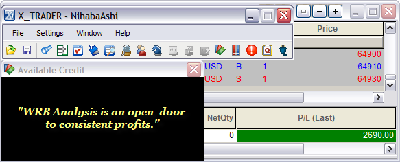

Trade Performance for Today: +26.90 points or $2690 dollars in the ICE Russell 2000 Emini TF ($TF_F) Futures

Attachment:

073010_wrbtrader_PnL_Blotter_Profit.png [ 32.62 KiB | Viewed 559 times ]

073010_wrbtrader_PnL_Blotter_Profit.png [ 32.62 KiB | Viewed 559 times ]

1 tick or 0.10 = $10 dollars and to find out more contract information about the Russell 2000 Emini TF...

click here.

------------------------------

The market summaries below are courtesy of Bloomberg, CNNMoney and Yahoo! Finance. U.S. Stocks Rise as Consumer Confidence Overshadows GDP: VideoJJuly 30 (Bloomberg) -- Bloomberg's Gigi Stone reports on the performance of the U.S. equity market today. Most U.S. stocks rose, extending the biggest monthly gain in a year for the Standard & Poor's 500 Index, as improving data on consumer confidence and business activity tempered concern the economic rebound is slowing. Bloomberg's Pimm Fox also speaks.

Stocks: Best Monthly Gain In A Year By Ben Rooney, staff reporter

July 30, 2010: 6:10 PM ET

NEW YORK (CNNMoney.com) -- Despite a mixed performance on Friday, stocks booked the best monthly gain in a year, with the Dow Jones industrial average and S&P 500 both rising nearly 7% in July.

Attachment:

The attachment 073010_wrbtrader_PnL_Blotter_Profit.png is no longer available

Stocks were supported this month by strong quarterly financial results from major U.S. companies. About 75% of the roughly 300 companies in the S&P 500 that have reported earnings so far have beat analysts' estimates.

But the earnings optimism has been tempered by ongoing concerns about the economy, particularly worries that tepid job growth will eventually undermine corporate profits.

"Even though earnings and guidance have been better than expected, there's still skepticism in the market because jobs have been missing in action," said Alec Young, an equity strategist at Standard & Poor's.

Friday's session was choppy, as investors weighed mixed reports on U.S. economic growth, consumer confidence and regional manufacturing activity.

The Dow Jones industrial average (INDU) fell 1 point, or less than 0.1%. The S&P 500 (SPX) index fell less than 1 point and the Nasdaq (COMP) composite gained 3 points, or 0.1%.

The rally this month came after stocks had drifted lower since April as investors grappled with concerns about the debt crisis in Europe and signs the recovery in the U.S. economy will be sluggish.

Stocks

slipped Thursday as cautious comments from a regional Federal Reserve president about the health of the economy spooked investors.

Looking ahead, Young said the market could push higher late next week if the government's July employment report comes in better than expected on Friday. Economists believe the report will show employers cut 160,000 jobs in July after a loss of 125,000 the month before.

Economy: Gross domestic product, the broadest measure of the nation's economic activity, rose at a 2.4% annual rate in the second quarter, down from an upwardly revised 3.7% in the first quarter.

Economists surveyed by Briefing.com had expected GDP to show an annualized rate increase of 2.5%.

It was the fourth straight quarter of growth, and seemed to back some economists' views that the recession that began in December 2007 ended at some point in the middle of 2009. But the report indicated that consumer spending, which drives the bulk of U.S. economic activity, remained weak.

Market-induced motion sickness: VideoSeparately, the Reuters-University of Michigan Consumer Sentiment index fell to 67.8 in July from 76 the month before. While the index reflected how nervous consumers were about the economy and job market, the decline was slightly smaller than expected. Economists had expected the index to fall to 67.5.

The Chicago PMI, a regional reading on manufacturing, rose more than expected in July. The index rose to 62.3 this month from 59.1 in June. Economists were expecting a reading of 56.3.

Earnings: Chevron (CVX, Fortune 500) posted second-quarter results that topped forecasts and said profit tripled in the quarter. Shares rose about 0.1%.

Merck (MRK, Fortune 500) reported earnings per share that beat analysts' expectations, even as net income fell 52% on acquisition costs. Sales growth, however, fell short of expectations. Shares fell 1.5%.

Companies: Walt Disney (DIS, Fortune 500) said early Friday it will sell Miramax Films for about $660 million to an investor group, Filmyard Holdings.

World markets: European stocks ended the day mixed. The CAC 40 in France fell 0.2%, while Germany's DAX gained 0.2%. The FTSE 100 in Britain fell more than 1%.

Asian markets finished lower. The Shanghai Composite fell 0.4% and the Hang Seng lost 0.3%, while the Nikkei in Japan tumbled 1.6%.

Currencies and commodities: The dollar was up versus the euro, but down against the British pound and the Japanese yen.

U.S. light crude oil for September delivery rose 59 cents to $78.95 a barrel.

COMEX gold's December contract gained $12.70 to $1,183.90 per ounce.

Bonds: Treasury prices rose, pushing the yield on the 10-year note down to 2.91% from 2.99% late Thursday. Bond prices and yields move in opposite directions.

Yahoo! Finance

Yahoo! Finance 4:30 pm : Disappointing GDP data had stocks down more than 1% in the early going, but for the second straight session they fought their way higher only to struggle near the neutral line. Despite such resistance, the stock market booked its best monthly performance in one year.

The U.S. economy expanded at an annualized rate of 2.4% in the second quarter, but that was a bit below the 2.5% that had been widely expected and down from the first quarter's upwardly revised 3.7% growth rate. Additionally, personal consumption for the second quarter increased 1.6% after a 1.9% increase in the first quarter.

The data provided fodder for doubts about the pace of the economic recovery, so stocks responded by retreating to a loss of more than 1% shortly after the open. Some reassurance was provided by a better-than-expected Chicago PMI figure, which came in at 62.3, and the final July Consumer Sentiment Survey, which was stronger-than-expected at 67.8.

Stocks gradually erased their losses, but resistance kept a cap on the move and restricted the stock market to a flat finish. Despite the anticlimactic close, the S&P 500 concluded July with a 6.9% gain - its best monthly performance since a 7.3% gain in July 2009.

Earnings were relegated to secondary status once again. Not even reports from Dow components Chevron (CVX 76.21, +0.19) and Merck (MRK 34.46, -0.60) made any real ripple in the broader market - both posted upside earnings surprises for the latest quarter.

In currency trade, the euro pulled back from the two-month high that it set in the prior session. It finished the session 0.3% lower, but still booked a 6.5% gain for July. Not only was that the currency's first monthly advance in eight months, but it was the best monthly performance since May 2009. The euro is still down 9.0% year-to-date, though.

Meanwhile, the Japanese yen climbed 0.4% to hit a fresh eight-month high. The yen is up 7.6% for the year.

Treasuries had a strong session. The yield on the benchmark 10-year Note moved back to 2.90% in response.

Commodities put in another strong session. In turn, the CRB Commodity Index advanced 1.5% for the second straight session. More impressive, though, is that the CRB advanced 6.1% in July. That made for its best monthly performance since May 2009.

Advancing Sectors: Consumer Discretionary (+0.7%), Materials (+0.5%), Health Care (+0.3%), Industrials (+0.2%), Consumer Staples (+0.2%)

Declining Sectors: Utilities (-0.6%), Tech (-0.5%), Energy (-0.3%), Telecom (-0.1%)

Unchanged: Financials DJ30 -1.22 NASDAQ +3.01 NQ100 +0.2% R2K +0.1% SP400 +0.3% SP500 +0.07 NASDAQ Adv/Vol/Dec 1444/2.17 bln/1176 NYSE Adv/Vol/Dec 1759/1.18 bln/1243

3:30 pm : Commodities put in another strong session. In turn, the CRB Commodity Index advanced 1.5% for the second straight session. More impressive, though, is that the CRB advanced 6.1% in July. That made for its best monthly performance since May 2009.

Natural gas prices continued their recent tear. As such, the commodity climbed 2.0% to settle pit trade at $4.29 per MMBtu, up 7.4% for the week.

Oil prices managed to climb back above $79 per barrel as crude contracts closed pit trade with a .9% gain at $79.05 per barrel.

Precious metals posted strong gains as well. Specifically, gold prices climbed 1.2% to finish the week at $118.20 per ounce and silver settled a sharp 2.8% higher at $18.11 per ounce. DJ30 +21.41 NASDAQ +8.79 SP500 +3.75 NASDAQ Adv/Vol/Dec 1511/1.71 bln/1073 NYSE Adv/Vol/Dec 1880/763 mln/1081

3:00 pm : The stock market continues to encounter resistance at the neutral line. Despite the lackluster action this afternoon, the S&P 500 is still on course for a monthly gain of about 6.6%. That would actually make for the stock market's best monthly performance in one year. While it is also the fourth monthly gain of 2010, the S&P 500 is still down 1.5% year-to-date. DJ30 -39.66 NASDAQ -2.73 SP500 -3.41 NASDAQ Adv/Vol/Dec 1368/1.50 bln/1203 NYSE Adv/Vol/Dec 1517/651 mln/1428

2:30 pm : Stocks are working their way back toward the neutral line. There isn't any particular news item to account for the stock market's swings in the past hour.

Participation has been relatively unimpressive this session. In turn, trading volume is lackluster at less than 600 million shares, so far, on the NYSE. DJ30 -30.13 NASDAQ -0.63 SP500 -2.05 NASDAQ Adv/Vol/Dec 1300/1.41 bln/1247 NYSE Adv/Vol/Dec 1512/595 mln/1427

2:00 pm : The stock market's move to the downside has taken on increased momentum. In turn, losses are starting to turn from modest into something more material.

Tech stocks, which make up the largest sector by market weight, remain amont the weakest performers. The sector is now down 1.0%.

Utilities remain in the worst shape, though. The sector is now down 1.1%. Even American Electric (AEP 35.95, -0.16) has succumbed to selling, despite better-than-expected earnings for the latest quarter. DJ30 -69.56 NASDAQ -10.44 SP500 -7.06 NASDAQ Adv/Vol/Dec 1197/1.31 bln/1321 NYSE Adv/Vol/Dec 1260/545 mln/1679

1:30 pm : Stocks have slipped a bit from their recent trading range. That has the major indices at their lowest levels of the afternoon.

Commodities continue to trade with strength, for the most part. In turn, the CRB Commodity Index is up 0.9%. Most of that move is the result of higher precious metals prices. Specifically, silver prices are up 2.3% to $18.03 per ounce and gold prices are up 1.2% to $1182 per ounce. DJ30 -39.51 NASDAQ -3.66 SP500 -3.54 NASDAQ Adv/Vol/Dec 1328/1.21 bln/1187 NYSE Adv/Vol/Dec 1401/495 mln/1525

1:00 pm : Stocks have retraced a 1% loss that stemmed from a disappointing second quarter GDP reading, but the market has struggled to turn the move into anything more.

The major equity averages were dropped for sharp, broad-based losses in the early going. Pessimism was underpinned by news that GDP increased at an annualized rate of 2.4% in the second quarter, but that was slightly below the 2.5% increase that had been widely anticipated. Less attention was paid to the fact that the first quarter figure was revised sharply higher to reflect annualized growth of 3.7%.

Despite the ominous open, stocks successfully worked their way off of their lows with help from a better-than-expected Chicago PMI figure and a higher-than-expected Consumer Sentiment Survey from the University of Michigan.

Though the mood among market participants is much improved, stocks remain mired near the neutral line. That's largely the consequence of a lack of leadership.

Earnings continue to generally exceed Wall Street's expectations, but none have had much of a positive influence over broader market trade. Among the more widely-held names that have recently reported, Dow components Chevron (CVX 75.47, -0.55) and Merck (MRK 34.36, -0.70) both posted upside earnings surprises.

The euro's move off of its intraday low hasn't motivated buyers either. The currency hit a two-month high yesterday, but pulled back this session. It has since trimmed its loss so that it lags the greenback by 0.3%.

Treasuries have been strong all session. In turn, the benchmark 10-year Note is up 20 ticks so that its yield is back near 2.90%. DJ30 -9.01 NASDAQ +3.64 SP500 -0.42 NASDAQ Adv/Vol/Dec 1456/1.11 bln/1041 NYSE Adv/Vol/Dec 1606/453 mln/1287

12:30 pm : An earnings miss and reduced outlook from MEMC Electronic Materials (WFR 9.40, -1.86) has shares of the semiconductor outfit under sharp pressure, such that roughly one-sixth of the stock's market cap has vanished. Its weakness has imbued shares of other semiconductor and semiconductor equipment plays, which have dragged down the Philadelphia Semiconductor Index to a 1.0% loss. Such weakness continues to detract from the broader tech sector, which is down 0.4%. DJ30 -9.09 NASDAQ +2.15 SP500 -1.01 NASDAQ Adv/Vol/Dec 1427/1.02 bln/1048 NYSE Adv/Vol/Dec 1610/419 mln/1274

12:00 pm : A lack of overall leadership has the stock market stuck at the neutral line. However, retailers have managed to put together a solid 0.5% gain. That space is currently led by Expedia (EXPE 22.52, +1.45), which posted better-than-expected earnings for its latest quarter. DJ30 -0.84 NASDAQ +2.99 SP500 -0.31 NASDAQ Adv/Vol/Dec 1461/930 mln/969 NYSE Adv/Vol/Dec 1609/380 mln/1253

11:30 am : Stocks have struggled to extend their recent advance. As such, they are back in negative territory.

For the second straight session, utilities are in the worst shape of any major sector. Yesterday they lost 1.6%, but this session they are down another 0.7%. Despite such weakness of late, the sector is on pace for a monthly gain of almost 7%. The S&P 500 is on pace for a similar monthly gain. DJ30 -8.78 NASDAQ -0.58 SP500 -1.35 NASDAQ Adv/Vol/Dec 1350/820 mln/1059 NYSE Adv/Vol/Dec 1527/334 mln/1315

11:00 am : The stock market has worked its way into positive territory to trade with a fractional gain. It had been down more than 1% shortly after the open.

The ascent has been steady and broad based. In turn, seven of the 10 major sectors are now in higher ground. Losses are presently limited to the energy (-0.2%), tech (-0.4%), and utilities (-0.5%) sectors.

Volatility has cooled as a result of the stock market's climb. As such, the Volatility Index is now up just 0.2% after it had been up nearly 9% one hour ago. DJ30 -0.99 NASDAQ +0.51 SP500 -0.13 NASDAQ Adv/Vol/Dec 1415/693 mln/916 NYSE Adv/Vol/Dec 1704/282 mln/1097

10:30 am : September crude oil has traded in the red for most of today's session, largely on strength in the dollar index. Crude fell to its lowest point in today's session of $76.83 per barrel, right at the open of pit trade. In recent activity crude attempted to rally off of its morning low, but that were brief and crude is now 1.1% lower at $77.48 per barrel.

September natural gas was in positive territory overnight and pushed to session highs of $4.88 per MMBtu around 8:00am ET. However, natural gas fell sharply off that high, main on strength in the dollar index, and moved into the red and new session lows of $4.78 per MMBtu. Currently, natural gas is flat at $4.82 per MMBtu.

Gold has traded in positive territory for the majority of morning activity and is currently 0.3% higher at $1171.90 per ounce. Highs this morning were put in at $1176.20 per ounce. Silver spiked hard this morning to fresh session highs of $17.99 per ounce as the dollar index fell sharply. Silver is currently 1.4% higher at $17.87 per ounce. DJ30 -25.89 NASDAQ -6.92 SP500 -1.78 NASDAQ Adv/Vol/Dec 1025/510.4 mln/1244 NYSE Adv/Vol/Dec 1257/214.4 mln/1475

10:00 am : The final Consumer Sentiment Survey for July came in at 67.8, which is slightly better than the 67.5 that many had expected following the preliminary reading of 66.5. The stronger-than-expected improvement has helped stocks continue to work their way upward.

Though the tone of trade has improved, stocks continue to contend with broad losses. As a result of such weakness, the Volatility Index is up nearly 9%.

Weakness among stocks and a rise in volatility has helped win support for Treasuries. In turn, the benchmark 10-year Note is up 15 ticks. Meanwhile, the 30-year Bond has spiked more than 50 ticks. Their yields stand at 2.93% and 3.99%, respectively. DJ30 -51.92 NASDAQ -17.43 SP500 -5.47 NASDAQ Adv/Vol/Dec 633/291 mln/1538 NYSE Adv/Vol/Dec 709/134 mln/1949

09:45 am : Stocks have made a modest bounce up from their opening lows, but weakness remains widespread with all 10 major sectors still in the red.

Weakness is currently most pronounced among tech stocks, which are down 1.1% at the moment. Such weakness has undercut the tech-rich Nasdaq.

Just released, the Chicago PMI came in at 62.3, which is better than the 56.3 that had been widely expected.

Coming up at 9:55 AM ET is the final Consumer Sentiment Survey for July from University of Michigan. DJ30 -53.51 NASDAQ -22.25 SP500 -7.02 NASDAQ Adv/Vol/Dec 465/204 mln/1665 NYSE Adv/Vol/Dec 479/95 mln/2180

09:15 am : S&P futures vs fair value: -11.30. Nasdaq futures vs fair value: -17.50. The stock market heads into the final session of July with a month-to-date gain of almost 8%, but stock futures suggest that the move will wane. Premarket weakness stems largely from smaller-than-expected second quarter GDP growth. A sharp, upward revision to first quarter GDP hasn't received much attention, however. A pullback by the euro has provided further fuel to sellers. The currency set a two-month high in the prior session, but it is presently down 0.5% against the greenback. The yen continues to climb, though. It is currently up 0.6% to a new eight-month high. Overseas trade is wrapped in widespread weakness, which has further undermined the mood of premarket participants. Though it would seem that generally better-than-expected earnings would provide a source of support, the reports continue to carry little sway with overall trade.

09:05 am : S&P futures vs fair value: -11.60. Nasdaq futures vs fair value: -17.50. Stock futures are near their morning lows and selling has accelerated overseas, where Germany's DAX is now down 1.0%. Its weakness is broad based as only the consumer services space (+0.2%) sports a gain. Weakness is most pronounced among tech stocks and materials stocks - both sectors are down 1.4% at the moment. According to recent data, retail sales in the country fell a steeper-than-expected 0.9% month-over-month. In France, the CAC has fallen to a 1.2% loss. Tech stocks are actually up 1.7% and oil and gas stocks are up 0.4% following better-than-expected results from energy giant Total (TOT). However, a 1.8% loss among financials and a 1.6% loss among industrials have undermined broader market action. Britain's FTSE has fallen to a 1.0% loss. Nearly 90% of its components are in the red. Utilities (+0.2%) have found some support, though. The euro has pulled back since it set a new two-month high against the greenback in the prior session; it is currently down 0.3%. The pullback comes amid news that eurozone unemployment was unchanged at 10.0% in June. In Asia, Japan's Nikkei dropped 1.6%. With a 2.4% loss, oil and gas plays were among the weakest plays. In earnings news, Honda Motor (HMC) reported a sharp rise in its first quarter profit. Meanwhile, continued strength in the yen has the currency up 0.6% against the greenback. Mainland China's Shanghai Composite slipped to a 0.4% loss. PetroChina (PTR) was a source of weakness, but China Petroleum (SNP) provided support. Banking issues proved to be a drag as Industrial & Commercial Bank of China and Bank of China both faltered. In Hong Kong, the Hang Seng slipped 0.3%. Banking issues and insurers weighed on financials (-0.5%), but consumer goods (-2.5%) saw some of the worst selling.

08:35 am : S&P futures vs fair value: -11.30. Nasdaq futures vs fair value: -18.00. Stock futures have recovered a bit from a recent flurry of selling that followed the latest data on economic growth. According to the Advance Report, second quarter GDP increased at an annualized rate of 2.4%, which is less than the 2.5% that had been expected, on average, by economists polled by Briefing.com. The softer-than-expected growth comes after the first quarter figure was revised upward to reflect annualized growth of 3.7%. Personal consumption for the second quarter increased 1.6% after a 1.9% increase in the first quarter and the GDP Price Index increased 1.1% after a 1.2% increase in the first quarter. Meanwhile, the second quarter Employment Cost Index increased 0.5% after it had increased 0.6% in the first quarter.

08:05 am : S&P futures vs fair value: -6.40. Nasdaq futures vs fair value: -9.50. Stock futures currently trail fair value by a modest margin as the euro eases off of its two-month high and Europe's primary bourses extend their slide from the prior session amid cautious comments about Spain. Asia succumbed to selling amid weak unemployment numbers. Data remains in focus with the Advance Second Quarter GDP figure due at the bottom of the hour, along with the second quarter Employment Cost Index. The Chicago PMI for July follows at 9:45 AM ET, then comes the final Consumer Sentiment Survey for July from University of Michigan at 9:55 AM ET. Earnings continue to come in droves, but consistent with recent sessions none of the announcements have had an impact on the overall mood of the market.

06:45 am : S&P futures vs fair value: -9.40. Nasdaq futures vs fair value: -10.60.

06:45 am : Nikkei...9537.3...-158.70...-1.60%. Hang Seng...21029.8...-64.00...-0.30%.

06:45 am : FTSE...5282.5...-30.80...-0.60%. DAX...6088.9...-45.60...-0.70%.

Special thanks to Bloomberg, CNNMoney and Yahoo! Finance for their market summaries.

Best Regards,

M.A. Perry

Trader and Founder of

WRB Analysis (wide range body analysis)

@

http://twitter.com/wrbtrader and http://stocktwits.com/wrbtrader Phone: +1 708 572-4885

Business Hours: 8am - 5pm est (Mon - Fri)

Skype Messenger: kebec2002

questions@thestrategylab.comGo Back To TheStrategyLab.com Homepage