Price Action Trade Results of M.A. Perry

Price Action Trade Results of M.A. Perry Trader and Founder of

WRB Analysis (wide range body/bar analysis)

TheStrategyLab Price Action Trading (no technical indicators)

wrbtrader (more info about me):

http://www.thestrategylab.com/wrbtrader.htm &

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=127&t=850Free Chat Room: http://www.thestrategylab.com/tsl/forum/viewforum.php?f=164 Users of WRB Analysis Real-Time Trades - TheStrategyLab Chat Logs (timestamp, entries/exits, position size):

http://www.thestrategylab.com/ftchat/forum/viewforum.php?f=20 Users of WRB Analysis Reviews / Accolades / Testimonials: http://www.thestrategylab.com/Accolades.htm Review of TheStrategyLab: http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3167 &

http://www.thestrategylab.com/thestrategylab-reviews.htmPrice Action Trading: http://www.thestrategylab.com/price-action-trading.htmTheStrategyLab Business Hours: 8am - 5pm est (Mon - Fri)

Telephone: +1 708 572-4885

wrbanalysis@gmail.com (24/7)

Stocktwits @

http://stocktwits.com/wrbtrader (24/7)

Twitter @

http://twitter.com/wrbtrader (24/7)

Attachment:

060118-wrbtrader-Price-Action-Trading-Broker-PnL-Statement-Profit+1625.00.png [ 112.81 KiB | Viewed 309 times ]

060118-wrbtrader-Price-Action-Trading-Broker-PnL-Statement-Profit+1625.00.png [ 112.81 KiB | Viewed 309 times ]

click on the above image to view today's performance verification Price Action Trade Performance for Today: Emini RTY ($RTY_F) futures @

$0.00 dollars or +0.00 points, Emini ES ($ES_F) futures @

$1625.00 dollars or +32.50 points, Light Crude Oil CL ($CL_F) futures @

$0.00 dollars or +0.00 points, Gold GC ($GC_F) futures @

$0.00 dollars or +0.00 points and EuroFX 6E ($6E_F) futures @

$0.00 dollars or +0.0000 ticks.

Total Profit @ $1625.00 dollars Russell 2000 Emini RTY Futures: 1 tick or 0.10 = $5.00 dollars and there's more contract information @

CMEGroup (formerly as TF @

The ICE)

S&P 500 Emini ES Futures: 1 tick or 0.25 = $12.50 dollars and there's more contract information @

CMEGroup Light Crude Oil CL (WTI) Futures: 1 tick or 0.01 = $10.00 dollars and there's more contract information @

CMEGroup Gold GC Futures: 1 tick or 0.10 = $10.00 dollars and there's more contract information @

CMEGroupEuroFX 6E Futures: 1 tick or 0.0001 = $12.50 dollars and there's more contract information @

CMEGroup Today's Trade Log & Price Action Analysis is archived @ http://www.thestrategylab.com/ftchat/forum/viewtopic.php?f=181&t=2837 All of my trades are posted

real-time at the above link for today's archive chat log in the timestamp ##TheStrategyLab

free chat room via the user name

wrbtrader along with the real-time trades by other users of WRB Analysis for anyone to do a real-time review (you must be a member of the chat room for a real-time review). Also, as stated since the birth of the free chat room TheStrategyLab...we are

not a signal calling trade alert room. Thus, there is no guru head trader telling you what to trade, when to buy and when to sell. I'm the moderator (I keep the peace between members) and my own live trades are posted within 3.2 seconds on average

after the trade confirmation in my broker trade execution platform via an

auto script to minimize delays in posting of my trades. You can review

today's price action trade journal about my trades (e.g. time, price entry, contract size, price exit, market analysis) as the trade traversed to its completion.

In addition, sometimes I'll post

real-time trading tips in the free ##TheStrategyLab chat room involving WRBs, WRB Hidden GAPs, Key Market Events (KME), WRB Zones, Reaction Highs/Lows, Contracting Volatility or Expanding Volatility...all key concepts from the WRB Analysis free study guide even though the free chat room is not design to be an education chat room because the education is

only performed at the forums in the private threads.

Quote:

These real-time trades involves price action concepts from

WRB Analysis free study guide,

Advance WRB Analysis Tutorial Chapters 4 - 12 and the

Volatility Trading Report (VTR) trade signal strategies. Yet, I'm always

backtesting new concepts of WRB Analysis, new trade entry rules, new trade management rules, new position size management rules before application in real money trades (small position size trades) to adapt to changed market conditions

prior to large position size trades and

prior to sharing the new concepts with fee-base clients...living up to the name of my website.

TheStrategyLab.

##TheStrategyLab Chat Room

##TheStrategyLab Chat Room is

free. The

purpose of TheStrategyLab is for you to post

your real-time analysis or trades so that you can

review as feedback for any trading day to provide valuable information about the results in

your broker statements. If you join the free chat room and then you decide to

not post any WRB Analysis about the price action or you decide to not post your trades or you decide to be silent (lurk without saying a word about today's markets)...you're not using the free chat room properly to help improve your trading and the chat room will be

useless to you. In addition, we

highly recommend that you use the free chat room with a professional trade journal software like tradebench.com, edgewonk.com, tradervue.com, tradingdiarypro.com, stocktickr.com, journalsqrd.com, tradingdiary.pro, mxprofit.com or trademetria.com because they can provide you with the

quantitative statistical analysis of your trading. You can then download your results and post them in your private thread here at the forum.

Access instructions for the free chat room

@ http://www.thestrategylab.com/tsl/forum/viewforum.php?f=164  Price Action Analysis

Price Action Analysis via Advance WRB Analysis Tutorial Chapters @

http://www.thestrategylab.com/WRBAnalysisTutorials.htm and there's a

free study guide of the WRB Analysis Tutorial Chapters 1, 2 and 3 @

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=119&t=718 Analysis -----> Trade Signals  Trade Signal Strategies

Trade Signal Strategies via Volatility Trading Report (VTR) @

http://www.thestrategylab.com/VolatilityTrading.htm and there's a

free trade signal strategy @

http://www.thestrategylab.com/tsl/forum/viewforum.php?f=89 so that you can freely test drive one of our price action trade strategies with support (answering your questions)

prior to purchasing the Volatility Trading Report (VTR). All WRB Analysis Tutorial Chapters 1 - 12 are included in the purchase of the Volatility Trading Report (VTR).

Daily Trading Plan Routine

Daily Trading Plan Routine @

http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=352&t=3733 contains brief information about trading plan, market context, brokers, trading time frames, position size management and other discussions.

-----------------------------

Market Context Summaries The below summaries by

Bloomberg,

Briefing,

Reuters and

Yahoo! Finance helps me to do a quick review of the fundamentals,

FED/

ECB/

BOE/

IMF actions or any important global economic events (e.g.

Eurozone,

MarketWatch.com) that had an impact on today's price action in many trading instruments I monitor during the trading day. Simply, I'm a strong believer that key market events causes key changes in supply/demand and volatility resulting in

trade opportunities (swing points and strong continuation price actions) that reach profit targets. Thus, I pay attention to these key market events, intermarket analysis (e.g. Forex EurUsd, EuroFX 6E futures, Gold GC futures, Light Crude Oil (WTI) CL & Brent Oil futures, Eurex DAX futures, Euronext FTSE100 futures, Emini ES futures, Emini RTY futures, Treasury ZB futures and U.S. Dollar Index futures) while using WRB Analysis from one trade to the next trade to give me the

market context for price action trading before the appearance of my

technical analysis trade signals. Therefore, I maintain these

archives for easy review to allow me to understand what was happening on any given trading day

in the past involving key market events to help better understand my trade decisions (day trading, swing trading, position trading)...something I can

not get from my broker PnL statements alone. Further, most financial websites remove (delete) their archives after a few years to make room for new content. Therefore, I maintain my own archives of the news content so that I have it available for me when financial websites no longer archives their content.

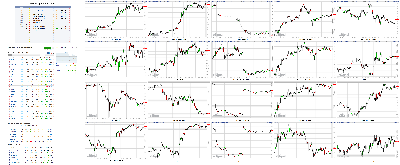

Attachment:

060118-TheStrategyLab-Chat-Room-Key-Markets.png [ 2.03 MiB | Viewed 317 times ]

060118-TheStrategyLab-Chat-Room-Key-Markets.png [ 2.03 MiB | Viewed 317 times ]

click on the above image to view today's price action of key markets discussed by members of TheStrategyLab chat room or private thread discussions The Market at 04:25PM ETDow: +219.37… | Nasdaq: +112.22… | S&P: +29.35…

NASDAQ Vol: 2.15 bln… Adv: 2075… Dec: 835…

NYSE Vol: 852 mln… Adv: 2098… Dec: 839…

Moving the Market

Italian political crisis calms down after President Mattarella approved a coalition government formed by the Five Star Movement and the League party

Employment Situation report for May shows higher-than-expected increase in nonfarm payrolls (223K actual vs 190K Briefing.com consensus) and in-line wage growth (+0.3%)

Growth-sensitive cyclical sectors pace broad-based rally; technology particularly strong

Sector Watch

Strong: Industrials, Materials, Technology, Financial, Health Care

Weak: Consumer Staples, Utilities

04:25PM ET

[BRIEFING.COM] The month of May might have ended with a whimper, but the month of June started with a bang. Driven by an easing of the political tension in Europe and another employment report out of the U.S. that produced strong job growth, modest wage growth, and the lowest unemployment rate since April 2000, the major indices put together a winning session that was punctuated by leadership from economically-sensitive sectors.

The gains for the major indices ranged from 0.9% for the Russell 2000 to 1.5% for the Nasdaq Composite. Sellers were an outnumbered bunch on Friday, evidenced by an advance-decline line at the NYSE and Nasdaq that favored advancing issues by a more than 2-to-1 margin.

Leading the advance, which had a risk-on demeanor before the opening bell, was the information technology sector (+1.9%). It kept good company, however.

Following in its footsteps were the materials (+1.5%), industrials (+1.2%), and financial (+1.1%) sectors. The countercyclical health care sector (+1.2%) offered an added measure of support that made it challenging to knock the indices back to any considerable degree during Friday's trading.

The bulk of today's gains were logged within the first hour of trading. They were solidified as the day went on by better than expected construction spending and ISM manufacturing data, as well as the news from the White House that the June 12 summit with North Korea in Singapore is back on in what it is apt to be a multi-step negotiating process for denuclearization of the Korean Peninsula.

Interestingly, the protectionist trade concerns that drove the market lower on Thursday were placed on the back burner on Friday.

Traders instead embraced the report out of Europe that Italy's president gave a mandate to the anti-establishment 5-Star Movement and right-wing League Party to form a government, thereby avoiding the need for a snap election that some thought could end up being a referendum on Italy's membership in the European Union.

That news triggered a risk-on tone in European markets that carried over to the U.S. The reassuring employment report simply accentuated the positive bias that persisted throughout the trading day.

Reflecting the upbeat tone, 27 out of 30 Dow components registered a gain on Friday while only two of the 11 S&P sectors -- utilities (-1.5%) and consumer staples (-0.03%) -- ended with a loss.

The energy sector (+0.5%) for its part kept its head above water even though oil prices ($65.83, -$1.14, -1.7%) fell sharply in a technically-driven sell-off.

Treasuries were also weak on Friday as some of the safe-haven premium tied to European politics was unwound along with the notion that the Federal Reserve won't raise the fed funds rate at least three times this year. The 2-yr note yield increased seven basis points to 2.48% while the 10-yr note yield jumped eight basis points to 2.90%.

Reviewing Friday's economic data:

May nonfarm payrolls increased by 223,000 (Briefing.com consensus 190,000). May private sector payrolls increased by 218,000 (Briefing.com consensus 177,000).

May unemployment rate was 3.8% (Briefing.com consensus 3.9%) versus 3.9% in April

May average hourly earnings were up 0.3% (Briefing.com consensus +0.3%), after increasing 0.1% in April. Over the last 12 months, average hourly earnings have risen 2.7%, versus 2.6% for the 12 months ending in April

The key takeaway from the May employment report is that it still had a Goldilocks hue to it, as it was accented with strong job growth and only moderate wage inflation.

The ISM Manufacturing Index increased to 58.7 (Briefing.com consensus 58.0) from 57.3 in April. The dividing line between expansion and contraction is 50.0; May marked the 21st consecutive month the index has been above 50.0.

The key takeaway from the report is the summary that respondents are experiencing price pressures and that those price pressures are causing price-increase discussions as they prepare for the second half of the year.

Total construction spending increased 1.8% in April (Briefing.com consensus +1.0%) following an unrevised 1.7% decline in March.

The key takeaway from the report is that it showed a welcome pickup in construction spending growth, which will be a source of support for Q2 GDP forecasts.

Nasdaq Composite +9.4% YTD

Russell 2000 +7.4% YTD

S&P 500 +2.3% YTD

Dow Jones Industrial Average -0.3% YTD

Week In Review:

The stock market finished the week on a mostly higher note as investors digested an easing of the political crisis in Italy, fresh tariff-related developments, and the Employment Situation report for May. The S&P 500 (+0.5%), the Nasdaq Composite (+1.6%), and the Russell 2000 (+1.3%) advanced, while the Dow Jones Industrial Average (-0.5%) finished a step lower.

U.S. markets opened the week on Tuesday following a three-day Memorial Day weekend. Sellers dominated that Tuesday session after Italian President Sergio Mattarella blocked the formation of a euro-skeptic government, vetoing the economic minister nominee of an anti-establishment coalition that was aiming to come to power. Italian bond yields surged in reaction as some feared the veto would prompt a snap election that could turn into a de facto referendum on Italy's membership in the European Union. The Italian political crisis calmed down on Thursday evening, when President Mattarella approved the formation of a ruling coalition between Italy's anti-establishment Five Star Movement and right-wing League party, effectively silencing the prospect of a snap election later this year.

Elsewhere in Europe, Spain endured some political drama of its own this week as Prime Minister Mariano Rajoy was ousted on Friday in a no-confidence vote following a corruption scandal involving 29 individuals with ties to his People's Party. Pedro Sanchez, the leader of the Socialist Party, will succeed Mr. Rajoy as prime minister. Separately, German financial giant Deutsche Bank hit a 16-month low on Thursday after The Wall Street Journal reported that it's on the Federal Reserve's list of troubled banks.

Back in the U.S., the stock market rebounded from its Tuesday slide on Wednesday with energy shares leading the charge following reports that OPEC and Russia will keep production cuts in place until at least the end of the year. West Texas Intermediate crude futures rallied on Wednesday in reaction, but still finished the week lower by 3.0%.

Stocks stumbled for a second time on Thursday when the Trump administration announced that it will let steel and aluminum tariff exemptions expire for the EU, Canada, and Mexico. The White House's decision, which elicited retaliatory responses from the EU, Canada, and Mexico as expected, will result in duties of 25% on steel imports and duties of 10% on imports of aluminum, effective June 1.

Wall Street bounced back on Friday, bolstered by an easing of the political tension in Europe, news that the June 12 summit with North Korea is back on, and the release of the Employment Situation report for May, which featured a better-than-expected increase in nonfarm payrolls (+223K actual vs +190K Briefing.com consensus) and a lower-than-expected unemployment rate (3.8% actual vs 3.9% Briefing.com consensus). The average hourly earnings figure came in as expected, showing a month-over-month increase of 0.3%.

The key takeaway from the employment report is that it still had a Goldilocks hue to it, having been accented with strong job growth and only moderate wage inflation. Furthermore, the strong job growth and low unemployment rate created some good feelings about the potential for a pickup in consumer spending that should aid the second quarter growth outlook.

Six of eleven S&P sectors declined this week, with financials (-1.3%), telecom services (-0.9%), and industrials (-0.7%) being the weakest performers. Conversely, energy (+2.5%), technology (+2.0%), and real estate (+1.7%) were the top-performing groups.

Retailers dominated the earnings front once again, with Costco (COST), Dollar General (DG), Dollar Tree (DLTR), lululemon (LULU), Ulta Beauty (ULTA), Dick's Sporting Goods (DKS), and others reporting their quarterly results, which came in mixed. The SPDR S&P Retail ETF (XRT) settled roughly flat for the week.

U.S. Treasuries were volatile this week, eventually finishing with modest gains. The benchmark 10-yr yield, which moves inversely to the price of the 10-yr Treasury note, finished the week lower by three basis points at 2.90%. Meanwhile, the U.S. Dollar Index eked out a fractional gain, settling the week at 94.22.

Dow: +219.37… | Nasdaq: +112.22… | S&P: +29.35…

NASDAQ Adv/Dec 2075/835. …NYSE Adv/Dec 2098/839.

03:30PM ET

[BRIEFING.COM]

Energy Settlement Prices:

July Crude Oil futures fell $1.14 (-1.7%) to $65.83/barrel

July Natural Gas settled $0.01 higher (0.34%) at $2.96/MMBtu

July RBOB Gasoline settled $0.02 lower (-0.93%) at $2.14/gallon

July Heating oil futures settled $0.02 lower (-0.91%) at $2.18/gallon

Metals Settlement Prices:

August gold settled today's session down $5.40 (0.41%) at $1299.3/oz

July silver settled today's session $0.04 higher (0.24%) at $16.49/oz

July copper settled $0.04 higher (1.31%) at $3.10/lb

Agriculture Settlement Prices:

July corn settled $0.02 lower at $3.91/bushel

July wheat settled $0.02 lower at $5.23/bushel

July soybeans settled $0.05 higher at $10.24/bushel

Dow: +183.84… | Nasdaq: +100.96… | S&P: +25.21…

NASDAQ Adv/Dec 1975/970. …NYSE Adv/Dec 2032/896.

03:00PM ET

[BRIEFING.COM] The broader market moved higher within the past half hour, in part due to President Donald Trump's comments at the White House to reporters following a meeting with North Korean representative Kim Yong Chol. President Trump detailed that relations with North Korea as as good as they've been in recent memory, and stated his belief that North Korea's Supreme Leader Kim Jong Un wants to denuclearize. President Trump also stated that a meeting between the United States and North Korea was set for June 12 in Singapore.

Looking ahead, semiconductor company Broadcom (AVGO 256.87, +4.80, +1.9%) will report quarterly results on Thursday evening. The stock has enjoyed a solid few sessions out of the PHLX Semiconductor Index (SOXX 191.07, +3.64, +1.9%) and the broader Technology SPDR (XLK 70.99, +1.09, +1.6%) during the past week plus, up 3.0% and 2.3% over the past eight sessions, respectively.

Peers Intel (INTC 56.84, +1.64, +3.0%) -- made 18 year highs today, Taiwan Semi (TSM 39.09, +0.39, +1.0%), NVIDIA (NVDA 256.79, +4.60, +1.8%), and Texas Instruments (TXN 114.16, +2.25, +2.0%) all post decent gains into the weekend.

Elsewhere, West Texas Intermediate crude oil futures settled at their lowest levels since April, down 1.8% at $65.81/bbl, extending its weekly decline to 3.1%.

Dow: +222.50… | Nasdaq: +108.03… | S&P: +26.57…

NASDAQ Adv/Dec 1981/880. …NYSE Adv/Dec 2039/865.

02:25PM ET

[BRIEFING.COM] A swift down and up move in the major averages in the past half hour was all show, as we're still near session highs in the big three.

Taking a glance at the S&P 500 sector standings the utility (-1.6%) space holds onto losses as investors opt for "risk-free" government bonds, as yields pare today's gains following this morning's jobs data. Some of the top decliners in the XLU today include NextEra Energy (NEE 162.70, -3.11, -1.9%), Duke Energy (DUK 75.83, -1.33, -1.7%), Dominion Energy (D 63.43, -0.76, -1.2%), Southern (SO 44.23, -0.66, -1.5%), and Exelon (EXC 40.77, -0.62, -1.5%).

Treasury prices are still solidly lower, but nearing session highs, allowing yields to post gains on Friday with the yield on the benchmark 10-yr note up six basis points at 2.88%, while the yield on the 2-yr note adds five basis points to 2.46%.

Dow: +200.38… | Nasdaq: +107.33… | S&P: +25.46…

NASDAQ Adv/Dec 1976/871. …NYSE Adv/Dec 2008/893.

02:00PM ET

[BRIEFING.COM] The major averages hover near session highs on Friday as the Nasdaq Composite continues to lead, up now about 1.5%.

Gold futures settled 0.4% lower on Friday at $1,299.30/oz, taking the yellow metal's weekly decline to 0.7%. Gold has been weaker today in part due to the post-jobs report strength in the dollar.

The U.S. Dollar Index is up 0.2% at 94.16.

Dow: +232.90… | Nasdaq: +110.88… | S&P: +29.14…

NASDAQ Adv/Dec 1996/842. …NYSE Adv/Dec 2042/840.

01:30PM ET

[BRIEFING.COM] Entering today's session, the Dow Jones Industrial Average was down 1.36% for the week. Today, however, it has made a nice move (+1.0%) to close that gap as 27 of its 30 components are trading higher.

The upside move has transpired in conjunction with a reassuring employment report for May, which cultivated positive vibes about the second quarter growth outlook.

Intel (INTC 56.95, +1.75, +3.2%) and Dow DuPont (DWDP 66.35, +2.24, +3.5%) are the biggest percentage gainers in the Dow today, yet Boeing (BA 356.70, +4.54, +1.3%), Goldman Sachs (GS 229.79, +3.91, +1.7%), 3M (MMM 200.19, +2.96, +1.5%), and Apple (AAPL 189.96, +3.09, +1.7%) are making a much greater difference for the price-weighted average.

Today's notable laggards in the Dow include Chevron (CVX 124.17, -0.14, -0.1%), General Electric (GE 13.99, -0.08, -0.6%), and Walt Disney (DIS 99.42, -0.05, -0.1%).

Dow: +246.89… | Nasdaq: +113.72… | S&P: +30.79…

NASDAQ Adv/Dec 2000/822. …NYSE Adv/Dec 2002/821.

01:00PM ET

[BRIEFING.COM] The month of June has gotten off to a fine start. Bolstered by relatively positive political developments out of Europe and a clearly positive employment report for May out of the U.S., the major indices have been in rally mode since the opening bell. Currently, they are at, or near, their highs for the day with gains ranging from 0.9% (Russell 2000) to 1.4% (Nasdaq Composite).

The news of note out of Europe was that Italian President Mattarella gave a populist coalition a mandate to form a government, thereby avoiding the lingering uncertainty associated with holding a snap election several months from now. In turn, Spain ousted Prime Minister Rajoy in a no-confidence vote and interim prime minister, Pedro Sanchez, who is a member of the Socialist Party, refrained from calling for a snap election.

With the cloud of snap election uncertainty lifted from the eurozone, a risk-on tone took root in the European stock and peripheral bond markets that carried over to the U.S.

That risk-on disposition got solidified with the release of the May Employment Situation Report, which had a Goldilocks hue to it once again, as nonfarm payroll growth (223,000) was strong while average hourly earnings growth (+2.7% year-over-year) was moderate.

The unemployment rate fell to 3.8%, which is its lowest level since April 2000.

The low unemployment rate and the strong payroll growth created some good feelings about the potential for a pickup in consumer spending that should benefit Q2 GDP growth. In turn, a better than expected rebound in construction spending in April (Actual +1.8%, Briefing.com consensus +1.0%, Prior -1.7%) and a stronger than expected ISM Manufacturing Index for May (Actual 58.7, Briefing.com consensus 58.0, Prior 57.3) helped accentuate the positive second quarter growth outlook.

Fittingly, the stock market's favorite growth sector -- the information technology sector (+1.7%) -- has led today's rally effort along with other economically-sensitive sectors that include materials (+1.5%), financials (+1.3%), and industrials (+1.3%).

Buying interest has been broad based, evidenced by gains in 27 of the Dow's 30 components and in all but one of the 11 S&P sectors.

The one sector holdout is the utilities sector (-1.8%), which has gotten squeezed by the market's risk-on demeanor and the jump in interest rates that has reflected a relaxation of safe-haven buying interest and some acceptance of the idea that the strong employment report should keep the Federal Reserve on pace for at least three rate hikes this year.

The yield on the 2-yr note has increased seven basis points to 2.48% while the yield on the 10-yr note has jumped seven basis points to 2.89%.

Dow: +225.90… | Nasdaq: +107.02… | S&P: +27.91…

NASDAQ Adv/Dec 1975/823. …NYSE Adv/Dec 1982/860.

12:25PM ET

[BRIEFING.COM] There has been no let up in today's market as the major indices are all in rally mode and trading at, or near, their best levels of the day.

Buyers, who kept mostly to the sidelines on Thursday, have returned today, emboldened by some favorable political news out of Europe and some favorable economic news out of the U.S.

For the time being, they seem to have put any concerns about protectionist trade developments on the back burner, which is to say the trade matters are still simmering and can't be ignored as a potential market-moving catalyst in coming sessions.

The latter point notwithstanding, the sell-off in the CBOE Volatility Index (13.45, -1.98, -12.8%) would suggest market participants aren't seeing a compelling need to hedge against downside risk in the near term. That perspective can change in an instant, yet it's fair to say the market has a confident demeanor about it today.

Dow: +220.03… | Nasdaq: +102.87… | S&P: +27.49…

NASDAQ Adv/Dec 1909/854. …NYSE Adv/Dec 1914/926.

12:00PM ET

[BRIEFING.COM] With political developments in Italy triggering a risk-on mindset, it should come as no surprise that the S&P 500 information technology sector (+1.7%) is setting today's winning pace.

Gains in mega-cap stocks like Apple (AAPL 189.82, +2.95, +1.6%), Alphabet (GOOG 1118.50, +33.51, +3.1%), and Microsoft (MSFT 100.66, +1.82, +1.8%) are driving the sector's outperformance.

In turn, those gains, and an upside showing from fellow mega-cap Amazon.com (AMZN 1646.43, +16.81, +1.0%), have put some juice in the Nasdaq Composite, which is today's best-performing index and trading at its high for the session.

The relatively broad-based nature of today's advance is reflected in the Dow Jones Industrial Average, which is benefiting from gains in 27 of its 30 components. The only laggards include General Electric (GE 14.04, -0.04, -0.3%), Procter & Gamble (PG 72.93, -0.24, -0.3%), and Verizon (VZ 47.66, -0.01, -0.02%).

Dow: +208.28… | Nasdaq: +105.06… | S&P: +27.05…

NASDAQ Adv/Dec 1936/823. …NYSE Adv/Dec 1951/864.

11:25AM ET

[BRIEFING.COM] Equity indices continue to drift near their session highs, with the tech-heavy Nasdaq Composite (+1.2%) showing relative strength.

FAANG names, including Facebook (FB 193.78, +1.93), Amazon (AMZN 1641.29, +11.67), Apple (AAPL 189.37, +2.48), Netflix (NFLX 354.92, +3.32), and Alphabet (GOOG 1117.75, +33.08), have helped push the Nasdaq higher, adding between 0.8% and 3.1%. Chipmakers have also done well, sending the PHLX Semiconductor Index higher by 1.5%. Advanced Micro (AMD 14.23, +0.51) is leading the semiconductor rally with a gain of 3.7% while Dow component Intel (INTC 56.77, +1.57) is up 2.8%.

The S&P 500's technology sector is up 1.5% today, hovering at the top of the sector standings and extending its weekly gain to 1.6%. For comparison, the S&P 500 is up 0.3% week to date. Energy is the only sector with a better weekly gain (+3.0%), but real estate isn't far behind (+1.5%).

Dow: +192.97… | Nasdaq: +93.34… | S&P: +24.33…

NASDAQ Adv/Dec 1952/757. …NYSE Adv/Dec 2001/802.

10:55AM ET

[BRIEFING.COM] The major U.S. stock indices are solidly higher this morning, sporting gains between 0.8% and 1.2%.

10 of 11 sectors are in the green, including financials (+1.1%), consumer discretionary (+0.7%), industrials (+1.1%), energy (+0.7%), materials (+1.4%), technology (+1.3%), health care (+0.8%), consumer staples (+0.2%), telecom services (+0.4%), and real estate (+0.3%). Utilities (-1.2%) is the lone laggard.

In the bond market, U.S. Treasuries are still solidly lower, pushing yields higher across the curve. The yield on the benchmark 10-yr Treasury note is currently up seven basis points at 2.89%, while the yield on the 2-yr note is up five basis points at 2.46%.

Dow: +198.43… | Nasdaq: +87.69… | S&P: +24.59…

NASDAQ Adv/Dec 1940/728. …NYSE Adv/Dec 2020/754.

10:35AM ET

[BRIEFING.COM]

Commodities are beginning the day lower

Overall, commodities, as measured by the Bloomberg Commodity Index, are currently -0.3 at 90.41

Dollar index is currently +0.3% at 94.24

Looking at energy...

July WTI crude oil futures are now -$0.51 at $66.53/barrel

In other energy, Jul natural gas is -$0.01 at $2.94/MMBtu

Moving on to metals...

June gold is currently -$6.20 at $1293.90/oz, while Jul silver is -$0.03 at $16.43/oz

Jul copper is now +$0.02 at $3.08/lb

Dow: +198.22… | Nasdaq: +74.01… | S&P: +22.87…

NASDAQ Adv/Dec 1835/859. …NYSE Adv/Dec 1997/761.

10:05AM ET

[BRIEFING.COM] Equity indices have extended their opening gains, with the S&P 500 now up 0.8%.

Just in, the ISM Index for May increased to 58.7 from an unrevised reading of 57.3 in April, while the Briefing.com consensus expected a reading of 58.0.

Separately, Construction Spending rose 1.8% in April, while the Briefing.com consensus expected an increase of 1.0%.

Dow: +220.55… | Nasdaq: +66.06… | S&P: +22.75…

NASDAQ Adv/Dec 1906/666. …NYSE Adv/Dec 1982/698.

09:40AM ET

[BRIEFING.COM] The major averages are higher in the opening minutes of today's session, sporting gains of around 0.7% apiece.

Most S&P 500 sectors are in positive territory this morning. The financials (+1.3%), materials (+1.0%), industrials (+0.9%), and technology (+0.9%) groups are the top-performing sectors, while the utilities (-0.4%) and real estate (-0.1%) sectors are at the back of the pack.

As a reminder, the ISM Index for May (Briefing.com consensus 58.0) and the Construction Spending report for April (Briefing.com consensus +1.0%) will be released at 10:00 AM ET.

Dow: +186.91… | Nasdaq: +56.53… | S&P: +18.67…

NASDAQ Adv/Dec 1947/568. …NYSE Adv/Dec 1905/668.

09:20AM ET

[BRIEFING.COM] S&P futures vs fair value: +17.80. Nasdaq futures vs fair value: +45.50.

The stock market is on course for a higher open, as the S&P 500 futures are trading 18 points, or 0.7%, above fair value.

Investors received the Employment Situation report for May earlier this morning. The notable headlines are as follows:

May nonfarm payrolls increased by 223,000 (Briefing.com consensus 190,000). Over the past three months, job gains have averaged 179,000 per month

May private sector payrolls increased by 218,000 (Briefing.com consensus 177,000)

May unemployment rate was 3.8% (Briefing.com consensus 3.9%) versus 3.9% in April

May average hourly earnings were up 0.3% (Briefing.com consensus +0.3%), after increasing 0.1% in April

The average workweek in May was 34.5 hours (Briefing.com consensus 34.5) versus 34.5 hours in April

U.S. Treasuries, which were backing up ahead of the release, have remained on the defensive. The yield on the benchmark 10-yr Treasury note is up nine basis points at 2.91%, and the yield on the 2-yr Treasury note is up seven basis points at 2.48%. Yields move inversely to prices.

In addition to the Employment Situation report, investors will receive two more economic reports today, the ISM Index for May (Briefing.com consensus 58.0) and the Construction Spending report for April (Briefing.com consensus +1.0%), both of which will cross the wires at 10:00 AM ET.

On the earnings front, Costco (COST 195.30, -2.94) is down 1.5%, Ulta Beauty (ULTA 234.54, -12.37) is down 5.0%, and Big Lots (BIG 36.68, -4.23) is down 10.3% after reporting their quarterly results. Conversely, lululemon (LULU 113.00, +7.95) is up 7.7% after reporting a solid first quarter and raising its guidance.

In Europe, Italian President Sergio Mattarella approved a coalition government formed by the anti-establishment Five Star Movement and the right-wing League party, ending months of political uncertainty. Separately, Spanish Prime Minister Mariano Rajoy was forced out of office after losing a confidence vote.

08:51AM ET

[BRIEFING.COM] S&P futures vs fair value: +15.30. Nasdaq futures vs fair value: +40.80.

The S&P 500 futures are trading 15 points, or 0.6%, above fair value.

Equity indices in the Asia-Pacific region ended the week on a mixed note. The Bank of Japan lowered its daily purchases of 5- to 10-yr debt by JPY20 billion to JPY430 billion. The action was met with an uptick in Japan's 10-yr yield (+1 bp to 0.05%) while the yen dipped against the dollar. U.S. Secretary of State Mike Pompeo said that his meeting with a senior North Korean official shows that things are going in the right direction. Meanwhile, North Korea's Supreme Leader Kim Jong-un reportedly expressed hope that the conflict with the United States will be solved step-by-step.

In economic data:

China's May Caixin Manufacturing PMI 51.1 (expected 51.3; last 51.1)

Japan's May Manufacturing PMI 52.8 (expected 52.5; last 52.5). Q1 Capital Spending +3.4% year-over-year (expected 3.2%; last 4.3%)

South Korea's May Nikkei Manufacturing PMI 48.9 (last 48.4). May CPI +1.5% year-over-year (expected 1.6%; last 1.6%). May trade surplus $6.70 billion (last $6.80 billion). May Imports +12.6% year-over-year (expected 10.7%; last 5.2%) and May Exports +13.5% year-over-year (expected 12.7%; last 6.1%)

Australia's May AIG Manufacturing Index 57.5 (last 58.3)

New Zealand's Q1 Terms of Trade Index -1.9% quarter-over-quarter (expected -2.0%; last 0.8%)

India's May Nikkei Markit Manufacturing PMI 51.2 (expected 51.5; last 51.6)

---Equity Markets---

Japan's Nikkei shed 0.1%, extending this week's loss to 1.2%. Takeda Pharmaceutical, Furukawa, Komatsu, Chugai Pharmaceutical, Dainippon Screen Manufacturing, Advantest, Terumo, Fast Retailing, NEC, and Kikkoman lost between 1.0% and 3.4%.

Hong Kong's Hang Seng added 0.1%, narrowing this week's loss to 0.3%. CNOOC, China Shenhua Energy, Link Reit, Sino Land, Henderson Land, China Overseas, and China Construction Bank rose between 0.5% and 3.6%. On the downside, Galaxy Entertainment fell 2.9% and Sands China dropped 3.7%.

China's Shanghai Composite lost 0.7%, dropping 2.1% for the week. Beijing Tiantan Biological Products, Tonghua Dongbao Pharmaceutical, Shanghai Fosun Pharmaceutical, Shandong Hualu Hengsheng Chemical, Tongwei, and Topchoice Medical Investment surrendered between 5.5% and 7.7%.

India's Sensex slipped 0.3%, but gained 1.1% for the week. Tata Steel, Oil & Natural Gas, Hindustan Unilever, Power Grid, Adani Ports, and Infosys lost between 1.0% and 2.6%.

Major European indices trade on a higher note with Italy's MIB (+2.5%) returning to the middle of its range from Monday. Italian debt has also rallied, pressuring the 10-yr yield 28 basis points to 2.56%. Overnight, Italy's President Sergio Mattarella gave Giuseppe Conte the mandate to form a government. New ministers are expected to be sworn in today. Meanwhile in Spain, Prime Minister Mariano Rajoy was forced out of office and PSOE leader Pedro Sanchez was named acting prime minister. Mr. Sanchez did not call for a snap election, allowing Spanish debt to rally, pressuring the country's 10-yr yield 13 basis points to 1.36%, a level last seen in mid-May.

In economic data:

Eurozone May Manufacturing PMI 55.5, as expected (last 55.5)

Germany's May Manufacturing PMI 56.9 (expected 56.8; last 56.8)

UK's May Manufacturing PMI 54.4 (expected 53.5; last 53.9)

France's May Manufacturing PMI 54.4 (expected 55.1; last 55.1)

Italy's May Manufacturing PMI 52.7 (expected 53.0; last 53.5)

Spain's May Manufacturing PMI 53.4 (expected 54.2; last 54.4)

Swiss May SVME PMI 62.4 (expected 62.6; last 63.6)

---Equity Markets---

UK's FTSE has climbed 0.7%. Select consumer names and financials have shown relative strength with Dixons Carphone, Barratt Developments, ITV, Barclays, RBS, Prudential, Standard Life, Aviva, Provident Financial, and Persimmon rising between 1.5% and 3.8%.

Germany's DAX trades up 1.3% with help from most components. Commerzbank and Deutsche Bank lead with respective gains of 5.4% and 3.5% while other heavyweights like Bayer, Merck, SAP, Volkswagen, Siemens, Daimler, and BMW sport gains between 0.7% and 1.5%.

France's CAC is higher by 1.4% with all but four components in the green. Credit Agricole, AXA, Societe Generale, and BNP Paribas are up between 1.8% and 3.5% while TechnipFMC, Accor, Renault, Total, Louis Vuitton, and Peugeot have risen between 1.1% and 2.6%.

Italy's MIB has jumped 2.5%. Financials like Bper Banca, Banco Bpm, UBI Banca, Banca Generali, UniCredit, Intesa Sanpaolo, and FinecoBank are up between 3.0% and 10.3%.

08:34AM ET

[BRIEFING.COM] S&P futures vs fair value: +11.00. Nasdaq futures vs fair value: +28.00.

The S&P 500 futures are trading 11 points, or 0.5%, above fair value.

Just in, May nonfarm payrolls increased by 223,000 while the Briefing.com consensus expected an increase of 190,000. The prior month's increase was revised to 159,000 from 164,000. Nonfarm private payrolls rose by 218,000 while the Briefing.com consensus expected an increase of 177,000. The previous month's increase was revised to 162,000 from 168,000.

Average hourly earnings increased 0.3% (Briefing.com consensus +0.3%), while the previous month's increase was left unrevised at 0.1%. The average workweek was reported at 34.5 (Briefing.com consensus 34.5). The unemployment rate declined to 3.8% from 3.9% (Briefing.com consensus 3.9%).

07:59AM ET

[BRIEFING.COM] S&P futures vs fair value: +13.50. Nasdaq futures vs fair value: +34.80.

It's been an up-and-down week for the U.S. equity market, which is currently on course for a higher start to today's session, as the S&P 500 futures are trading 14 points, or 0.5%, above fair value.

The Employment Situation report for May, which will be released at 8:30 AM ET, could further boost the upbeat sentiment, or shift it in favor of the bears, but it will surely elicit some response from the market as it's arguably the most influential economic report available. The Briefing.com consensus expects that today's release will show the addition of 190,000 nonfarm payrolls, a 0.3% increase in average hourly earnings, and an unemployment rate of 3.9% (unchanged from April). Particular emphasis will be placed on the average hourly earnings figure, which is seen as a good gauge of future inflation.

In addition to the Employment Situation report, investors will receive two additional economic reports today, the ISM Index for May (Briefing.com consensus 58.0) and the Construction Spending report for April (Briefing.com consensus +1.0%), both of which will cross the wires at 10:00 AM ET. May auto and truck sales will be released throughout the day.

Canada and Mexico have retaliated against the United States' Thursday decision to impose tariffs on steel and aluminum imports, and the European Union looks poised to do the same. Meanwhile, Italian President Sergio Mattarella approved a coalition government formed by the anti-establishment Five Star Movement and the right-wing League party, putting months of political uncertainty in the rear-view mirror. Separately, in Spain, Prime Minister Mariano Rajoy was forced out of office after losing a confidence vote.

U.S. Treasuries are solidly lower this morning, sending yields higher across the curve. The benchmark 10-yr yield is up seven basis points at 2.90%.

In U.S. corporate news:

Costco (COST 194.22, -4.02): -2.0% despite beating earnings and revenue estimates.

Ulta Beauty (ULTA 235.50, -11.41): -4.6% after lowering its earnings and revenue guidance for Q2.

lululemon (LULU 113.25, +8.20): +7.8% after beating top and bottom line estimates and raising its guidance.

Big Lots (BIG 37.01, -3.90): -9.5% after missing earnings and revenue estimates and lowering its guidance.

Reviewing overnight developments:

Equity indices in the Asia-Pacific region ended the week on a mixed note. Japan's Nikkei -0.1%, Hong Kong's Hang Seng +0.1%, China's Shanghai Composite -0.7%, India's Sensex -0.3%.

In economic data:

China's May Caixin Manufacturing PMI 51.1 (expected 51.3; last 51.1)

Japan's May Manufacturing PMI 52.8 (expected 52.5; last 52.5). Q1 Capital Spending +3.4% year-over-year (expected 3.2%; last 4.3%)

South Korea's May Nikkei Manufacturing PMI 48.9 (last 48.4). May CPI +1.5% year-over-year (expected 1.6%; last 1.6%). May trade surplus $6.70 billion (last $6.80 billion). May Imports +12.6% year-over-year (expected 10.7%; last 5.2%) and May Exports +13.5% year-over-year (expected 12.7%; last 6.1%)

Australia's May AIG Manufacturing Index 57.5 (last 58.3)

New Zealand's Q1 Terms of Trade Index -1.9% quarter-over-quarter (expected -2.0%; last 0.8%)

India's May Nikkei Markit Manufacturing PMI 51.2 (expected 51.5; last 51.6)

In news:

The Bank of Japan lowered its daily purchases of 5- to 10-yr debt by JPY20 billion to JPY430 billion. The action was met with an uptick in Japan's 10-yr yield (+1 bp to 0.05%) while the yen dipped against the dollar.

U.S. Secretary of State Mike Pompeo said that his meeting with a senior North Korean official shows that things are going in the right direction. Meanwhile, North Korea's Supreme Leader Kim Jong-un reportedly expressed hope that the conflict with the United States will be solved step-by-step.

Major European indices trade on a higher note with Italy's MIB (+2.7%) returning to the middle of its range from Monday. Italian debt has also rallied, pressuring the 10-yr yield 28 basis points to 2.56%. UK's FTSE +0.8%, Germany's DAX +1.0%, France's CAC +1.4%.

In economic data:

Eurozone May Manufacturing PMI 55.5, as expected (last 55.5)

Germany's May Manufacturing PMI 56.9 (expected 56.8; last 56.8)

UK's May Manufacturing PMI 54.4 (expected 53.5; last 53.9)

France's May Manufacturing PMI 54.4 (expected 55.1; last 55.1)

Italy's May Manufacturing PMI 52.7 (expected 53.0; last 53.5)

Spain's May Manufacturing PMI 53.4 (expected 54.2; last 54.4)

Swiss May SVME PMI 62.4 (expected 62.6; last 63.6)

In news:

Overnight, Italy's President Sergio Mattarella gave Giuseppe Conte the mandate to form a government. New ministers are expected to be sworn in today.

In Spain, Prime Minister Mariano Rajoy was forced out of office and PSOE leader Pedro Sanchez was named acting prime minister. Mr. Sanchez did not call for a snap election, allowing Spanish debt to rally, pressuring the country's 10-yr yield 13 basis points to 1.36%, a level last seen in mid-May.

07:30AM ET

[BRIEFING.COM] S&P futures vs fair value: +13.80. Nasdaq futures vs fair value: +36.00.

06:59AM ET

[BRIEFING.COM] S&P futures vs fair value: +12.80. Nasdaq futures vs fair value: +30.00.

06:59AM ET

[BRIEFING.COM] Nikkei...22171.35...-30.50...-0.10%. Hang Seng...30493...+24.40...+0.10%.

06:59AM ET

[BRIEFING.COM] FTSE...7728.88...+50.70...+0.70%. DAX...12721.04...+116.20...+0.90%.

04:15PM ET

[BRIEFING.COM] The U.S. equity market returned to negative territory for the week on Thursday, giving back a good chunk of Wednesday's rebound effort, as investors digested the latest tariff-related headlines and looked ahead to Friday's release of the Employment Situation report for May. The major averages finished near the bottom of their daily ranges, with the S&P 500 and the Dow Jones Industrial Average dropping 0.7% and 1.0%, respectively. The tech-heavy Nasdaq Composite showed relative strength, shedding just 0.3%, as tech names outperformed.

President Trump's administration announced on Thursday that it will let steel and aluminum tariff exemptions expire for the EU, Canada, and Mexico, effectively slapping a duty of 25% on steel imports and a duty of 10% on imports of aluminum coming from the three U.S. trading partners. The tariffs, which elicited retaliatory threats, will go into effect June 1st.

Meanwhile, Secretary of State Mike Pompeo said the U.S. and North Korea are making progress towards a June 12 summit, and The New York Times reported that a delegation of North Korean officials will be hand-delivering a letter to President Trump from North Korean leader Kim Jong Un. In Europe, Italy's Five-Star Movement and League parties have reportedly reached a deal to form a coalition government, and German financial giant Deutsche Bank tumbled to a 16-month low after The Wall Street Journal reported that it's on the Federal Reserve's list of troubled banks.

On Wall Street, nine of eleven S&P 500 sectors settled Thursday in negative territory, with the utilities sector (+0.1%) and the top-weighted technology sector (unch) being the two exceptions. The tech group, which represents around a quarter of the broader market by itself, was helped by positive performances from giants Facebook (FB 191.78, +4.11) and Alphabet (GOOG 1084.99, +17.19), which advanced 2.2% and 1.6%, respectively. Chipmaker Micron (MU 57.59, -4.98) didn't do so hot though, tumbling 8.0%, after being downgraded to 'Equal-Weight' from 'Overweight' at Morgan Stanley.

The industrials, consumer staples, and telecom services sectors finished at the back of the pack with losses between 1.3% and 1.6%, but most groups didn't lose more than 1.0%. The consumer discretionary sector (-0.5%) finished in line with the S&P 500, but there were several big movers within the group. For instance, Dollar Tree (DLTR 82.59, -13.76) and Dollar General (DG 87.48, -9.04) dropped 14.3% and 9.4%, respectively, after missing Q1 earnings estimates, and General Motors (GM 42.70, +4.87) rallied 12.9% after announcing that Softbank will be investing $2.25 billion in GM's self-driving unit.

Outside of the equity market, U.S. Treasuries finished Thursday slightly higher, sending yields lower across the curve. The yield on the benchmark 10-yr Treasury note slipped two basis points to 2.82%. Meanwhile, the U.S. Dollar Index declined 0.1% to 93.97, and WTI crude futures dropped for the seventh time in eight sessions, tumbling 1.7% to $67.04 per barrel.

Reviewing Thursday's batch of economic data, which included Personal Income, Personal Spending, and the PCE Price Index for April, the weekly Initial Claims report, the Chicago PMI for May, and Pending Home Sales for April:

Personal income climbed 0.3% in April (Briefing.com consensus +0.3%) following a revised increase of 0.2% in March (from 0.3%). Meanwhile, personal spending rose 0.6% in April (Briefing.com consensus +0.3%) following a revised increase of 0.5% in March (from 0.4%). The PCE Price Index rose 0.2% in April (Briefing.com consensus +0.2%), and the core PCE Price Index, which excludes food and energy, increased 0.2% (Briefing.com consensus +0.1%). Year-over-year, the core PCE Price Index is up 1.8%, unchanged from the last reading (which was revised down from +1.9%).

The key takeaway from the report is that real PCE was up 0.4%, leaving it well above the first quarter average growth rate of less than 0.1% and solidifying expectations for stronger GDP growth in the second quarter. Separately, the firming trend in the price indexes should contribute to an internal belief at the Federal Reserve that there is scope for three rate hikes in 2018.

The latest weekly initial jobless claims count totaled 221,000, while the Briefing.com consensus expected a reading of 227,000. Today's tally was below the unrevised prior week count of 234,000. As for continuing claims, they declined to 1.726 million from a revised count of 1.742 million (from 1.741 million).

The latest initial claims report is encouraging, yet it will be glossed over by market participants, who will turn a more attentive eye to Friday's release of the Employment Situation Report for May.

The Chicago PMI for May hit 62.7 (Briefing.com consensus 57.9), up from 57.6 in April.

The key takeaway from the report is that all five barometer components increased in May, reflecting renewed growth momentum in manufacturing activity in the Chicago Fed region.

Pending Home Sales decreased 1.3% in April (Briefing.com consensus +0.7%). Today's reading follows a revised 0.6% increase in March (from +0.4%).

On Friday, investors will receive the Employment Situation report for May at 8:30 AM ET. The Briefing.com consensus expects that the report will show the addition of 190,000 nonfarm payrolls, a 0.3% increase in average hourly earnings, and an unemployment rate of 3.9% (unchanged from April). In addition, the ISM Index for May (Briefing.com consensus 58.0) and the Construction Spending report for April (Briefing.com consensus +1.0%) will cross the wires at 10:00 AM ET, and May auto and truck sales will be released throughout the day.

Nasdaq Composite +7.8% YTD

Russell 2000 +6.5% YTD

S&P 500 +1.2% YTD

Dow Jones Industrial Average -1.2% YTD

Dow: -251.94… | Nasdaq: -20.34… | S&P: -18.74…

NASDAQ Adv/Dec 1141/1793. …NYSE Adv/Dec 1076/1882.

Price Action Trading

@ http://www.thestrategylab.com/price-action-trading.htm

Trade Strategies via Volatility Analysis

@ http://www.thestrategylab.com/VolatilityTrading.htm

Rebuttal to Emmett Moore via TheStrategyLab.com Review

@ http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3167

The Strategy Lab: Valforex - The Manipulative Review Scam

@ http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3676

TheStrategyLab Review

@ http://www.thestrategylab.com/thestrategylab-reviews.htm

Advance WRB Analysis Tutorial Chapters 4 - 12

@ http://www.thestrategylab.com/WRBAnalysisTutorials.htmDisclaimer: Today's trading performance is not an indication of my future performance and not an indication of the future performance for any trader that decides to learn/apply WRB Analysis. The risk of loss can be substantial. Therefore, you must carefully consider if trading is suitable for you within the context of your financial condition. TheStrategyLab.com is an education and research site. The resources on this site are provided for informational purposes only and should not be used to replace professional educational and professional research because we are retail traders only. TheStrategyLab.com does not accept liability for your use of the website and its resources.

We make no guarantees of success and your level of success is dependent upon other factors including your skill as a trader, knowledge, financial condition, market conditions and other factors. Trading is stressful and you should always consult a doctor in all matters relating to physical and mental health of you & your family because trading can impact beyond your financial condition regardless if you're a profitable or losing trader. Also, you can read our full disclaimer statement @ http://www.thestrategylab.com/Disclaimer.htmBest Regards,

M.A. Perry

Online user name

wrbtrader (more info about me)

@ http://www.thestrategylab.com/tsl/forum/viewtopic.php?f=127&t=850 & http://www.thestrategylab.com/wrbtrader.htmTheStrategyLab Price Action Trading (no indicators)

Trader and Founder of

WRB Analysis (wide range body/bar analysis)

@ http://twitter.com/wrbtrader

@ http://twitter.com/wrbtrader  @ http://stocktwits.com/wrbtraderhttp://www.thestrategylab.com

@ http://stocktwits.com/wrbtraderhttp://www.thestrategylab.com Phone: +1 708 572-4885

TheStrategyLab Business Hours: 8am - 5pm est (Mon - Fri)

Skype Messenger: kebec2002

wrbanalysis@gmail.com