Trade Results of M.A. Perry

Trade Results of M.A. Perry Trader and Founder of

WRB Analysis (wide range body/bar analysis)

Price Action Trading (no technical indicators)

Attachment:

122110_wrbtrader_PnL_Blotter_Profit.png [ 32.24 KiB | Viewed 851 times ]

122110_wrbtrader_PnL_Blotter_Profit.png [ 32.24 KiB | Viewed 851 times ]

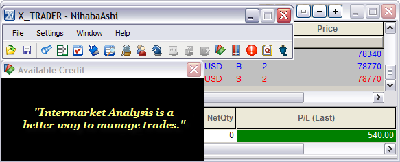

click on the above image to view today's trading summary Quote:

It's the holidays and spent most of the day shopping (last minute christmas gifts) instead of trading. However, I was able to get in three trades today and my best trade of the day was a Long position around 0938am est that netted +1.30 points per contract via volatility analysis.

Trade Performance for Today: +5.40 points or

$540 dollars in the Russell 2000 Emini TF ($TF_F) Futures.

1 tick or 0.10 = $10.00 dollars and to find out more contract information about the Russell 2000 Emini TF...

click here.

In addition, today's

#FuturesTrades trading chat room logs provides details about each trade from entry to exit along with commentary as the trade traversed...all archived

@ http://www.thestrategylab.com/ftchat/forum/viewtopic.php?f=84&t=710. However, be advised that I'm

frequently testing new trade signal methods or new trade management rules (e.g. stop/loss, trailing stops, profit targets, order types, time frames, workstation templates et cetera) after entry of existing profitable trade signal methods. Thus,

adapting is a critical variable to my consistent profits along with preventing me from becoming complacent in my trading...this helps avoid trading account drawdowns.

Also, posted below are direct links to information about my

trade methodology and

trading plan (there's a difference between the two) that enables me to identify key trading areas in the price action that represent changes in supply/demand and volatility along with being able to exploit these changes via WRB Analysis (wide range body/bar analysis).

WRB Analysis Tutorials

WRB Analysis Tutorials @

http://www.thestrategylab.com/WRBAnalysisTutorials.htm and there's a

free study guide of the WRB Analysis Tutorial Chapters 1, 2 and 3 @

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=5&t=180.

Volatility Trading Report (VTR)

Volatility Trading Report (VTR) @

http://www.thestrategylab.com/VolatilityTrading.htm and there's a

free trade signal strategy @

http://www.thestrategylab.com/tsl/forum/viewforum.php?f=89 so that you can freely test drive one of our trade strategies with support

prior to purchasing the Volatility Trading Report (VTR).

Trading Plan Daily Routine

Trading Plan Daily Routine @

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=128&t=854 -----------------------------

Market Summaries

Market SummariesThe below summaries by

Bloomberg,

CNNMoney and

Yahoo! Finance helps me to do a quick review of the fundamentals, FED actions, global economics that had an impact on today's price action. Simply, I'm a strong believer that many variables causes key changes in supply/demand and volatility that's arguably just as important as my technical analysis.

CNNMoney.com -

Stocks end at highest levels in more than two years Attachment:

122110_Key_Price_Action_Markets.png [ 201.85 KiB | Viewed 791 times ]

122110_Key_Price_Action_Markets.png [ 201.85 KiB | Viewed 791 times ]

click on the above image to view today's price action of key markets By Hibah Yousuf, staff reporter

December 21, 2010: 4:33 PM ET

NEW YORK (CNNMoney.com) -- U.S. stocks rose modestly Tuesday but managed to close at their highest levels in more than two years as investors set their sights on 2011.

The Dow Jones industrial average (INDU) rose 55 points, or 0.5%, led by gains in shares of American Express (AXP, Fortune 500), Bank of America (BAC, Fortune 500) and JPMorgan Chase (JPM, Fortune 500). The blue chip index finished at 11,533, its highest level since August 29, 2008.

The S&P 500 (SPX) added 8 points, or 0.6%, with Adobe (ADBE) and Jabil Circuit (JBL, Fortune 500) among the biggest winners. The broader index closed at its highest level since September 19, 2008.

The tech-heavy Nasdaq (COMP) gained 18 points, or 0.7%, to reach its highest level since December 28, 2007.

Stocks are up about 5% this month, with the S&P 500 and the Nasdaq posting gains for 13 of the month's 15 trading session so far. All three major indexes are poised for double-digit gains for the year.

But as investors close out their books leading up to the holidays, the rest of the year is likely to be pretty quiet.

"Trading volume is fairly light, and it's not uncommon to see the market continue on the trajectory it has been on during the month of December," said Robert Siewert, portfolio manager at Glenmede.

Still, investors are feeling more optimistic lately.

"Looking out into 2011, the economy remains pointed in the right direction," Siewert said. "As long as the economic conditions continue to improve, the stock market should continue to benefit."

Fortune 500: Worst stocks of 2010

On Monday, stocks ended mixed after waffling between gains and losses. The three major indexes have risen to two-year highs during the last few weeks, since President Obama announced the compromise deal on the Bush-era tax rates. Last Friday, the president signed a tax-cut plan into law.

World markets: Korean peninsula tensions have eased slightly. North Korea initially threatened it would retaliate militarily following a South Korean live-fire naval drill exercise. However, North Korean military leaders instead issued a warning to South Korea and the United States.

Asian markets ended the session higher. The Shanghai Composite jumped 1.8%, the Hang Seng in Hong Kong rallied 1.6% and Japan's Nikkei gained 1.5%.

Also in Asia, the Bank of Japan held its key interest rate unchanged between zero and 0.1%. And China's vice premier said China has supported the European Union with its debt crisis, also according to government-owned news agency Xinhua.

European stocks were also ended higher. Britain's FTSE 100 gained 1%, the DAX in Germany rose 0.9%, and France's CAC 40 rallied 1.1%.

Eurozone debt woes continue to brew for overseas investors.

Moody's Investors Service put Portugal's government bond ratings on review for a possible downgrade. Moody's cited "uncertainties about Portugal's longer-term economic vitality;" "concerns about Portugal's ability to access the capital markets at a sustainable price," and concerns about whether the government will be able to support the banking sector, "which may be needed for the banks to regain access to the private capital markets" as reasons for the downgrade watch, according to a statement from the company.

0:00 /5:00Obama's bull market about to turn 3

Companies: Toyota Motor Corp. (TM) -- the Japanese automaker that suffered a series of high-profile recalls -- will pay $32.4 million in civil penalties, the U.S. Department of Transportation said Monday. The penalty is the maximum allowed by law. Toyota's stock rose 1%.

Deutsche Bank (DB) AG agreed Tuesday to pay $553.6 million for taking part in fraudulent federal tax shelters, according to federal regulators. The stock gainsed 0.5%.

After the closing bell, Nike (NKE, Fortune 500) said its profit rose 22% to $457 million, or 94 cents per share, on revenue of $4.8 billion. Analysts were expecting the sporting giant to report earnings per share of 88 cents. Shares rose 0.3% after hours.

After the closing bell on Monday, Adobe Systems (ADBE) reported a profit of $269 million, or 53 cents per share, compared with a loss of $32 million, or 6 cents per share, during the same period a year earlier. Shares of Adobe surged 6%.

Economy: The Census Bureau reported Tuesday that the population of the United States grew 9.7%, to 308.7 million people over the past decade -- the slowest rate of growth since the Great Depression.

Nevada was the fastest growing state over the decade, followed by Arizona and Utah. Michigan was the big loser -- with Rhode Island, Ohio and Louisiana also lagging badly.

Currencies and commodities: The dollar rose against the euro, the British pound and the Japanese yen.

Oil for February delivery added 45 cents to settle at $89.82 a barrel.

Gold futures for February delivery rose $2.70 to settle $1,388.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury ticked down, pushing the yield up to 3.31%.

Yahoo! Finance -

Market Update 4:20 pm : The stock market advanced for the tenth time in 11 sessions to set a new two-year high as financials provided leadership in the face of a narrow gain by the greenback. However, action was generally anemic again as share volume dwindled.

The major stock indices of both Europe and Asia moved markedly higher overnight. Their gains helped inspire buying at home, such that domestic averages gapped higher in the early going.

Financials were quick to provide leadership to the broader market as the sector settled with a 1.6% gain. Bank stocks were especially strong. Diversified banks ripped to a 2.2% gain while regional banks advanced 1.9%. Toronto-Dominion Bank (TD 71.95, +2.44) was a standout after the outfit confirmed its plan to take over Chrysler Financial. The $6.3 billion acquisition comes as part of the firm's expansionary effort.

Strength in the financial sector helped push the S&P 500 through near-term resistance around the 1250 zone. A couple of hours was spent consolidating those gains along the 1254 line before some late buying took the stock market to its best level since September 2008. The late move lost momentum, though, and the stock market settled in the 1254 to 1255 zone.

It is impressive that the stock market's advance came after the dollar turned an early loss into a narrow gain. Early weakness in the greenback came as the euro advanced after China's Vice Premier expressed that his country supports efforts by the European Union and International Monetary Fund to stem sovereign debt problems of the eurozone and countries in its periphery. Gains by the euro were partly clipped by early morning news that analysts at Moody's put Portugal's credit rating on review for possible downgrade, but were later completely dashed shortly after analysts at Fitch issued cautious commentary on Greece's credit rating.

Earnings news was limited. Both Jabil Circuit (JBL 19.55, +1.89) and Adobe Systems (ADBE 30.93, +1.75) posted better-than-expected earnings then went on to issue upside guidance.

No economic data was issued today. That certainly didn't help share volume, which has already been hampered by the thinning of trading desks ahead of year-end holidays. A lack of participation this session resulted in share volume of barely 800 million shares on the NYSE.

Advancing Sectors: Financials (+1.6%), Materials (+1.0%), Energy (+0.9%), Industrials (+0.7%), Tech (+0.6%), Consumer Discretionary (+0.5%), Telecom (+0.2%)

Declining Sectors: Consumer Staples (-0.4%), Health Care (-0.2%), Utilities (-0.1%)DJ30 +55.03 NASDAQ +18.05 NQ100 +0.5% R2K +1.1% SP400 +0.7% SP500 +7.52 NASDAQ Adv/Vol/Dec 1928/1.65 bln/730 NYSE Adv/Vol/Dec 2079/809 mln/945

3:30 pm : Commodities were mixed today. Soft commodities (+1.4%) led the way higher today after coffee futures surged 4.1%. Industrials also finished with a positive bias after cotton (+1.8%) and copper (+1.7%) posted sizeable gains. Earlier this morning, helped by import data in China and a force majeure at a Chilean mine, March copper traded to a new all time high at $4.29 per pound.

Feb gold gained 0.1% to finish at $1388.80 per ounce while March silver ended up 0.1% to $29.39 per ounce. Both metals finished modestly higher despite some strength in the dollar.

Jan natural gas shed 4.2% to end at $4.06 per MMBtu, giving back all of yesterday's gains, after it sold off throughout the session. It closed just above session lows at $4.05. Feb crude oil ended up 0.5% to $89.82 per barrel.DJ30 +51.20 NASDAQ +17.41 SP500 +7.35 NASDAQ Adv/Vol/Dec 1866/1.3 bln/792 NYSE Adv/Vol/Dec 2004/549.4 mln/973

3:00 pm : The S&P 500 has spent the past two hours hugging the 1254 line. That has made for some rather lackluster action this afternoon.

Despite the recent crawl, stocks head into the final hour of the session with solid gains that are supported by a broad-based bid -- advancing issues outnumber decliners by almost 3-to-1 in the S&P 500.

Treasuries have caught a modest bid in recent trade. In turn, the benchmark 10-year Note is back in positive territory and its yield down just a few basis points. DJ30 +48.44 NASDAQ +16.46 SP500 +6.68 NASDAQ Adv/Vol/Dec 1886/1.21 bln/798 NYSE Adv/Vol/Dec 2039/483 mln/955

2:30 pm : Strength this morning in cotton futures prices had sent shares of the cotton ETF (BAL 79.90, -2.30) to a fresh 52-week high, but the ETF was unable to hold that gain. Pressure has become increasingly intense so that the ETF is now down sharply. In a similar fashion, the sugar ETF (SGG 94.79, -0.70) reversed into the red after it set a 52-week high of its own earlier today.

Meanwhile, the broader market continues to move sideways as the S&P 500 hugs the 1254 line. It is on pace for its tenth gain in 11 sessions. DJ30 +44.69 NASDAQ +17.16 SP500 +6.71 NASDAQ Adv/Vol/Dec 1851/1.10 bln/802 NYSE Adv/Vol/Dec 2026/440 mln/948

2:00 pm : The S&P 500 recently eased back a bit as the dollar set a fresh session high. The dollar has paused near that high so that it continues to trade with a 0.2% gain; meanwhile, the S&P 500 has steadied itself at the 1254 line.

Trading volume has been light, and it will likely remain that way for the rest of the week as many trading desks become more thinly staffed during year-end holidays. So far, barely 400 million shares have traded hands on the NYSE this session. Such a sluggish pace makes it very unlikely that overall share volume on the Big Board will surpass 1 billion today. DJ30 +48.90 NASDAQ +17.31 SP500 +6.99 NASDAQ Adv/Vol/Dec 1874/1.02 bln/781 NYSE Adv/Vol/Dec 2005/410 mln/958

1:30 pm : The dollar has made its way into positive territory against competing currencies. That has the Dollar Index up to a 0.2% gain after it had started the session in the red.

The greenback's push to a fresh session high has caused stocks to ease off of their own session highs. Still, the major equity averages are up nicely for the day. DJ30 +49.65 NASDAQ +16.90 SP500 +6.81 NASDAQ Adv/Vol/Dec 1864/950 mln/776 NYSE Adv/Vol/Dec 2003/375 mln/940

1:05 pm : Stocks have been in higher ground all session. Initial strength was underpinned by solid gains overseas, but the stock market's new two-year high has come mostly as a result of leadership from the financial sector.

Stocks made a modest gap up in the early going. The move followed gains in excess of 1% in Asia and gains of about 1% in Europe.

A dip by the dollar also helped support a positive tone to early trade. Most of the dollar's decline came against the euro, which advanced as China's officials expressed support for the efforts of the EU and IMF in solving the sovereign debt problems of the eurozone and countries in its periphery. The euro saw some selling in response to news that analysts at Moody's put Portugal's credit rating on review for possible downgrade. The euro has since slipped to a slight loss.

Though the euro's retreat has helped lift the dollar, stocks continue to gradually add to gains. Financials have been a key source of support in that move. The sector is up 1.5%.

Within the financial sector, banks are particularly strong -- diversified banks are up 2.5%. Toronto-Dominion Bank (TD 71.41, +1.90) made headlines after it confirmed its plan to acquire Chrysler Financial for about $6.3 billion.

However, tech plays Jabil Circuit (JBL 19.44, +1.78) and Adobe Systems (ADBE 30.60, +1.42) are among this session's best individual plays. Both posted better-than-expected earnings for the latest quarter and complemented that feat with upside guidance.

Consumer staples stocks have been out of favor for almost the entire session. Even as the broader market pushes to a new two-year high, the defensive-oriented sector continues to trade with a collective loss of 0.4%. DJ30 +55.59 NASDAQ +16.93 SP500 +7.35 NASDAQ Adv/Vol/Dec 1842/890 mln/767 NYSE Adv/Vol/Dec 2007/353 mln/919

12:30 pm : Broad-based support continues to prop up the stock market, but financials are still a source of primary support. The financial sector is up 1.3%.

Within the financial sector, banks are particularly strong. As such, the KBW Bank Index is up 1.6%, which puts it at a fractionally improved six-month high. Among this session's best performing banking issues, Toronto-Dominion Bank (TD 71.41, +1.90) is up sharply following confirmation of its plan to acquire Chrysler Financial for about $6.3 billion. DJ30 +47.53 NASDAQ +15.63 SP500 +6.49 NASDAQ Adv/Vol/Dec 1823/800 mln/724 NYSE Adv/Vol/Dec 2010/315 mln/913

12:00 pm : The S&P 500 and Nasdaq Composite both added fractionally to their session highs in recent trade. The Dow has yet to match the levels that it registered about 90 minutes ago.

Though overall gains remain moderate, this session's advance has held firm in the face of a recent bounce by the dollar. The dollar had been down with a narrow loss in the early going, but it has since moved to the flat line.

Most of the greenback's recent bounce comes in response to a retreat by the euro, which had been up as much as 0.5% in the face of news that analysts at Moody's have put Portugal's credit rating on review for possible downgrade. A negative reaction to that particular headline had been partly tempered by news that officials from China had expressed support for the efforts of the EU and IMF in solving the sovereign debt problems of the eurozone and countries in its periphery. DJ30 +44.81 NASDAQ +13.54 SP500 +5.93 NASDAQ Adv/Vol/Dec 1788/705 mln/780 NYSE Adv/Vol/Dec 1974/275 mln/923

11:30 am : Consumer staples stocks have taken a downturn in recent trade. The sector had been up 0.3% at its session high, but it is now down to a 0.3% loss, which puts it at a fresh session low. Losses in Colgate-Palmolive (CL 79.70, -0.78) and Philip Morris International (PM 58.45, -0.47) have imbued the broader consumer staples space with weakness.

While the defensive-oriented consumer staples space has come under pressure, so have Treasuries. Losses among Treasuries are only modest, but their weakness comes after they had traded with solid gains ahead of the open. The benchmark 10-year Note is now down just a few ticks and the 30-year Bond is off by about a dozen ticks. DJ30 +41.06 NASDAQ +13.25 SP500 +5.50 NASDAQ Adv/Vol/Dec 1751/600 mln/780 NYSE Adv/Vol/Dec 1876/235 mln/994

11:00 am : The stock market is hovering near the top end of its trading range, which was initially set about 30 minutes ago. Today's high also makes for an improved two-year best.

Jabil Circuit (JBL 19.14, +1.48) and Adobe Systems (ADBE 30.60, +1.42) represent this session's two best performers by percent gained. Both posted better-than-expected earnings for the latest quarter and went on to issue upside guidance. Buying in the pair has shares of JBL at a fresh 52-week high, but ADBE is only at a two-month high. DJ30 +43.14 NASDAQ +13.08 SP500 +5.68 NASDAQ Adv/Vol/Dec 1754/525 mln/726 NYSE Adv/Vol/Dec 1888/212 mln/954

10:30 am : Several key commodities started today on a strong note, but they have since run into selling pressure. Still, the CRB Commodity Index continues to sport a 0.5% gain.

Oil prices came close the $90 per barrel mark earlier this morning, but they have since pared gains so that the commodity trades at $89.50 per barrel, up 0.2%. Staying in the energy complex, natural gas prices have remained under relatively steady pressure so that they are down 1.6% to $4.17 per MMBtu.

Gold prices are now down 0.2% to $1383.20 per ounce after thay had been as high as $1390 per ounce earlier this morning. Silver prices were as high as $29.50 per ounce, but they have since retreated to $29.20 per ounce to trade with a 0.5% loss. Copper prices under March contracts are currently at $4.26 per pound after they had set a record high of almost $4.29 per pound earlier this morning.

Cotton prices continue to climb. The commodity was last quoted at $1.59 per pound after it went limit up in a 3.2% spike. DJ30 +46.25 NASDAQ +12.03 SP500 +5.80 NASDAQ Adv/Vol/Dec 1706/415 mln/727 NYSE Adv/Vol/Dec 1849/175 mln/945

10:00 am : Action remains choppy in early trade, but the tone is still upbeat as the broader market sports a solid gain amid broad-based support.

Financials remain in the best shape. They are now up 0.8%. Materials stocks are close behind, however. That sector is up 0.7%.

Strength among basic materials plays is widespread. Of the sector's 30 members, all but one are in higher ground. The list of advancers is currently topped by International Paper (IP 26.78, +0.54) and Owens Illinois (OI 30.29, +0.46). Newmont Mining (NEM 59.92, -0.27) stands out as the sector's only component that is currently in the red. Its slide comes after silver and gold prices encountered sudden selling pressure shortly ahead of the session's open -- gold prices are down 0.2% to $1382 per ounce and silver is off by 0.5% to $29.20 per ounce.

Advancing Sectors: Financials (+0.8%), Materials (+0.7%), Industrials (+0.6%), Tech (+0.5%), Energy (+0.3%), Telecom (+0.1%)

Declining Sectors: Consumer Discretionary (-0.3%), Consumer Staples (-0.1%), Utilities (-0.1%)

Unchanged: Health CareDJ30 +35.08 NASDAQ +10.41 SP500 +4.72 NASDAQ Adv/Vol/Dec 1550/255 mln/741 NYSE Adv/Vol/Dec 1831/122 mln/905

09:45 am : An opening bid took the S&P 500 up to 1252, which marks a fractionally improved two-year high, but it has since wavered a bit.

Financials are a source of early leadership. The sector is up 0.7% with help from consumer finance plays (+1.1%), regional banks (+1.1%), and diversified banks (+1.0%).

Consumer discretionary plays are trailing. Their collective losses have the sector down 0.3%. Auto retailers (-2.9%) are in some of the worst shape amid the latest quarterly report from CarMax (KMX 32.95, -2.95). Shares of KMX were actually bid higher in premarket action, but sharp pressure at the open prompted a precipitous drop. DJ30 +32.62 NASDAQ +10.12 SP500 +4.10 NASDAQ Adv/Vol/Dec 1534/160 mln/660 NYSE Adv/Vol/Dec 1869/88 mln/806

09:15 am : [BRIEFING.COM] S&P futures vs fair value: +4.50. Nasdaq futures vs fair value: +6.40. Stock futures suggest a strong start to trade is in order. Expected gains at the open should put the S&P 500 near key resistance levels that are close to 1250, which was probed in the prior session for the first time in more than two years. Strength this morning comes amid impressive moves by overseas markets, including those in Europe, even though Moody's made note of a possible downgrade of Portugal's credit rating. That downgrade crimped overnight gains by the euro, but did little to dissuade buyers among European bourses. Gains by the euro have weighed on the dollar, but the greenback recently made a modest move off of its low. Still, a lingering loss in the buck has helped support the positive tone among stocks ahead of the open. This morning's bid also marks a continuation of the support provided by market participants over the past two weeks, although buying has been barely moderate at times.

09:05 am : [BRIEFING.COM] S&P futures vs fair value: +5.40. Nasdaq futures vs fair value: +7.60. Commodities are catching a nice bid in the early going. In turn, the CRB Commodity Index is up 0.5%, which puts it at a new two-year high. Among the more widely followed commodities, oil prices are up 0.5% to $89.84 per barrel, gold prices are up 0.3% to $1389.50 per ounce, and silver prices are up 0.4% to $29.47 per ounce. Natural gas prices have been pressured, though; they are down 1.6% to $4.17 per MMBtu. Meanwhile, copper prices set this morning a new all time high of almost $4.29 per pound and cotton futures prices traded limit up to a new all time high of $1.59 per pound. Financial media point to supply concerns for both copper and cotton as catalysts for their moves. A dip by the dollar has also helped.

08:35 am : [BRIEFING.COM] S&P futures vs fair value: +5.20. Nasdaq futures vs fair value: +7.10. Futures for the S&P 500 continue to trade with strength. Overseas markets also remain in strong shape. Germany's DAX is currently up 0.8%. Its strength has been broad based as only a handful of names in the German bourse fail to move higher. Tech issues have generally been the best plays; they are up 1.6% collectively. France's CAC has also been helped by a broad bid. It is up 0.7%. Of the CAC's 40 members, only L'Oreal, Pernod-Ricard, Danone, and AXA (AXA) are in the red. Total (TOT) and Societe Generale are out in front of the action. Britain's FTSE is up 0.9% at the moment. Its advance has been led by natural resource plays like Rio Tinto (RIO), BHP Billiton (BHP), and Royal Dutch Shell (RDS.A). Health care plays have lagged as the sector sheds 0.3% amid weakness in pharmaceutical play GlaxoSmithKline (GSK).

In addition to gains by Europe's major bourses, the euro has also moved higher. It is currently up 0.4% against the greenback. Its strength comes after China's Vice Premier commented that China supports efforts by the EU and IMF to stem sovereign debt troubles of the continent. However, the euro run into some overnight pressure after Moody's put Portugal's debt rating on review for a possible downgrade.

In Asia, Japan's Nikkei advanced to a 1.5% gain. Fast Retailing scored one of the strongest moves as it settled more than 3% higher. A broader bid helped lift more than 90% of the issues in the Nikkei. In economic news, Japan's central bank kept its target rate at 0.10% and its asset purchase plan steady, both as expected. In China, the Shanghai Composite climbed 1.8%. PetroChina (PTR) was a primary leader, but its strength was complemented by China Shenhua and China Life Insurance. Hong Kong's Hang Seng settled with a 1.6% gain. It was led by HSBC (HBC) and CNOOC (CEO). Of the 45 names that make up the index, only China Unicom failed to move higher; it finished flat instead.

08:00 am : [BRIEFING.COM] S&P futures vs fair value: +3.70. Nasdaq futures vs fair value: +5.60. Stock futures are slightly higher this morning. The underlying bid, though modest, marks a continuation of the support that has boosted the broader market in nine of the past 10 sessions (incremental gains included). Overseas strength has helped support the positive tone of premarket trade this morning. So has a slight dip by the dollar, which has lost ground against the euro. The euro attracted some support amid news that officials from China expressed support for the sovereign debt problems of Europe. The euro's gains were clipped, though, after analysts at Moody's put Portugal's credit ratings on review for possible downgrade. So far, corporate news is light, although Jabil (JBL) and Adobe (ADBE) both posted strong quarterly results and issued strong outlooks.There are no major items on the economic calendar today.

06:39 am : S&P futures vs fair value: +3.40. Nasdaq futures vs fair value: +3.90.

06:39 am : Nikkei...10370.53...+154.10...+1.50%. Hang Seng...22993.86...+354.80...+1.60%.

06:39 am : FTSE...5933.18...+41.60...+0.70%. DAX...7061.65...+43.10...+0.60%.

Special thanks to Bloomberg, CNNMoney and Yahoo! Finance for their market summaries.

Best Regards,

M.A. Perry

Trader and Founder of

WRB Analysis (wide range body/bar analysis)

Price Action Trading (no technical indicators)

@

http://twitter.com/wrbtrader and http://stocktwits.com/wrbtrader Phone: +1.708.572.4885

Business Hours: 8am - 5pm est (Mon - Fri)

Skype Messenger: kebec2002

questions@thestrategylab.comGo Back To TheStrategyLab.com Homepage