(click on image

to review trade performance results)

(click on image

to review trade performance results)

https://www.thestrategylab.com/images/thestrategylab-review-102306-wrb-analysis.png

https://www.thestrategylab.com/images/thestrategylab-review-102306-wrb-analysis.png

Archive

Chat Log @

https://www.thestrategylab.com/102306FuturesTrades.htm

Archive

Chat Log @

https://www.thestrategylab.com/102306FuturesTrades.htm

Verification

of Price Action Trade Performance

@

https://www.thestrategylab.com/tsl/forum/viewforum.php?f=383

Verification

of Price Action Trade Performance

@

https://www.thestrategylab.com/tsl/forum/viewforum.php?f=383

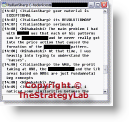

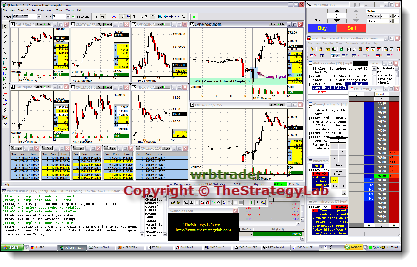

Image

on the left represents what many users in the

private chat rooms were able to see via live

screen sharing in real-time as the trades

occurred in the broker trade execution platform

and then the same trades are posted real-time

(average of 3.2 seconds delay via an

auto-script) in the free chat room.

I

took a quick screenshot during the live

screen sharing for marketing purposes within

minutes after my last trade of the day,

for my own private trade journal documentation

and for verification that I traded on that

specific trading day I posted real-time trades

in the free chat room for those that were not in the chat room or

not

allowed in the live screen sharing for

whatever reason with others that were allowed.

Further,

I use a multiple monitor setup while trading.

Other monitors not shown above, website or forum

for security & privacy reasons because they

contain the key markets for my volatility

analysis and correlation analysis.

WRB

Analysis Free Chat Room @ https://www.thestrategylab.com/ftchat/forum/

WRB

Analysis Free Chat Room @ https://www.thestrategylab.com/ftchat/forum/

Recent

simulation trade performance via the CME Group

Trade Against A Pro Futures Challenge @

https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=360&t=4038

Recent

simulation trade performance via the CME Group

Trade Against A Pro Futures Challenge @

https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=360&t=4038

Recent real money trade

performance @

https://www.thestrategylab.com/tsl/forum/viewforum.php?f=147

Recent real money trade

performance @

https://www.thestrategylab.com/tsl/forum/viewforum.php?f=147

You can use WRB Analysis for day trading, swing

trading or position trading...it is a trading

course that is an introduction into

understanding the price action you're

trading...it does not teach

how to trade.

Price Action Trading Analysis, Price Action

Trading Strategies, Price Action Trading Chat

Room and Price Action Trading Forum @

TheStrategyLab

----------------------

Introduction

Introduction

Foundation of WRB Analysis

@ WRB Analysis Free Study Guide

(word .doc & .PDF file)

Foundation of WRB Analysis

@ WRB Analysis Free Study Guide

(word .doc & .PDF file)

First

of all, there's a free study guide that

represents the first three basic WRB Analysis

Tutorial chapters for you to download, review

and apply to your trade

signal strategies or to help you design your

own trade signal strategies.

That's right...WRB Analysis is not

a trade signal strategy...its an

analysis of the price action so that

you will better understand the price action you're

trading along with improving the performance of

your own trade signal strategies when you use key

concepts from WRB Analysis.

There are a few older

versions (dated before 2015) on the internet

as such @ Forexfactory.com forum and other

trader forums that I'm not an active member of

those forums. The current version of the WRB Analysis Free Study

Guide is only available

directly from wrbtrader @ TheStrategyLab Support Forum

and it is dated January 2021 with more

specific information about what Key Market Events

(KMEs) and Correlation Analysis in tutorial

chapter 2.

For example, Key Market

Events (KMEs) that are important to

trading Emini Futures...those KMEs are not

important for someone trading the Canadian Dollar

and you must determine different KMEs that are

important to trading the Canadian Dollar. Just the

same, the

specific Key Market Events (KMEs) that

are important to trading Energy Futures...those

KMEs are not important for someone trading

the EuroFX Futures and you must determine different

KMEs that are important to trading the EuroFX

Futures.

Simply, you need

to find out which Key Market Events (KMEs)

are important to whatever you're trading and

TheStrategyLab can help you with such as you're

trying to determine how to use your trade signal

strategies with our price action analysis called WRB

Analysis.

Reminder: If you do not know

which KMEs

are important to your trading instrument...our

price action analysis called WRB Analysis will be

useless to use with your trade signal strategies.

Reminder: If you do not know

which KMEs

are important to your trading instrument...our

price action analysis called WRB Analysis will be

useless to use with your trade signal strategies.

How do you

determine which KMEs are important in

understanding the price action of your trading

instrument ?

You need to open

your charts and begin documenting the dates and

time of big WRB Hidden GAP intervals. Next, you

need to research a site that has a good history of

key market events such as an economic calendar or

a news site that involves your specific trading

instrument...you then need to use tutorial chapter

2 of the WRB Analysis Free Study Guide

to determine if the WRB Hidden GAP interval has

qualified as a WRB Zone.

(click

on image to review trade performance results)

(click

on image to review trade performance results)

https://www.thestrategylab.com/tsl/forum/download/file.php?mode=view&id=5682

https://www.thestrategylab.com/tsl/forum/download/file.php?mode=view&id=5682

Archive

Chat Log @

November 1st Thursday 2018

Archive

Chat Log @

November 1st Thursday 2018

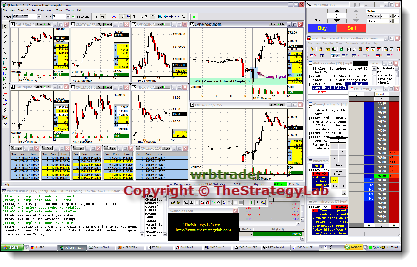

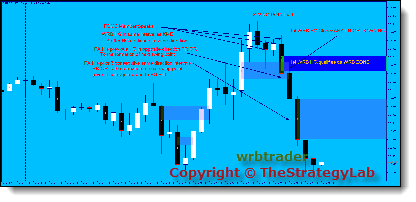

The above

verification image represents my middle monitor

(widescreen) of a three monitors

configuration...the image of my middle monitor is

then posted in my private trade journal that is

located in our private thread section of the free

TSL discussion forum.

As stated

earlier, not shown in my verification of

trading images are my other monitors that contains

charts involving KMEs, WRB Zones, Volatility

Analysis, Intramarket/Intermarket Analysis, and

Correlation Analysis for most of the trades shown

in my broker trade execution platform screenshots.

Next, you contact

us @ TheStrategyLab Support Forum

and begin posting DOKs to verify that you understand

the WRB Analysis Free Study Guide along with you

posting verification you're applying WRB

Analysis with your trade signal strategy via

redacted screenshots of timestamp trade fills in

your broker trade execution platform...the latter

verification information is only posted in your private

thread because we will use your timestamp of

trade fills in your broker trade execution

platform with your posted charts to verify your

application of key concepts from the WRB Analysis Free Study

Guide.

Also, the most

current version of January 2021 (not the 2014

version) for the WRB Analysis Free Study Guide

mentions the importance of inter-market

correlation analysis but the specific

details you'll need to ask TheStrategyLab

(wrbtrader) questions only in your private

thread because the specific details are only

shared with active members of the forum that have

posted their verification of learning/applying the

free study guide...DOKs and redacted screenshots

of timestamp trade fills in broker trade execution

platform that verifies the trader understands

& applying WRB Analysis Study Guide in their

trading.

- The January 2021 new

version of the WRB Analysis Free Study Guide

contains new corrections to typos, new charts,

redacted screenshots of timestamp trade fills in

broker trade execution platform, broker

statements, and other information not found in

the 2014 version.

Further, there's

information involving WRB Analysis that will never

be shared in any of the education resources. It's

Key KME WRB Zones that are different than the

normal KME WRB Zones in the WRB Analysis Free

Study Guide. Yet, if you consistently read the

free chat room chat logs since 2021...you will be

able to pick up tidbits about Key KME WRB

Zones that has dramatically improved my profit

targets and trade performance results since 2021

although I'm cautious that's its related to the

Covid Pandemic and increasing volatility.

Simply, we do not

share everything in the WRB Analysis Free Study Guide...the

best info involves current market conditions (not

market conditions from years ago) and is only

shared with those that have verified their

learning (understanding)/application of the WRB

Analysis Free Study Guide via your interaction

with wrbtrader at our forum in your private trade

journal.

- Also, this helps to

minimize the trolling by traders that do

not like the fact that I do not share key

information with them about WRB Analysis after

they refuse to post the required verification

information in their private thread @ TheStrategyLab Support

Forum

WRB

Analysis for TheStrategyLab involves what's known

as Wide Range Body

Analysis. Yet, if you're not interested in WRB Analysis and

you prefer to learn something very different

that's called Wide Range Bar

Analysis...there's another free website not

associated with TheStrategyLab that teaches Wide

Range Bar Analysis @ https://dotnettutorials.net/lesson/wrb-trading-strategy/

Dot Net

Tutorials

Dotnettutorials.net (WRB

Trading Strategy) is a completely different trade

method involving using WRB intervals as a trade

signal strategy that is trying to identify a

smaller trend (price direction) within a larger

time frame.

Dotnettutorials.net (WRB

Trading Strategy) is a completely different trade

method involving using WRB intervals as a trade

signal strategy that is trying to identify a

smaller trend (price direction) within a larger

time frame.

As stated,

WRB Trade Strategy has no correlation to

TheStrategyLab and is often used in error by

traders interested in TheStrategyLab's WRB

Analysis.

In fact, the

creator of the WRB Trading Strategy method (Dot

Net Tutorials) is not a user of WRB

Analysis in which they make no reference

to our price action analysis of the WRB Analysis Free Study Guide

(e.g. KMEs, strong continuation / swing point

price actions, WRB Zones, contracting volatility,

volatility analysis, correlation analysis).

Once again,

WRB Analysis is just a price action analysis (not

a trade signal strategy) that works with your

trade signal strategies and it differs greatly

from Wide Range Bar Analysis (a WRB trade

signal strategy).

In contrast,

WRB Trade Strategy uses WRBs to determine trend

direction and using WRB intervals as a trade

signal strategy.

----------

Primary

Differences

Primary

Differences

WRB

Analysis (aka

Wide

Range

Body

Analysis) is only a price action analysis that

works with your trade signal strategy. In fact,

if you do not have a trade signal strategy...you

can not use WRB Analysis. In contrast, once

again, Wide Range Bar Analysis is

a trade signal strategy.

WRB Analysis

involves using candlestick charts whereas Wide

Range Bar Analysis involves using

bar charts and we've seen Wide Range Bar Analysis

associated with automated trading systems or

mechanical trading systems. In comparison, WRB

Analysis is a discretionary price action analysis

as you can see when you download / read the WRB Analysis Free Study

Guide.

WRB Analysis

(Wide Range Body

Analysis) involves Key Market Events (KMEs) as

explained in the WRB Analysis Free Study Guide.

Simply, WRB Analysis recognizes the importance of

the "first WRB Hidden GAP" interval that appears after

a key market event but only if it qualifies as

either a strong continuation price action or

swing point price action...resulting in as a WRB

Zone.

Also, WRB

Analysis puts emphasis on "contracting volatility"

intervals whereas Wide Range Bar

Analysis refers to these particular intervals as

"narrow range".

- KMEs,

first WRB Hidden GAP interval,

contracting volatility intervals and WRB Zones

are not concepts of Wide Range Bar

Analysis.

In fact, a

person online that does not mention the

above key concepts while talking about WRB

Analysis...its a person that's actually using Wide

Range Bar Analysis and/or does not

understand WRB Analysis.

Yet, if they

insist they're using WRB Analysis...they should be

able to show proof of their understanding via a

DOK as shown by users @ https://www.thestrategylab.com/tsl/forum/viewforum.php?f=61

along with getting a reply from me that their DOK

to verify their understanding of WRB Analysis is

correct or incorrect just like the user

did involving his understanding of WRB Analysis

via his DOK image as shown below.

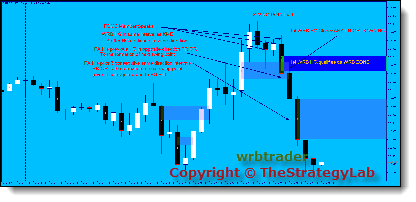

(click on image

to review DOK verification of understanding WRB

Analysis)

(click on image

to review DOK verification of understanding WRB

Analysis)

https://www.thestrategylab.com/tsl/forum/download/file.php?id=6090

https://www.thestrategylab.com/tsl/forum/download/file.php?id=6090

Member

complete DOK verification @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=61&t=4506

Member

complete DOK verification @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=61&t=4506

Many

DOK examples of understanding WRB Analysis @

https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=61&t=719

Many

DOK examples of understanding WRB Analysis @

https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=61&t=719

In addition,

WRB Analysis users do not use volume. The

exception are Volume Spread Analysis (VSA) users

that use volume as part of their trade signal

strategy and they have merged WRB Analysis into

their trade signal strategy to improve the results

of its trade performance.

Thus, WRB

Analysis users only use volatility analysis (not

volume) to help with understanding the price

action they're trading.

Once again,

if the person insist that he/she do in fact

understand WRB Analysis...ask the person for

DOK charts that explains tutorial chapter 2

of the WRB Analysis Free Study Guide involving

both strong continuation price actions and swing

point price actions via the above key concepts.

Also, if the

person insist they're using WRB Analysis

(Wide Range Body Analysis) in their

trading (simulator or real money)...the

person should be able to easily post

verification of application via redacted

screenshots of timestamp trade fills in

broker trade execution platform to support any

positive / negative opinions about WRB Analysis to

go along with the charts that they used for

trading to explain their trades via WRB Analysis.

- Some of our WRB

Analysis users go a step further via showing

quantitative statistical analysis of their trade

signal strategy performance without WRB

Analysis versus the trade signal

performance with WRB Analysis embedded in their

trade strategy...posted in their private

thread because some users want privacy or

protection of their proprietary trade methods.

This type

of verification about any commentary by anyone

using WRB Analysis is important because

the verification requirements is requested in our

education resources here @ TheStrategyLab.

Further, it helps to ensure they're not a

clueless troll that's confused about the

differences between WRB Analysis and Wide

Range Bar Analysis.

In

fact, the more verification info that's posted

by a user of WRB Analysis in his/her private

thread...the more I share about WRB

Analysis.

----------

With that

said, one of the biggest problems with retail

traders (that's you) is that trading is performed

first via the perspective of the trade signal before the analysis

or there's very little understanding of

the analysis. Further, more often than not for

retail traders, the documentation & journaling

of the analysis is poor from the beginning and

then continuing to be poor into the documentation

& journaling of the trading (simulator or real

money).

In contrast,

to succeed in trading...we need to understand the

price action (the analysis) prior

to any trading (simulator or real money) must be

ongoing with the documentation & journaling.

This process will help minimize trade losses and

make you a more consistent / profitable trader as

you design your trade signal strategies or fix

problems with your current trade signal

strategies.

Thus, the

minimum requirement to get traveling

along the road of consistent profits is to first

backtest your trade signal strategy and then

properly document & journal your

design/analysis/simulator trading prior

to any real money trading. By the way, you can

still manually backtest your trade signal strategy

if you do not know anything about programming

& coding. You just need access to historical

data/charts for the manual backtesting. If you can

not do the minimum requirement prior

to real money trading...you're just a lazy trader

that will most likely join the list of failed

traders

Analysis

---> Trade Signal

Strategy ---> Backtest

Trade Signal Strategy ---> Simulator Trading

(documenting & journaling) ---> Real Money

Trading (documenting & journaling)

Analysis

---> Trade Signal

Strategy ---> Backtest

Trade Signal Strategy ---> Simulator Trading

(documenting & journaling) ---> Real Money

Trading (documenting & journaling)

I know what you're thinking.

Yep, its a lot of work and nobody told you

that you will need to do the above to succeed

as a profitable trader but you gotta

do the work or else you will just

become another failed trader. You can get

started via starting your private trade

journal at TheStrategyLab.

Members

Private Trade Journals & Private Threads

@

https://www.thestrategylab.com/tsl/forum/viewforum.php?f=117

Members

Private Trade Journals & Private Threads

@

https://www.thestrategylab.com/tsl/forum/viewforum.php?f=117

With that said, M.A. Perry (that's me) begin

developing this type of price action analysis of

the markets in the early 1980's and begin trading

one strategy derived from WRB Analysis in the late

1980's. I then begin documenting WRB Analysis

online via the user name NihabaAshi (user name

derived from martial arts and Japanese

Candlesticks Analysis). Today, I

use the online user name wrbtrader and I

now use several different trade signal strategies

embedded with key concepts from WRB Analysis to

exploit different types of market conditions due

to the fact that market conditions are never the

same from one trading day to the next trading day

as in one size does not fit all.

Thus, I

concentrated on understanding the price action

(trends, range, chop et cetera) via WRB Analysis

for many years prior to

developing my first trade signal strategy with

rules from entry to exit...prior

to my very first trade. Further, in the 1980's

when I first started studying the markets (no

trading at this time for many years) because I was

a teenager...I came upon the price action of a WRB

accidentally when a hand drawn chart I was

preparing for a relative, that was a floor trader

at the time, when I realized upon completing the

hand drawn chart that I was missing one interval.

That missing interval was a Wide Range Bar

(expansion bar) in comparison to prior intervals.

In my review, I noticed how that missing interval

had impact on a few swing points, reaction points

and profit targets later in the hand drawn chart.

I immediately began studying other charts of

different markets and started seeing other similar

like price actions to prompt my initial curiosity

into what I would later call WRB Analysis. Yet, I

initially called them Wide Range Bar Analysis

until I had access to candlestick charting

software in the early 90's. Thus, I traverse from

bar charts to candlestick charts and my definition

of the word WRB involved both candlestick charts

and bar charts. However, I developed a preference

of Wide Range Body Analysis (candlestick

charts) because I was able to quickly "visualize"

the developing price action on candlestick charts

in comparison to using bar charts especially when

I became more of a price action only trader that

doesn't use computer codes nor automation trading

to exploit changes in supply/demand via changes in

volatility.

What exactly is

WRB Analysis?

What exactly is

WRB Analysis?

WRB Analysis is a method that involves the

combination of analyzing changes in volatility and

supply/demand. Simply, WRB helps traders to

understand and exploit changes in volatility as a

way to identify key price areas where there's an

important change in supply/demand prior to the

appearance of any trade signals.

WRB

Analysis can be applied to time based

candlestick or bar charts, volume based charts

or tick based charts although the chart examples

at this website are via time

based candlestick charts.

WRB

Analysis can be applied to time based

candlestick or bar charts, volume based charts

or tick based charts although the chart examples

at this website are via time

based candlestick charts.

Also, WRB

Analysis identifies changes in supply/demand

that's occurring between buyers and sellers along

with providing a map for exploiting the price

action from swing point to swing point regardless

if your a day trader, swing trader or position

trader.

The word WRB

means Wide Range Body

(candlestick chart users) or Wide Range

Bar (bar chart users)

and there are different types of WRBs based upon

volatility analysis, gap analysis or

support/resistance analysis. Yet, be aware that

you can use Bar charts for WRB Analysis but you

must be using Wide

Range Body Analysis

and not Wide Range Bar Analysis.

The wide range is

an interval that has a body (difference

between Open and Close) or bar (difference between

high and low) with a price area larger than each

of the prior three intervals. In fact,

you can use any number greater than three

intervals as long as it's not less than three due

to the behavior of volatility analysis because its

less reliable and too difficult to analyze the

volatility of two intervals or less regardless if

the intervals are based upon time, volume or tick.

Simply, you want as much market context as

possible from the price action to help ensure

proper analysis of changes in volatility and

supply/demand.

Yet, there will

often be a different number of WRBs, WRB Hidden

Gaps and WRB Zones depending upon what aspect of

the expansion interval is being used as a

measurement. However, even

though you may see the word body used

more often than the word bar in my

discussions of WRB Analysis at

TheStrategyLab.com or charts posted elsewhere

online, it does not imply that candlestick

charts should be used instead of bar charts…it’s

only because I have a personal preference in

using candlestick charts even though WRB

Analysis has nothing to do with Japanese

Candlestick Analysis.

In

fact, about 25% of our clients use bar

charts instead of candlestick charts while using

WRB Analysis in their trading.

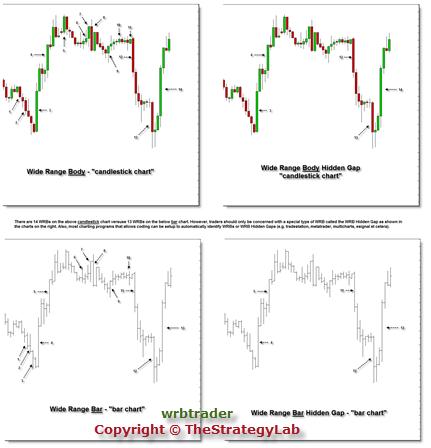

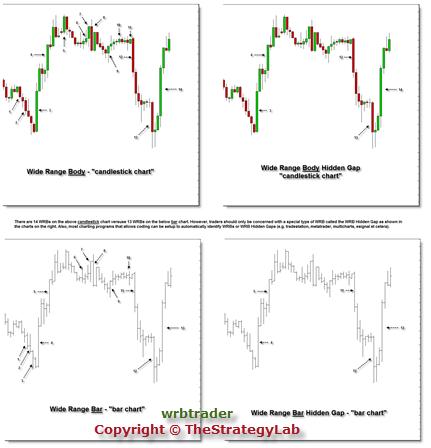

Charts of WRB

(wide range bodies) and (wide range bars)

Charts of WRB

(wide range bodies) and (wide range bars)

(click on chart to review WRB Analysis

Differences)

https://www.thestrategylab.com/images/wrb-analysis-candlestick-chart-versus-bar-chart.png

https://www.thestrategylab.com/images/wrb-analysis-candlestick-chart-versus-bar-chart.png

We ask for you to

take a closer look and review the chart examples

on the left to see the technical difference when

comparing a candlestick chart to a bar chart via

WRB Analysis. Charts on the left in the image

represents all WRBs whereas charts on the

right in the image represents the important WRBs

called WRB Hidden Gaps.

It's the WRB

Hidden Gaps that traders should be

monitoring because they represent key changes in

supply/demand and volatility. Simply, not all WRBs

are important and the few that are important must

be identified to be able to identify where key

market participants are most likely to get

involved in the price action.

Also, most

charting programs that allows coding can be setup

to automatically identify WRBs or WRB Hidden Gaps

(e.g. tradestation, metatrader, multicharts,

esignal et cetera).

WRB Analysis in

combo with your Strategy

WRB Analysis in

combo with your Strategy

WRB Analysis are not trade signals by itself.

Instead, it must be merged with your trade signals

or used to confirm a trade signal is valid for

trading. Thus, WRB Analysis is an understanding

of the price action and that in itself

makes it much more important than just trade

signals.

WRB Analysis can

be used just to get a better understanding of what

really is leading your trading instrument for a

particular trading day, used only as profit

targets for those that have trouble staying with

their winners, used to improve the trade

management (after entry) of many different types

of methods or trading styles (day trader, swing

trader or position trader).

Therefore, the purpose of WRB

Analysis is to be integrated

into your own methods to enhance their

performance of any of the

following strategies you may be using as your

trade methodology:

Breakout

Strategy

Breakout

Strategy

Fading

Breakout

Strategy

Fading

Breakout

Strategy

Divergence

Strategy

Divergence

Strategy

Support/Resistance

Strategy

Support/Resistance

Strategy

Confluence

Strategy

Confluence

Strategy

Double

Bottom/Double Top Strategy

Double

Bottom/Double Top Strategy

GAP Strategy

(Regular Session Gaps and Globex All Session Gaps)

GAP Strategy

(Regular Session Gaps and Globex All Session Gaps)

Trend Strategy

Trend Strategy

Range Strategy

Range Strategy

Profit Target

Strategy

Profit Target

Strategy

Volume

Spread Analysis (TheStrategyLab.com has a

few clients using VSA even though we ourselves do

not use this methodology)

Volume

Spread Analysis (TheStrategyLab.com has a

few clients using VSA even though we ourselves do

not use this methodology)

Intermarket

Analysis

Intermarket

Analysis

Market Seasonal

Tendencies (Cycles) Analysis

Market Seasonal

Tendencies (Cycles) Analysis

Volatility

Analysis and it replaces the need for volume

analysis

Volatility

Analysis and it replaces the need for volume

analysis

Japanese

Candlestick Patterns (time and volume based

candlestick charts)

Japanese

Candlestick Patterns (time and volume based

candlestick charts)

Traditional Chart

Patterns (ex. triangles, wedges, head and

shoulders, flags, pennants and rectangle price

action)

Traditional Chart

Patterns (ex. triangles, wedges, head and

shoulders, flags, pennants and rectangle price

action)

Technical

Indicators (ex. rsi, cci, macd, stochastics,

moving averages, average true range, obv and many

others)

Technical

Indicators (ex. rsi, cci, macd, stochastics,

moving averages, average true range, obv and many

others)

Trading

Instruments suitable for WRB Analysis

Tutorials

Trading

Instruments suitable for WRB Analysis

Tutorials

The nature of WRB Analysis

Tutorials makes it suitable for any of the following trading

instruments.

Futures

Futures

Forex Currencies

Forex Currencies

Stocks

Stocks

Exchange Traded Funds

Exchange Traded Funds

WRB Analysis

Tutorial Chapters 1, 2 and 3 Free Study Guide

WRB Analysis

Tutorial Chapters 1, 2 and 3 Free Study Guide

You

can download the free study guide @

https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=5&t=180

However,

if you are not using any of the above trade

methodologies and want to find out more

information about our trade strategies that has

WRB Analysis integrated into the strategies...click

here.

Last of all, if you have any

trading related questions...please do not hesitate

to contact us because we've helped hundreds of

traders regardless if they use our methods or

their own trade methods.

@

@