(click on image to view

trading results)

(click on image to view

trading results)

http://www.thestrategylab.com/images/102606NihabaAshiPnLBlotterProfit.png

http://www.thestrategylab.com/images/102606NihabaAshiPnLBlotterProfit.png

Archive Chat Log @

http://www.thestrategylab.com/102606FuturesTrades.htm

Archive Chat Log @

http://www.thestrategylab.com/102606FuturesTrades.htm

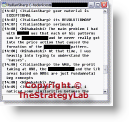

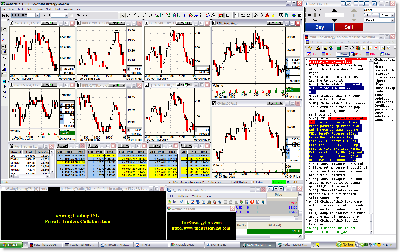

Image

on the left represents what some members

from the private chat room that qualified

for live screen sharing were able

to see on my screen...

I

took a quick screenshot within minutes

after my last trade of the day for

marketing purposes, for my own private

trade journal documentation (other two

monitors not shown) and for verification that I traded on

that specific trading day I posted

real-time trades in the chat room for

those that were not in the chat room

or not

allowed in the live screen sharing

for whatever reason with others that were

allowed.

I

document my trading

with images like this every trading day

(several different times per day) in

combo with my daily brokerage

statements so that I know what one of my

monitors looked like on a specific

trading day because I use different

templates in my chart configurations and

my broker PnL statement screens.

In fact, I've distributed many images like

this of different trading days on

different webpages here at my website and

at my forum just in case someone says they

didn't see any verification.

-------------------

You will

find information here to be describing risks

associated with trading based upon our

observations about specific types of

individuals that decide to become traders.

We want to ensure that traders using our

resources fully understand the risks

involved in trading because we notice this

failure to discuss risks by other traders

and businesses in trading has been increasing

at charting services, brokers, blogs,

forums, chat rooms, twitter, stocktwits or

other social medias.

In fact, I

specifically discuss theses risks often

at forums and it seems to fall upon deaf

ears or

I'm attacked because traders have the

perception in error that I'm discouraging

them from trading. This risk warning also

extends into the vendor industry by any

resource that is financially compensated

(e.g. book authors, mentors, signal calling,

blogs with sponsors, blogs compensated for

making recommendations, charting sites, news

sites, Youtube and so on) for anything they

are discussing in an effort to help traders:

Trading Risks

Trading Risks

Trading

generally is not appropriate for

someone with limited resources, limited

trading capital, untreated psychological

problems, low stress tolerance, low risk

tolerance, and lacks an understanding of

risk of ruin.

Trading of

futures, forex currencies, exchange traded

funds, stocks, CFDs, derivatives and other

investment products that are leveraged, can

carry a high level of risk, and may not

be suitable for all traders. The nature of

leveraged products means that any market

movement will have an equally proportional

effect on your deposited funds. This may

work against you as well as for you. It is

possible that you could sustain a total loss

of initial margin funds and will need to

deposit additional funds to maintain your

position.

If you fail

to meet any margin requirement, your

position may be liquidated and you will be

responsible for any resulting losses.

Selling short may result in losses beyond

your initial deposit as well, because you

may have to purchase a security at a very

high price in order to cover a short

position. In fact, most traders will rapidly

lose their initial deposited funds for

trading and may even lose more than their

deposit beyond just their capital.

Therefore, you should not speculate

with capital that you cannot afford to lose.

Also, we're

available to talk to any user of WRB

Analysis about the below topics to help them

navigate the difficulties of trading. You

can contact us @

http://www.thestrategylab.com/Contact.htm

Most retail traders

and vendors do not talk about the

Risk of Ruin. You must

understand the risk of ruin and how to

minimize it. TheStrategyLab only

discusses risk of ruin with any

fee-base client that verifies

their trading via WRB Analysis with

DOKs & Screenshots of Trade Fills

in broker trade execution platform.

Most retail traders

and vendors do not talk about the

Risk of Ruin. You must

understand the risk of ruin and how to

minimize it. TheStrategyLab only

discusses risk of ruin with any

fee-base client that verifies

their trading via WRB Analysis with

DOKs & Screenshots of Trade Fills

in broker trade execution platform.

Too many traders

understand very little about the

indicators, price action or market

conditions they're trading within.

They trade with real money too soon to

only then either have a spectacular

blow up or

slow bleed in their trading account

until they can no longer trade due to

low capital.

Too many traders

understand very little about the

indicators, price action or market

conditions they're trading within.

They trade with real money too soon to

only then either have a spectacular

blow up or

slow bleed in their trading account

until they can no longer trade due to

low capital.

Other's foolishly believe they'll

figure it out on their own while

listening to traders at other social

media sites...others that do not

have a verified trade performance when

in reality you should not be

trading at all. This particular

approach (blind leading the blind) is

very common in the retail

trading community and should be

avoided unless you enjoy losing money.

Instead, you should consult with

someone about the details of your

trade method (sharing any recent

backtests, simulation trading or

professional trade journal results)

and its application in current market

conditions prior to any

further real money trading.

You're doomed in

trading if you're unable to document

your trading via keeping all of your

broker statements (digital or printed)

or making screenshots of timestamp

trade fills in your broker trade

execution platform at the end of your

trading day that will allow you to verify

that the trade method you're using

does in fact correlate with the trade

fills broker trade execution platform

/ broker statements.

You're doomed in

trading if you're unable to document

your trading via keeping all of your

broker statements (digital or printed)

or making screenshots of timestamp

trade fills in your broker trade

execution platform at the end of your

trading day that will allow you to verify

that the trade method you're using

does in fact correlate with the trade

fills broker trade execution platform

/ broker statements.

Many retail day

traders can not trade stocks because

of the

PDT rule

that requires a 25k capital in the

trading account. Brokers in the future

business know this and take advantage

of it via allowing traders to open 5k

to 10k trading accounts to trade on

margin via several contracts or more.

Seriously, most people have financial

problems and do not know how to manage

their debts and they have this

illusion they have good risk

management to trade on margin under

the facade its just a small

trading account. Don't

misunderstand, I'm not saying if you

have a large trading account you'll be

able to manage the risks involved in

trading.

Many retail day

traders can not trade stocks because

of the

PDT rule

that requires a 25k capital in the

trading account. Brokers in the future

business know this and take advantage

of it via allowing traders to open 5k

to 10k trading accounts to trade on

margin via several contracts or more.

Seriously, most people have financial

problems and do not know how to manage

their debts and they have this

illusion they have good risk

management to trade on margin under

the facade its just a small

trading account. Don't

misunderstand, I'm not saying if you

have a large trading account you'll be

able to manage the risks involved in

trading.

In

contrast, I'm saying brokers should do

a much better job in educating their

clients about proper use of margin and

leverage. In addition, they should

require their clients to take a class

on the topic along with passing a test

at the end of the class similar to

requirements for a drivers license

because most traders will fail at

trading due to poor risk management

involving abuse of margin and

leverage.

Backtest your

trade method on many different

trading instruments to determine which

trading instrument is more suitable

for your trade method. You may

discover that what you're currently

trading or plan to trade is less

profitable than a trading instrument

you do not want to trade or didn't

consider for trading. In fact, do your

backtest once a month or once each

quarter of the year until you've

master the markets and can determine

when to switch trading instruments

without the need of doing backtests.

Backtest your

trade method on many different

trading instruments to determine which

trading instrument is more suitable

for your trade method. You may

discover that what you're currently

trading or plan to trade is less

profitable than a trading instrument

you do not want to trade or didn't

consider for trading. In fact, do your

backtest once a month or once each

quarter of the year until you've

master the markets and can determine

when to switch trading instruments

without the need of doing backtests.

Simply, do not get married

to one trading instrument but I'm not

saying to trade something different

each hour or each day. This isn't

rocket science involving how to

properly select a trading instrument.

Learn your trading instrument so that

you know when market conditions has

changed that requires you to go to the

sidelines (no trading)...remaining on

the sidelines until market conditions

improve so that you're trading in

market conditions that give you the

best chance to be profitable.

Be careful

about live

streaming

(e.g. Youtube, Discord, Twitch) your

trading to an audience if the purpose

is for you to follow your trading

plan.

It's too much of a distraction and too

much pressure / stress while you're

trading with real money especially if

you already know there are consistent

mental mistakes in your trading that's

impacting your confidence.

Be careful

about live

streaming

(e.g. Youtube, Discord, Twitch) your

trading to an audience if the purpose

is for you to follow your trading

plan.

It's too much of a distraction and too

much pressure / stress while you're

trading with real money especially if

you already know there are consistent

mental mistakes in your trading that's

impacting your confidence.

Yet, if

you're live streaming your trading to

get followers and/or to help verified

your trade performance...its ok to use

live streaming for such.

You will

not

be able to trade

for a living as

a newbie trader but you may be able to

be profitable and then slowly grow

your trading account for many months

or years. You did notice I didn't say

days or weeks ? In contrast, with

proper risk management and good

education about all those things that

most traders do not talk about (e.g.

trader psychology, behavior finance,

cognitive decision making, stress

management and other variables) that

includes treating your trading like a

business...you may reach your goal of

trading for a living unless you're

purely involved in trading as a hobby,

academic reasons or you're just a

drive-by curiosity seeker.

You will

not

be able to trade

for a living as

a newbie trader but you may be able to

be profitable and then slowly grow

your trading account for many months

or years. You did notice I didn't say

days or weeks ? In contrast, with

proper risk management and good

education about all those things that

most traders do not talk about (e.g.

trader psychology, behavior finance,

cognitive decision making, stress

management and other variables) that

includes treating your trading like a

business...you may reach your goal of

trading for a living unless you're

purely involved in trading as a hobby,

academic reasons or you're just a

drive-by curiosity seeker.

Further,

you should not fund trading with

retirement savings, student loans, personal

loans, credit cards, second mortgages,

emergency funds, funds set aside for

purposes such as education or homeownership,

or funds required to meet your living

expenses. Seriously, stay away from the

markets if you got debt problems or you're

creating a debt problem. Also, if you're

thinking about quitting your job...a job

with health, medical and dental

insurance...don't quit your job when you can

easily use your vacations to trade

full-time, days off from your job to trade

full-time, take a leave of absence to trade

full-time or find a different job that's

more compatible to your trading schedule.

Your job is your

security blanket. It will help

tremendously with minimizing the pressures

involving trading and minimizing you're

need to use poor risk management in an

effort to succeed. This will help to avoid

blow up trading days or avoid consistent

losses that will negatively impact

you financially, psychologically and

socially. Yet, if your plan is to become a

full-time trader, do not quit your job.

Instead, use your vacations, sick days,

leave of absence, change your work hours

to trade full-time with real money to

determine if there's merits to quitting

your job. If there's proof you can trade

profitably, ensure you've saved up a

minimum of 1 - 2 years of income

to live on and this income must not be

part of your trading capital.

Your job is your

security blanket. It will help

tremendously with minimizing the pressures

involving trading and minimizing you're

need to use poor risk management in an

effort to succeed. This will help to avoid

blow up trading days or avoid consistent

losses that will negatively impact

you financially, psychologically and

socially. Yet, if your plan is to become a

full-time trader, do not quit your job.

Instead, use your vacations, sick days,

leave of absence, change your work hours

to trade full-time with real money to

determine if there's merits to quitting

your job. If there's proof you can trade

profitably, ensure you've saved up a

minimum of 1 - 2 years of income

to live on and this income must not be

part of your trading capital.

Trading

requires good knowledge of financial

markets, trading techniques and strategies.

You should understand that while trading you

will be competing with algorithms,

institutional traders, hedge funds, prop

firm traders, licensed traders and other

market professionals. Therefore, do not make

the mistake in believing you're competing

only against other retail traders. In

addition to normal market risks, you may

experience losses due to system failures.

Trading also may result in paying large

commissions. The total size of commissions

that you pay on your trades may

significantly add to your losses or

significantly reduce your profits.

Before

deciding to trade you should carefully

consider your objectives, financial

resources, needs, your level of experience

and other circumstances that includes

consulting with your family members about

your plans to be a trader. Therefore, we

highly recommend you seek advice from an

independent financial advisor and a verified

profitable private trader that has a

strong understanding about risk

of ruin before going into trading

with real money...both of these individuals

you should see in person.

No Trading Advice Provided

No Trading Advice Provided

Any

opinions, chats, messages, emails, news,

research, analyses, prices, or other

information contained on this Website are

provided as general market information for educational

and entertainment purposes only, and

do not constitute trading advice. We offer no

signal calling trade service and we do not

mentor although we get lots of request to do

such.

Also, the

Website should not be relied upon as a

substitute for a professional trade journal,

extensive independent market research before

making your actual trading decisions and

before you learn / apply WRB Analysis.

Opinions, market data, recommendations or

any other content is subject to change at

any time without notice. TheStrategyLab,

will not accept liability for any

loss or damage, including without limitation

any loss of profit, which may arise directly

or indirectly from use of or reliance on

such information.

Just as

important, we do not recommend the use of

technical analysis as a sole means of

trading decisions nor do we believe you can

be a profitable trader via technical

analysis all by itself. Technical analysis

is just one variable and there are other

important variables such as discipline,

stress management, properly capitalized,

position size management, proper trading

instrument selection, proper home/office

trading environment, team collaboration and

many other variables that are just as

important as your trade strategies. We do

not recommend making hurried trading

decisions. You should always understand that

our performance or the performance of any

user of TheStrategyLab is not an

indication for your future performance.

Therefore,

we make no guarantees you

will become a profitable trader if you use

TheStrategyLab resources. In fact, we

provide free resources for you to

determine on your own the merits of WRB

Analysis via you comparing your trade

results without WRB Analysis versus your

trade results using price action concepts

from WRB Analysis. Simply, your own trade

results with and without WRB Analysis

outweighs any other verification you can

think about. Further, if you decide to

purchase any of our education content prior

to doing your own due diligence

(use of the free resources), you will have

dramatically increased your trading risks.

Disclaimer

Disclaimer

(click on image to view

trading results)

(click on image to view

trading results)

http://www.thestrategylab.com/images/050307mFuturesTrades.png

http://www.thestrategylab.com/images/050307mFuturesTrades.png

Archive Chat Log @

http://www.thestrategylab.com/050307FuturesTrades.htm

Archive Chat Log @

http://www.thestrategylab.com/050307FuturesTrades.htm

TheStrategyLab,

makes no guarantees about your

trading when you decide to backtest,

simulate trade and then trade real money via

WRB Analysis. If you're someone that needs

verification that WRB Analysis is useful,

you're required to compare your trading

results before learning the

WRB Analysis free study guide versus

your trading results after

learning/applying the

WRB Analysis free study guide to

determine if WRB Analysis improves your

trading.

More

importantly, you must document your

trading (simulator or real-money) as

recommended when using WRB Analysis for

verification about any facts (good or

bad) you publicly state about WRB Analysis.

You must do this for your due diligence.

You can

document your use of WRB Analysis via

backtesting, broker statements of simulator

trades, broker statements of real money

trades and quantitative statistical analysis

via a professional trade journal

software such

as tradebench.com, edgewonk.com,

tradervue.com, tradingdiarypro.com,

stocktickr.com, journalsqrd.com,

tradingdiary.pro, mxprofit.com or

trademetria.com

In

addition, our performance record, our

real-time trades in the free chat room, our

broker PnL statements, our testimonials

(accolades), our clients real-time trades,

our clients broker PnL statements, our

clients full broker statements is not

an indication of your future performance if

you decide to learn/apply WRB Analysis.

Markets are always changing...low volatility

to high volatility, high volatility to low

volatility, trend to range, range to trend,

global economics, changes in exchange rules,

changes in technology and changes in your

own personal lives that will have arguably

the most impact on your trading. Therefore,

as stated above, we make no guarantees

because we do not know the future nor can we

control it.

Trades

represented for TheStrategyLab are via the

real-time trade results posted by our user

name wrbtrader. Although we allow

traders to use our free chat room, make

public the archives of the real-time trades

posted in the free chat room posted by

TheStrategyLab and users of WRB Analysis,

make public our broker PnL statements and

give access to archives of clients broker

statements...TheStrategyLab does not give

anyone access to its trading accounts nor do

we share our full broker statements

with anyone for security reasons and

tax reasons. Yet, other WRB Analysis

users that post their real-time trades,

broker PnL statements, full broker

statements...we are not liable for

any errors, inaccuracies or problems (e.g.

hacked trading accounts, identity theft,

harassment) associated with their decision

to share that information with anyone.

If you're a

user of WRB Analysis in the past and you

posted any of the above information in the

public areas of the free TSL support

forums...we can move that information into a

private thread for you at your request. In

contrast, if you already have a private

thread and you've posted broker

statements, statistical analysis reports,

proprietary trading systems in your private

thread...it is secured, private and will never

be shared.

By the way,

there are vendors that have copied our free

education content and then edited some of

the content to then only sell it for a fee.

There's also free users of WRB Analysis that

have developed their own indicators of WRB

Analysis without contacting us so that we

can verify that the indicators represent the

price action definitions of WRB Analysis. We

are not responsible for your trading results

via those indicators.

Traders that are struggling via WRB

Analysis while complaining about WRB

Analysis without verification

(e.g. real-time trades, broker PnL

statements) that show date, timestamp

entries/exits, chart time frame along with

the trader telling documenting the reason

(WRB Analysis) for the trades so that we

can verify they're using WRB Analysis

correctly...we consider their commentary

hearsay (without truth) because they

are required to properly document

their trading via WRB Analysis and

document their simulator trading prior

to any real money trading.

Traders that are struggling via WRB

Analysis while complaining about WRB

Analysis without verification

(e.g. real-time trades, broker PnL

statements) that show date, timestamp

entries/exits, chart time frame along with

the trader telling documenting the reason

(WRB Analysis) for the trades so that we

can verify they're using WRB Analysis

correctly...we consider their commentary

hearsay (without truth) because they

are required to properly document

their trading via WRB Analysis and

document their simulator trading prior

to any real money trading.

Seriously,

if someone say they used WRB Analysis and it

doesn't work...tell them to send their

documentation of verification to us

considering they are required to

maintain such documentation of their trading

when they decided to learn/apply WRB

Analysis regardless if its via a simulator

or real money. Next, after they sent the

information to us...you tell the trader to

contact you and confirm to you that they had

sent the documentation to TheStrategyLab.

Simply,

if you decide to bad mouth us...you better

have proof via your trading results,

backtesting results or documentation of

your learning as you agreed to do when you

decided to use WRB Analysis.

You can

then contact us and ask us if we received it

and what was our analysis of the

documentation. This is important because we

already have users of WRB Analysis posting

real-time trades, broker PnL statements,

full broker statements, public testimonials

at our forum and other locations outside of

TheStrategyLab...showing good results and

some showing bad results. Those showing poor

results, we know who they are and have a

good relationship with them because we're

still helping them. In contrast, those that

provide no proof of their struggles with WRB

Analysis, they are either not using WRB

Analysis or they used something from someone

else that they thought in error represented

WRB Analysis.

Trading Risks

Trading Risks No Trading Advice Provided

No Trading Advice Provided @

@