Hi thirdsector,

Thanks for the questions and I've now included you on the access list for the 30 day free trial. Thus, the link below is now valid for you to access the WRB Analysis Tutorial Chapters 1, 2 and 3 that represent the basic tutorial chapters. You'll have access for 30 days in which I will provide support to your questions while you merge WRB Analysis into whatever trade signal strategy you're using to help improve the performance of your trade strategies.

http://www.thestrategylab.com/tsl/forum/viewforum.php?f=61 In contrast, the advance tutorial chapters are 4 - 12 are price at $75 per chapter and you qualify for the special discount offers at the below link.

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=5&t=165 With that said, below are my answers to your initial questions. Quote:

1. SO what constitutes a WRB and how is one determined when you have more than one consecutive wide candle in a trend?

The following link contains some very basic info about what constitutes a WRB and posted below is the definition.

http://www.thestrategylab.com/WRBAnalysis.htm A wide range body is an interval that has a body (difference between Open and Close) with a price area larger than the bodies of each of the prior three intervals.

You can use any number greater than the above three intervals as long as its not less than three due to the behavior of volatility analysis because its too difficult to analyze the volatility via less than two intervals regardless if the intervals are based upon time, volume or tick. It doesn't matter how many WRBs are occuring. What's important to know that not all WRBs are the same. Simply, some WRBs are important while others are unimportant and that's the purpose of the WRB Analysis Tutorials is to use the objective rules within the tutorials to determine which WRBs are important and which ones are not important.

WRBs determined to be important is a WRB that represents a

key change in supply/demand.

In addition, the WRB Analysis Tutorials will teach you via objective rules how long to use a WRB that has been identified as important regardless if its a trend, range, high volatility, low volatility or any other type of market condition. Thus, if you have more than one WRB in a trend, its possible for both to be important, both to not be important or only one of them to be important and the WRB Analysis Tutorials teaches how to determine

which WRB is important.

Quote:

2. Once and WRB Supply/Demand zone is determined how is a zone closed?

There are 12 WRB Analysis Tutorial chapters and each tutorial chapter has an objective rules to determine when a WRB S/R Zone is closed as a source to look for your trade signals. However, all WRB S/R Zones can be used for profit targets regardless if they are closed or still open.

Basically, for most of the tutorial chapters, a zone is closed when the price action after the WRB (a WRB that has been determine to be a key change in supply/demand)

Quote:

3. Given overlapping zones, how does the overlap affect decision making for current price action?

It's not common to have overlapping zones because zones do close but once in awhile you'll have two overlapping zones in which both are still open for use. In such cases when two zones are overlapping and open, they are still treated as indepent of each other due to the fact they are produced by different reasons which is why there's 12 different WRB Analysis Tutorial chapters.

For example, tutorial chapter 2 you could have a zone determine via a WRB in reaction to a key economic report while another zone that's overlapping is determine via a WRB from tutorial chapter 4 involving volatility breakouts. Simply, it's rare to have overlapping and open WRB S/R Zones produced via the same WRB tutorial chapter.

Quote:

4. If the zones are active how do you determine a potential target, considering that some candles can be very wide?

First of all, the WRB Analysis Tutorials are designed for those that already have their own entry and exit signals. Therefore, a simple rule is if your exit signal is occurring as a WRB or within a WRB S/R Zone...that's when you have confirmation it's time to exit. However, if a WRB forms before your exit signal appears or if the price reaches a WRB S/R Zone prior to the appearance of your exit signal...it's highly recommended you exit your position or scale out and/or adjust your initial stop/loss protection into a profitable trailing stop if the price retraces back towards your entry.

Simply, after entry and when price moves your way (it's profitable)...if the price action develops into a WRB or reaches a WRB S/R Zone...it's telling you that you need to make a trade decision and/or make a stop adjustment regardless if it's your profit target or not. Yet, as a reminder, not all WRBs are important (key change in supply/demand) and any important WRB that develops and is immediately a key change in supply/demand as it is occurring in real-time (not via hindsight)...you must make a trade decision.

However, most clients using their own entry and exit signals usually stick with their own exit signals and then exit their position at the

next WRB or WRB S/R Zone (which ever comes first) that appears after their profit goal was reached (giving them more of a profit or a little less). Yet, I myself don't trade that way and I often use discretion (this is where the discretionary aspect comes into play based upon market experience) to determine if I will exit a position at a WRB or WRB S/R Zone if such occurs

prior to my profit target and a few clients use similar exit approach as I do.

Profit Targets via WRB Analysis whichever comes first after your entry or whichever is more suitable with your exit signal:

* Formation of a WRB

* Price reaches a prior recent WRB

* Price reaches a open WRB S/R Zone or closed WRB S/R Zone

* Advance profit target method based upon WRB Analysis is reserved only for fee-base clients that have either purchase all 12 WRB Tutorial Chapters or posted a D.O.K for all 12 WRB Tutorial Chapters.

Quote:

5. Given that different time frames for a currency can have different readings, how does one prioritize the analysis, for instance larger timeframes first, or equal weight, or considered separately?

If your trade signal (entry signal) is occurring on the 1 hour chart interval...you must only use WRB S/R Zones from the 1 hour chart interval. However, if your trade signal involves more than one chart interval as in a multi time frame signal...that's when it's ok to use WRB S/R Zones from the multi time frames involving your trade signal.

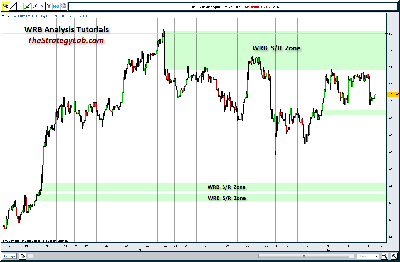

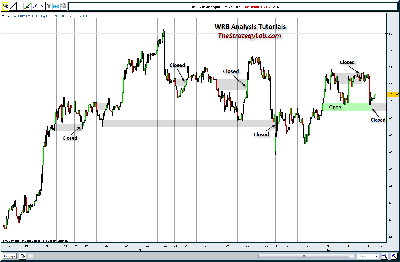

With that said, I've attached two charts of GBPJPY...one chart represent current open WRB S/R Zones via the green highlights while the other chart shows a few WRB S/R Zones that were open (gray highlight) and then closed (gray highlight).

You'll immdediate notice that some WRBs have no annotations because these WRBs are not important (key change in supply/demand) via the 12 WRB Analysis Tutorials. Also, you can annotate any of the below charts with your entry/exit signals for me to show you which of your trade signals qualify as WRB S/R Zone via tutorial chapter 3.

Attachment:

thirdsector_GBPJPY_60min_Open_Zones.png [ 61.85 KiB | Viewed 508 times ]

thirdsector_GBPJPY_60min_Open_Zones.png [ 61.85 KiB | Viewed 508 times ]

Attachment:

thirdsector_GBPJPY_60min_Closed_Zones.png [ 65.15 KiB | Viewed 515 times ]

thirdsector_GBPJPY_60min_Closed_Zones.png [ 65.15 KiB | Viewed 515 times ]

Best Regards,

M.A. Perry

Trader and Founder of

WRB Analysis (wide range body analysis)

@

http://twitter.com/wrbtrader http://www.thestrategylab.com Phone: +1 708 572-4885

Business Hours: 8am - 5pm est (Mon - Fri)

Skype Messenger: kebec2002

questions@thestrategylab.com