Hi seabird, Thanks for the chart, questions and the annotation of where your trade signal occurs.

Quote:

It seems that after a while the chart may be full of WRB zones. How do they expire? Is there a special significance if the price moves back to an expired zone?

The best way to answer that question is to let you read the WRB Analysis Tutorial Chapters 1, 2 and 3. However, most WRB S/R Zones when expired do not regain their importance even when price moves back to the expired zone. However, there is a special zone that can be reactivated after expiring when price action does return but that's only discussed in one of the advanced tutorial chapters 4 - 12 that's only for fee-base clients.

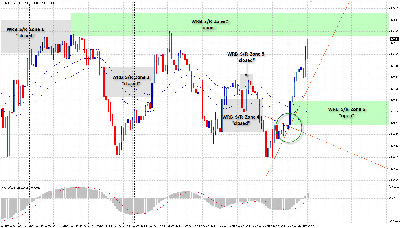

However, another possibility (not part of any advance tutorial chapter) is that an expired zone may look like it's being reactivated just because the a new WRB Zone looks like it's overlapping with the prior expired zone as shown on the attached chart via WRB S/R Zone 4 and 6.

Quote:

I trade Forex: EUR-USD and GBP-USD on 15, 30, 60 and 240 minute charts and have an interest in learning ho to trade shorter timeframes. I use 34 EMAs (the wave concept developed by Raghee Horner) to determine the trend. If there is one I try to get on it. If there is no trend I wait for a momentum trade to set up via S&R brakeouts. I have tested many indicators but I find that they lag the action. I would like to get better at understanding price action and using it for better timing. The chart I posted shows an entry. After the inside bar there was a fake to the downside but it reverse to the upside with a strong impulse signal crossing the wave.

By the way, that strong impulse signal crossing the wave is a special type of WRB as you will learn in the tutorial chapters 1, 2 and 3. It's what I call a volatility spike that's a breakout of the prior price contraction along with it having interaction with a prior WRB that gave an alert the price direction could change. As you can see on the annotated chart that your impulse signal crossing the wave had also qualified as a WRB S/R Zone itself. Thus, as explained in tutorial chapter 3 (using your trade signals as WRB S/R Zones when/if they qualify as such) that your trade signals may contain a wealth of information besides just signalling a trade entry. They could help confirm any price action that occurs afterwards as another trade signal and they can be used as profits for other trades.

With that said, I've now included you on the access list for the 30 day free trial and the link below is now valid for you to access the WRB Analysis Tutorial Chapters 1, 2 and 3 version 2.0 study guide that represent the basic tutorial chapters. You'll have access for 30 days in which I will provide support to your questions while you merge WRB Analysis into whatever trade signal strategies you're using to help improve the performance of your trade strategies.

To determine the merits of the WRB Analysis Tutorials...you simply compare the results of your trade signals within the WRB S/R Zones versus the results of your trade signals that didn't occur within WRB S/R Zones.

Note: Please read the WRB Analysis Tutorial chapters 1, 2 and 3 study guide at the below link prior to asking any more questions about WRB Analysis. http://www.thestrategylab.com/tsl/forum/viewforum.php?f=61In contrast, the advance tutorial chapters are 4 - 12 are price at $75 per chapter and you qualify for the special discount offers at the below link.

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=5&t=165 Attachment:

seabird_EURUSD.png [ 411 KiB | Viewed 472 times ]

seabird_EURUSD.png [ 411 KiB | Viewed 472 times ]

Best Regards,

M.A. Perry

Trader and Founder of

WRB Analysis (wide range body analysis)

@

http://twitter.com/wrbtrader http://www.thestrategylab.com Phone: +1 708 572-4885

Business Hours: 8am - 5pm est (Mon - Fri)

Skype Messenger: kebec2002

questions@thestrategylab.com