you're not expressing yourself as an expert nor are you giving anyone at other forums any specific trade advice about a particular trading instrument. In contrast, the gurus I've met online almost always talk about their trade methods at forums along with giving advice about how to trade or the guru is trying to use the forum to teach trading. I do not do such and I respect the terms of use policies of those forums.

More importantly, I just want a presence at those particular forums via my username wrbtrader because I wanted to secure my user name after I had some problems with traders I banned from my website many years ago.

Question:

What's the difference between mentoring and your free resources or fee base resources ?

Answer:

As stated, we currently do not mentor and the main difference you've asked about is that mentoring can only be properly perform in person to increase the odds dramatically that a student will have the tools to be a successful trader which is why most mentoring fails miserably because most mentors do it via online (e.g. chat room, weekend seminar et cetera). In contrast, our free resources and fee-base resources are like building blocks that must occur prior to any in person mentoring which is why many of the users of WRB Analysis are waiting for us to start a mentoring service to continue improving their trading. Just as importantly, mentoring is teaching someone how to trade and if you read the WRB Analysis free study guide...the free study guide does not teach you how to trade. Instead, the free study guide explains some of the price action concepts that I use while trading.

Simply, all we do is sell our strategies that we use to achieve the trading results you see posted in the free chat room called ##TheStrategyLab although we do not market our strategies in the free chat room because it is a SPAM FREE chat room via request of those that use the room.

In addition, your purchase entitles you to get support that's critical to the learning process of your trading. This support allows you to ask trading related questions involving our strategies and your trading instruments along with discussing with you real-time patterns from our strategies in the private chat strategy discussion chat room called ##VolatilityTradingTSL or ##WRB_Analysis and via private message on Skype, twitter or stocktwits.

I mainly use twitter and stocktwits via private message. Thus, you may not see a lot of public messages by my user name wrbtrader on those social media services but I'm very active on those social media services via private message.

To read about our personal opinion about how we define mentoring (coaching)...click here.

Question:

You post recent chart examples @ StockTwits @ TSL Support Forum of your trade strategies...are those trades you've taken ?

Answer:

Those charts at twitter, stocktwits, tradingview and the TSL Support Forum do not represent trades by TheStrategyLab itself. In contrast, the charts represent trades by some of the free users or fee base clients that used the concepts discussed in the WRB Analysis Tutorials or our trade strategies to make those trades (simulator or real money). To be more specific, if you contact me and discuss the details of a particular trade in which you used price action concepts from WRB Analysis...I will document the conversation and download a chart of price action for possible use for marketing/advertising at my own website or on twitter or stocktwits. the charts presents trades in key price action or trades that exemplify an illustration of one or several concepts from WRB Analysis.

As for the trades of TheStrategyLab.com, you can review our performance record @ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=147 for details about each trading day even though there are no charts included in our performance record.

Question:

There are different fee-based services associated with a different forum. How do I know which forum to join after payment ?

Answer:

The different forums you mention are clearly explained @ http://www.thestrategylab.com/forumlist.htm

Upon payment, if you have not registered for a forum, we will contact you with instructions to ensure you'll join the correct forum. However, if you join a fee-base forum prior to payment, your registration goes into a "verification status" prior to allowing you access to the fee-based contents posted at the forum. It will stay in the "verification status" for 72 hours until payment is received.

In the verification process, you will be asked questions that you must respond to with answers. One such question will involve asking if you downloaded, learned the WRB Analysis free study guide and if it was useful to your trading because you're required to have used the WRB Analysis free study guide for your due diligence prior to purchase.

Question:

Your broker profit/loss blotters that you show for the past few years show that you are a profitable trader. Therefore, why do you bother selling your strategies ?

Answer:

We have learned many things from our free users and fee base clients that have helped improve our own trading and some clients have become excellent traders themselves via our methods that we actually help each other during the trading day via the private strategy discussion chat rooms, skype associated with the fee-based strategies.

I'm not a lone wolf type of trader that wants to trade alone without any real-time communication with other traders during the trading day. Therefore, I prefer to communicate with other traders during the trading day. In fact, I want my communication to be with traders that understand the basics of WRB Analysis or understand other aspects of trading that's critical to my trading such as behavior finance, trader psychology and such. Without that communication, the trading results you see will have been less.

Simply, the free resources and fee-based strategies and have open the door to real-time market collaboration with other traders around the world that improves the trading of all those that have walked through TheStrategyLab.com doors via a vested financial interest that produces dividends for us and our clients. This type of trading collaboration with other traders using concepts from our WRB Analysis easily increases the odds for us to be able to consistently exploit the markets.

In addition, our marketing and payments made to TheStrategyLab.com usually occurs before or after trading hours. Thus, the hours designated for managing the website does not interfere with our trading. Therefore, if selling the trade methods interferes with our own trading results...we would stop being vendors as a second source of income. Just as important, the income from our website is a small dollar amount due to us not having the time to market ourselves outside of TheStrategyLab.

Question:

Do you have a refund policy ?

Answer:

Yes and it's a no refund policy. More information about our no refund policy @ http://www.thestrategylab.com/RefundPolicy.htm

Simply, we expect you to do your due diligence via using our free resources prior to you purchasing any of our fee-base resources so that you'll know exactly what you're getting. If you have any questions about our no refund policy...please do not hesitate to contact us.

Question:

How long would it take to become consistently profitable after purchasing your strategies or using your free resources ?

Answer:

It's impossible to answer this particular question because we don't know anything about you as a trader via many variables that deals with a trader's learning abilities, market experience, discipline level, ability to handle stressful trading conditions, home/office trading environment, issues within your personal life, changes in market conditions et cetera. In addition, as a reminder, our goal is to make you a better trader in comparison to your trading prior to your purchase of our fee-base resources...a goal that most of our clients achieve.

Question:

Do your strategies involve technical indicators (e.g. macd, cci, rsi, stochastics) ?

Answer:

No...we are price action only traders that do not use technical indicators but we do use technical analysis and basic understanding of the impact of key market events on the markets. Also, some users of WRB Analysis do use price action concepts from WRB Analysis merged with their indicators or proprietary trading systems.

Question:

Are your Volatility Trading Report (VTR) trade signal strategies or the free Fading Volatility Breakout (FVB) trade signal strategy applicable to all markets ?

Answer:

Our trade signal strategies are not applicable to every market because we are a strong believer that vendors should only market their services to trading instruments they currently trade, traded profitably in the past or have clients that are currently applying the trade methodology to particular trading instruments. To see the complete list of trading instruments that's applicable for trading via your strategies...click here.

In contrast, our WRB Analysis Tutorial Chapters are applicable to all markets (stocks, futures, exchange traded funds and forex currencies) that you're able to see WRBs and WRB Hidden GAPs.

Question:

Can you explain exactly what is WRB Analysis and how its beneficial to trading ?

Answer:

The word WRB means wide range body (candlestick chart clients) or wide range bar (bar chart clients) and there are different types of WRBs based upon either...[continue reading].

Question:

Are the trade signal strategies subjective or objective ?

Answer:

All of our trade signal strategies have a well-defined trading plan (objective).

Simply, you'll know the rules (not computer codes) for the pattern signal, confirmation signal, entry signal, initial stop/loss protection, trailing stops and when to exit a profitable trade. Yet, our trade signal strategies is not a mechanical system and that in itself implies it's a discretionary rule base trading method. Simply, objective rule base trade method but discretionary application due to traders (users) are different in comparison to another trader.

With that said, some users have coded the tutorial chapters and some of the advance trade signal strategies into their own proprietary trading systems...usually merged with their own custom methods. That in itself should tell you its not subjective because if it was...they would not be able to do what they did.

Question:

These strategies are a rule based method with no subjectivity in the pattern signal nor entry signal...can the strategies be coded for mechanical or automated trading (computer trades the method while the trader is doing other things)?

Answer:

We ourselves are not programmers and were unable to code the strategies for automation trading. Yet, you can download the WRB Analysis free study guide to see if you can program/code it yourself as some users have already done such. Some locations of these codes are posted in the WRB Analysis free study guide and our free Fading Volatility Breakout (FVB) trade signal strategy while other codes are private and only posted by the trader in his/her private thread because its merged with their own proprietary trade methods.

Question:

The ##TheStrategyLab trade log sometimes show you stating a particular trade is via intuition. What exactly does that imply considering your strategies are not subjective ?

Answer:

I take trades via my well-defined strategies and intuition trades based upon my experience in specific types of market conditions. I'm upfront about any trade I state is intuition versus other trades that are not intuition. Yet, all trades share a tick with a WRB Zone as required in the WRB Analysis education content.

There are some trolls intentionally posting misinformation about my intuition trades. For example, if I take 10 trades and 2 of the 10 trades were announced as intuition on entry into the trade...users of the free chat room do not get an explanation when the ask me to explain the intuition because my response is that its just "trade experience". Unfortunately, some of these traders that later become trolls...they will post misinformation elsewhere that my trades are confusing to them and it doesn't correlate with what they've learned from WRB Analysis.

Reality, if you read the archive chat logs of the free chat room, I often talk about the market does what it does and it does not depend on technical analysis or some quantitative reason. I'm able to exploit some of those situations via intuition. Yet, for some odd reason...its disturbing to some traders and they're very confused about intuition trading and then they feel the need to bad mouth it because they're not able to do it too.

Intuition trades are mainly trades where I'm not following my own rules due to the fact I may be designing a new strategy, trying a new trade management approach or relying on my market experience when I don't have trade signals from my the objective strategies but I do understand why the market is doing what it is doing. Yet, as stated, all my trades shared a tick with a WRB Zone as taught in WRB Analysis. Further, I keep separate trade result stats of my objective trades versus my intuition trades in which these stats gives a wealth of information about how I interacted with the markets on any given trading day.

With that said, it's very important you remember that I'm constantly looking for ways to improve my own trading and the trading of my clients as a discretionary trader using a rule-base trade method (no automation, no program codes, no algorithms).

Therefore, I need to try new things (research and development) so that my clients and I can adapt to market conditions when they change to help minimize drawdown periods and improve profit results...hence the name word "Lab" in TheStrategyLab.com

Question:

What percentage of traders using your strategies are profitable ?

Answer:

Several months after a client has purchased our strategies, we will ask them if our methods has improved their trade performance in comparison to their trade performance prior to purchasing our strategies....

Currently as of 2014, about 78% say YES and that number has been as low as 72% or as high as 83% depending upon which year (updated stats posted at TheStrategyLab.com home page).

Those that said YES does not imply they are making big profits nor do they send us any verification of their profit level although some do post an occasional broker profit/loss statement online at some discussion forum where they are a member without mentioning the source of their trading knowledge due to fear of being called a spammer or shill for TheStrategyLab.com

Further, of those that said YES...about 71% said they are exclusively using our strategies and nothing else while the remaining 29% used concepts from our methods to either improve their own methods or design new strategies that was more suitable to their trading style. The above info also shows that 22% has not seen an improvement in their trade performance although most believe it's too early to tell because they are still learning the strategies.

Here's another interesting stat...we keep track of traders within our social network (forum, chat room, twitter group) regardless if they are using our methods or using their own methods. Traders not using our methods (don't have access)...only 19% are profitable and most of them have openly stated they do not trust vendors or may try our methods in the future only after they've exhausted their self-learning process.

Question:

Is there a way to determine the potential performance level prior to purchasing the strategies ?

Answer:

First of all, this is an impossible question to answer because we do not know your learning curve, at home/work trading environment, trading tools you have access too, trading capital, trading experience and many other variables.

Secondly, do not assume you will achieve similar like trading results as my results because I have +20 years of market experience and 15 years of that is via trading. Thus, we only advertise that we will improve your trading in comparison to your trading prior to you using our trade methodology. Also, due to my extensive market experience as a price action only trader...it's the main reason why the real-time support is extremely helpful for clients that want to collaborate with me in real-time during the trading day.

Therefore, market experience has a big impact on my profit level, consistency and successful application of the strategies as it is for clients when I share the market experience. Simply, we do share with you our market experience via the support that's included with the purchase of our strategies.

Yet, please be aware that my trading results or the trading results of a client is not a good indicator of your potential performance if you were to purchase our strategies. In fact, the below variables will have a direct impact on your profit level:

Different strategies you tend to favor from our basket of strategies

Different broker and/or trade execution platform

Different charts viewing on your monitor(s)

Different at home or work trading environment

Different learning abilities

Different times and/or days when you tend to trade

Different trading styles via how you interact with the markets via our strategies

The above in any combination will have an impact on your performance level in comparison to another trader regardless if you use our strategies or strategies by someone else and it's what most vendors will not tell you about realities of trading.

Question:

Why is it so difficult to find traders at other forums using your methods to get first hand knowledge about the merits of your strategies without having to request references from you ?

Answer:

First of all, traders tend to find out about TheStrategyLab.com via search engine (e.g. Google), referral from another trader in their social network (e.g. Facebook) or via word of mouth (in person recommendation). Thus, we ourselves do not promote our services outside our website and if we see someone spamming (promoting our website without having been solicited for information) our website at another online resource such as a forum...we'll contact the site owner of the location where the spam was posted so that the info can be deleted.

With that said, you can easily determine the merits of our trade method via using the below free resources.

WRB Analysis Tutorial chapters 1, 2 and 3 study guide. You can download it @ http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=119&t=718

Fading Volatility Breakout (FVB) trade signal strategy. Access instructions @ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=89

##TheStrategyLab real-time chat room @ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=164

The above will allow you to determine on your own the merits of your trade methodology without needing references from other traders because you'll be able to interact with those "other traders" using our resources. In addition, your use of the above free resources will show us that you have a sincere interest in learning/applying our trade methods.

Question:

You have a free chat room called ##TheStrategyLab where those using the room are posting their real time trades and price action analysis. You also said that some members using ##TheStrategyLab or register to use the room are not exclusively using your methods.

http://www.thestrategylab.com/ftchat/forum

The question is why do they not purchase your strategies when you post consistent profits most trading days along with a broker profit/loss statement ?

Answer:

Some ##TheStrategyLab members are profitable via their own methods merged with price action concepts from our free resources (e.g. WRB Analysis free study guide, free FVB trade signal strategy) and that reason alone is why they aren't interested in purchasing any of our advance methods. Thus, some members are satisfied with our free resources and its the only thing they needed to jump start their own trade methods.

In addition, many members have already invested a lot of time & energy in their own methods and that in itself makes it very difficult for many to switch to our trade methods. Also, we don't market our strategies in real-time within ##TheStrategyLab chat room because it is a spam free chat room although we do some promotion within the archived chat log of ##TheStrategyLab posted at the support forum that's read by guest visitors. Simply, its common to have a member of ##TheStrategyLab not know we are vendors too.

Question:

Why should I pay for your strategies when I can just join the free chat room called ##TheStrategyLab to mimic (copy / mimic / piggyback) your trades as you post them in real-time ?

Answer:

##TheStrategyLab is not a signal calling trade alert room nor is it properly setup for traders to efficiently mimic each other trades due to the fact that there are a lot of market discussions and trades being posted by many different room members at the same time (Long and Short). In addition, the odds aren't good that you'll get the same fill nor the same exits due to the fact that the chat room members do not give warnings when a trade (entry or exit) is about to occur along with the fact that my trades are posted among trades being posted by other members.

Most importantly, I do not want any member in our free chat room to be blamed for the trade losses of another member that was using our free chat room and violating our terms of use policy.

Also, I have a strong belief that if you mimic trades by another trader without the permission of that trader...you'll instill poor trading habits that will be extremely difficult to fix when you do decide one day to learn how to trade on your own along with showing members of #TheStrategyLab that you're not interested in participating in the chat room via either posting trades or discussing the markets. Therefore, I don't recommend any trader to mimic the trades of another trader unless they have the exact same broker, trade execution platform, chart program, similar like chart layouts along with having access to the strategy being used to prevent blind trading. Further, I'm always trying new strategies (hence the name TheStrategyLab) to see if they are suitable for adding to my existing trading plan.

Simply, it will be a huge mistake for you to mimic my trades without my permission and without knowledge of knowing if the trade signal is from my profitable system or from something that's new and possibly not reliable.

However, I and other members do sometimes tell fee-based clients in the private ##VolatilityTradingTSL or ##WRB_Analysis real-time strategy discussion chat rooms about possible pending pattern signals or will discuss clues as they are occurring that a pattern signal may soon appear along with identifying key changes in supply/demand.

Question:

Is there a reason why you don't post information with your real-time trades in the ##TheStrategyLab chat room involving your stops and profit targets ?

Answer:

The information about my trade management is posted in the available free information at the TSL Support Forum within the free Fading Volatility Breakout (FVB) trade signal strategy and other trade management information within my "daily trading routine" links you'll find in the performance record at the TSL Support Forum. Simply, I don't repeat the same information for every trade in real-time whenever I post a trade in the chat room when you can easily read my trade management information at the TSL Support Forum.

Question:

Do you trade someone's else account besides your own trading account ?

Answer:

I'm not interested in trading the account of another individual because I'm well capitalized. In addition, trading my own account is stressful enough without having to worry about the money of someone else. In fact, some traders perform better when they trade the money of someone else. In contrast, I do not perform better when the money belongs to someone else or I know traders are trying to mimic (copy) my trades.

Yeah, for me to say the above implies I've tried it and the results were not good and far too stressful. That's the thing about trading, you got to know your strengths and weaknesses and then exploit what you're good at while staying away from situations that you perform poorly.

Question:

I'm interested in WRB Analysis for my exit strategy while not interested in WRB Analysis for my entry strategy because I am confident in my entries because they back-tested well and my real money trading results have profitable results.

Simply, my problem involves exiting profitable trades too early. Thus, can your fee-based strategies help me with my exit strategy so that I can capture more profits from profitable trades ?

Answer:

Yes.

The WRB Analysis information in our fee-based strategies do exploit trades that are profitable to allow you to capture more of the price movement that continues to move in your favor. This is accomplish via using WRB's to tell you when to move your initial stop/loss protection into a 1 tick/pip profitable trailing stop and then giving you a better understanding of shifts in supply/demand via Volatility Analysis...allowing for better management of trailing stops if you choose to adjust them from the 1 tick/pip profitable trailing stop

We also encourage you to send us detailed charts of trades (good profits, poor profits and losers) with info about the entry/time of price, exit/time of price and basic info about your entry signal. We'll then reply with customized solutions based upon our WRB Analysis integrated with your trading style and methodology.

Simply, every trader is different and having access to some basic information about your entry strategy with chart examples will allow us to design a customized profitable solution via our WRB Analysis for your exit strategy problems.

Question:

Should I purchase the Advance Tutorial Chapters or the Volatility Trading Report (VTR) trade signal strategies even though I have not started trading ?

Answer:

Yes but only after your use of the WRB Analysis free study guide and you've maintain a statistical analysis of your trading with WRB Analysis on a simulator including screenshots of timestamp trade fills versus your trading before you learned WRB Analysis. In fact, I may one day start a mentoring (coaching) program and one of the requirements for students prior to any mentoring is that I will request their statistical analysis results for review. You can do this without any real money trades and learn from your backtests & simulator trading without risking any real money.

With that said, its very common for traders to purchase our fee-base methods so that they can learn prior to opening a trading account after using WRB Analysis on a simulator. This allows them to build up confidence via understanding the strategies and the statistical analysis prior to any real-money trading.