Hi,

It's important to remember that DOK are demonstration of knowledge. Thus, you must pretend I don't know anything about WRB Analysis and you're the one teaching me the concepts of WRB Analysis. Therefore, if you have questions, they must be posted as a separate message posts and not called DOKs.

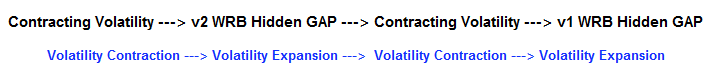

With that said, I'm a little confused by your question about the FVB strategy. For an interval to qualify as a v2 interval...that implies its a WRB. Thus, to be called a WRB...the body of the WRB must be greater than the bodies of each of the prior three intervals. The same is true for the v1 interval. Thus, I think you're asking why I didn't mentioned the three intervals before v2. I didn't mention it because I felt its understood via the fact I called the interval a v2 (volatility expansion) and via the fact the intervals shown in the charts prior to the v2 are contracting volatility in comparison to the v2 interval without me having to annotate them. In contrast, the volatility contraction between the v2 and v1

must be shown (annotated as such) to show the relationship of the v2 to the v1 intervals to each other.

Simply, you can't called something a V interval if its not volatility expansion. To be called volatility expansion implies the intervals prior were contracting volatility in comparison to the V interval. Therefore, there must be a contracting segment prior to the v2 or else it's not a v2.

Therefore, it's important that you remember the rest of that quote from the FVB strategy because it does mention the

prior three intervals before the v2 (the complete quote is below)...

Quote:

Strong Continuation definition #2 involves a v2 WRB (expanding volatility) followed by a minimum of three small range intervals (volatility contraction) that's then followed by a v1 WRB (expanding volatility) in the same direction in which

one of the WRB's must be a WRB Hidden GAP.

In addition, the contracting volatility between v2 and v1, does not retrace (fill in the range) of the v2 WRB and its prior three intervals...discussed in

tutorial chapter 2 (please review discussion in study guide).

In addition, there's a very important image example in tutorial chapter 2 explanation of the strong continuation definition #2 price action. I'll now update the FVB strategy to include the image from tutorial chapter 2 study guide to ensure that it's understood that v2 is a WRB and that it is volatility expansion.

Attachment:

WRB-Tutorial-2-Contraction-Expansion-Contraction-Expansion-Strict.png [ 3.23 KiB | Viewed 1783 times ]

WRB-Tutorial-2-Contraction-Expansion-Contraction-Expansion-Strict.png [ 3.23 KiB | Viewed 1783 times ]

Note: As stated in tutorial chapter 2, the above image is a very strict price action description of v2 and v1 as WRB Hidden Gaps. Instead, use the rule that only one of the V intervals is required to be a WRB Hidden GAP interval while the other is just a WRB interval. As for your chart example, try to remember the concept involving the c2/c1 intervals interaction with each other along with their involvement with strong continuation definition #2 (v1 WRB Hidden Gap WRB Zone). Now draw a horizontal line from the high price of what you had called on your chart as "Reaction High-A"...line drawn to go to the right until it hits the WRB Hidden Gap that you called its high price as "Reaction High-B".

What do you see? Do you see a WRB Hidden GAP (reaction high B) that's acting like a c2 interval from the FVB that penetrated above that horizontal line and then the next interval as a c1 (reaction high B) that close below the horizontal line of reaction high A...very similar to Fading A Breakout.

![Martial Arts [ec18]](./images/smilies/emoticonmartialarts.gif)

As a reminder, you should not attempt to learn both the WRB Analysis Tutorial chapters 1, 2 & 3 at the same time as you're learning the FVB strategy. Instead, you must first master the WRB Analysis Tutorials and then learn the FVB strategy to prevent misunderstandings in the FVB strategy because such can result in failing to be able to 'adapt" the strategy along with not being able to design your own strategies based upon concepts from the FVB strategy.

Best Regards,

M.A. Perry

Cap10 wrote:

Hi,

I continue to practice identifying price action configurations.

As I am using the FVB strategy, I am looking to first define a WRB-HG Zone, according to the strategy meaning, looking for: V-Contraction | V2 Hidden Gap | V-Contraction | V1 Hidden Gap

Question: does the strategy require two V-contraction segments or just one in between V2 and V1?

I ask because the FVB strategy seems to indicate, on page-3, that it starts with a V2:

" Strong continuation definition #2 involves a v2 WRB (expanding volatility) followed by a minimum of three small range intervals (volatility contraction) that's then followed by a v1 WEB (expanding volatility) in the same direction in which one of the WRB's must be a WRB Hidden Gap. "

I think this is an important clarification.

So I didn't identify a complete set of these conditions today, here attached is the chart nonetheless.

Many thanks,

cap10